Featured

Probe Missing $15bn, N200bn Oil Revenues, SERAP Tells Tinubu

The Socio-Economic Rights and Accountability Project (SERAP) has urged President Bola Tinubu to set up a presidential panel of enquiry to promptly probe the grim allegations that over US$15 billion of oil revenues, and N200 billion budgeted to repair the refineries are missing and unaccounted for between 2020 and 2021, as documented by the Nigeria Extractive Industries Transparency Initiative (NEITI).

SERAP urged the President to “name and shame anyone suspected to be responsible for the missing and unaccounted for public funds and to ensure their effective prosecution as well as the full recovery of any proceeds of crime.”

SERAP also urged Tinubu “to fully implement all the recommendations by NEITI in its 2021 report, and to use any recovered proceeds of crime.”

In the letter dated 23 September 2023 and signed by SERAP deputy director Kolawole Oluwadare, the organisation said there was a legitimate public interest in ensuring justice and accountability for these serious allegations, adding that taking these important measures would end the impunity of perpetrators.

SERAP said, “As President and Minister of Petroleum Resources, your office ought to be concerned about these damning revelations, by getting to the bottom of the allegations and ensuring that suspected perpetrators are promptly brought to justice, and any missing public funds fully recovered.”

The letter read in part: “Any failure to investigate these grave allegations, bring suspected perpetrators to justice and recover any missing public funds would have serious resource allocation and exacerbate the country’s debt burden.

“It would also create cynicism, suspicion, and eventually citizens’ distrust about the ability of your government to combat high-level official corruption, as well as deter foreign investment and limit growth and development.

“We would therefore be grateful if the recommended measures are taken within seven days of the receipt and/or publication of this letter. If we have not heard from you by then, SERAP shall consider appropriate legal actions to compel your government to comply with our request in the public interest.

“The findings by NEITI suggest a grave violation of the public trust and the provisions of the Nigerian Constitution 1999 [as amended], national anticorruption laws, and the country’s obligations under the UN Convention against Corruption.

“The allegations of corruption documented by NEITI undermine economic development of the country, trap the majority of Nigerians in poverty and deprive them of opportunities.

“Your government has a constitutional duty to ensure transparency and accountability in the spending of the country’s wealth and resources.

“According to the 2021 report by the Nigeria Extractive Industries Transparency Initiative (NEITI), government agencies including the Nigerian Petroleum Development Company (NNPC) and the Nigerian Upstream Petroleum Regulatory Commission (NPDC) failed to remit $13.591 million and $8.251 billion to the public treasury.

“The NNPC and NPDC failed to remit over 70% of these public funds. NEITI wants both the NNPC and NPDC to be investigated, and for the missing public funds to be fully recovered.

“The report also shows that in 2021, the State Owned Enterprises (SOE) and its subsidiaries (the NNPC Group) reportedly spent US$6.931billion on behalf of the Federal Government but without appropriation by the National Assembly. The money may be missing.

“The NNPC also reportedly obtained a loan of $3 billion in 2012 purportedly to settle subsidy payments due to petroleum product marketers but there is no disclosure of the details of the loan, subsidy and the beneficiaries of the payments.

“The report also shows that N9.73 billion was paid to the NNPC as pipeline transportation revenue earned from Joint Venture operations but the money was neither remitted to the Federation nor properly accounted for. The NPDC in 2021 also failed to remit $7.61 million realized from the sale of crude oil.

“The report documents that about N200 billion was spent on refineries rehabilitation between 2020 and 2021 but “none of the refineries was operational in 2021 despite the spending.’ NEITI wants the spending to be investigated, as the money may be missing.

“Section 13 of the Nigerian Constitution 1999 [as amended] imposes clear responsibility on your government to conform to, observe and apply the provisions of Chapter 2 of the constitution. Section 15(5) imposes the responsibility on your government to ‘abolish all corrupt practices and abuse of power’ in the country.

“Under Section 16(1) of the Constitution, your government has a responsibility to ‘secure the maximum welfare, freedom and happiness of every citizen on the basis of social justice and equality of status and opportunity.

“Section 16(2) further provides that, ‘the material resources of the nation are harnessed and distributed as best as possible to serve the common good.

“Similarly, articles 5 and 9 of the UN Convention against Corruption also impose legal obligations on your government to ensure proper management of public affairs and public funds, and to promote sound and transparent administration of public affairs.

“The UN Convention against Corruption and the African Union Convention on Preventing and Combating Corruption to which Nigeria is a state party obligate your government to effectively prevent and investigate the plundering of the country’s wealth and natural resources and hold public officials and non-state actors to account for any violations.

“Specifically, article 26 of the UN convention requires your government to ensure ‘effective, proportionate and dissuasive sanctions’ including criminal and non-criminal sanctions, in cases of grand corruption.

“Article 26 complements the more general requirement of article 30, paragraph 1, that sanctions must take into account the gravity of the corruption allegations.

“Nigeria is also a participating state of the Extractive Industries Transparency Initiative (EITI), which aims to foster greater governmental accountability for the use of natural resource wealth through the creation of a set of international norms on revenue transparency.

“EITI also aims to tackle corruption, poverty and conflict associated with natural resource wealth. Nigeria has the obligations to implement the EITI Standard, which sets out the transparency norms with which participating States including Nigeria must comply.

Featured

Rivers A Strategic Hub for Nigeria’s Blue Economy -Ibas …Calls For Innovation-Driven Solutions

The Administrator of Rivers State, Vice Admiral (Rtd.) Ibok-Ete Ibas, has emphasized the need for innovation-driven strategies, strategic partnerships, and firm policy implementation to fully harness the vast potential of the blue economy.

Speaking during a courtesy visit by participants of Study Group 7 of the Executive Course 47 from the National Institute for Policy and Strategic Studies (NIPSS) at Government House, Port Harcourt, on Monday, Ibas highlighted the importance of diversifying Nigeria’s economy beyond oil by leveraging maritime resources to create jobs, enhance food security, strengthen climate resilience, and generate sustainable revenue.

The Administrator, according to a statement by his Senior Special Adviser on Media, Hector Igbikiowubo, noted that with coordinated efforts and innovative solutions, the blue economy could serve as a catalyst for inclusive growth, economic stability, and long-term environmental sustainability.

“It is estimated that a fully developed blue economy could generate over $296 million annually for Nigeria, spanning fisheries, shipping and logistics, marine tourism, offshore renewable energy, aquaculture, biotechnology, and coastal infrastructure,” he stated.

“We must transition from extractive practices to regenerative, inclusive, and innovation-driven solutions. This requires political cohesion, intergovernmental collaboration, robust infrastructure, and institutional capacity—all of which must be pursued with urgency and intentionality,” he added.

Ibas urged sub-national governments, particularly coastal states, to domesticate the national blue economy framework and develop tailored strategies that reflect their comparative advantages.

He stressed that such efforts must be guided by disciplined planning, regulation, and investment to maximize the sector’s potential.

Highlighting Rivers State’s pivotal role, the Administrator outlined its strategic advantages as follows:

•Nearly 30% of Nigeria’s total coastline (approximately 853km)

•Over 40% of Nigeria’s crude oil and gas output

•More than 33% of the country’s GDP and foreign exchange earnings

•416 of Nigeria’s 1,201 oil wells, many located in marine environments

•Two of Nigeria’s largest seaports, two oil refineries, and the Nigerian Liquefied Natural Gas (NLNG) terminal in Bonny Island—one of Africa’s most advanced gas facilities

Despite these opportunities, Ibas acknowledged challenges such as pollution, coastal erosion, illegal oil refining, unregulated fishing, inadequate infrastructure, and maritime insecurity.

He reaffirmed his administration’s commitment to institutional reforms, coastal zone management, and inter-agency collaboration to build a governance structure that supports a sustainable blue economy.

“Sustainability must be embedded in our development models from the outset, not as an afterthought. We are actively exploring partnerships in maritime education, aquaculture development, port modernization, and renewable ocean energy. We welcome knowledge-sharing engagements like this to refine our strategies and enhance implementation,” he said.

He urged the NIPSS delegation to ensure their findings translate into actionable recommendations that address the sector’s challenges.

Leader of the delegation, Vice Admiral A.A. Mustapha, explained that the visit aligns with their strategic institutional tour mandate on the 2025 theme: “Blue Economy and Sustainable Development in Nigeria: Issues, Challenges, and Opportunities.”

The group is engaging stakeholders to deepen understanding of policy efforts and institutional roles in advancing sustainable development through the blue economy.

Featured

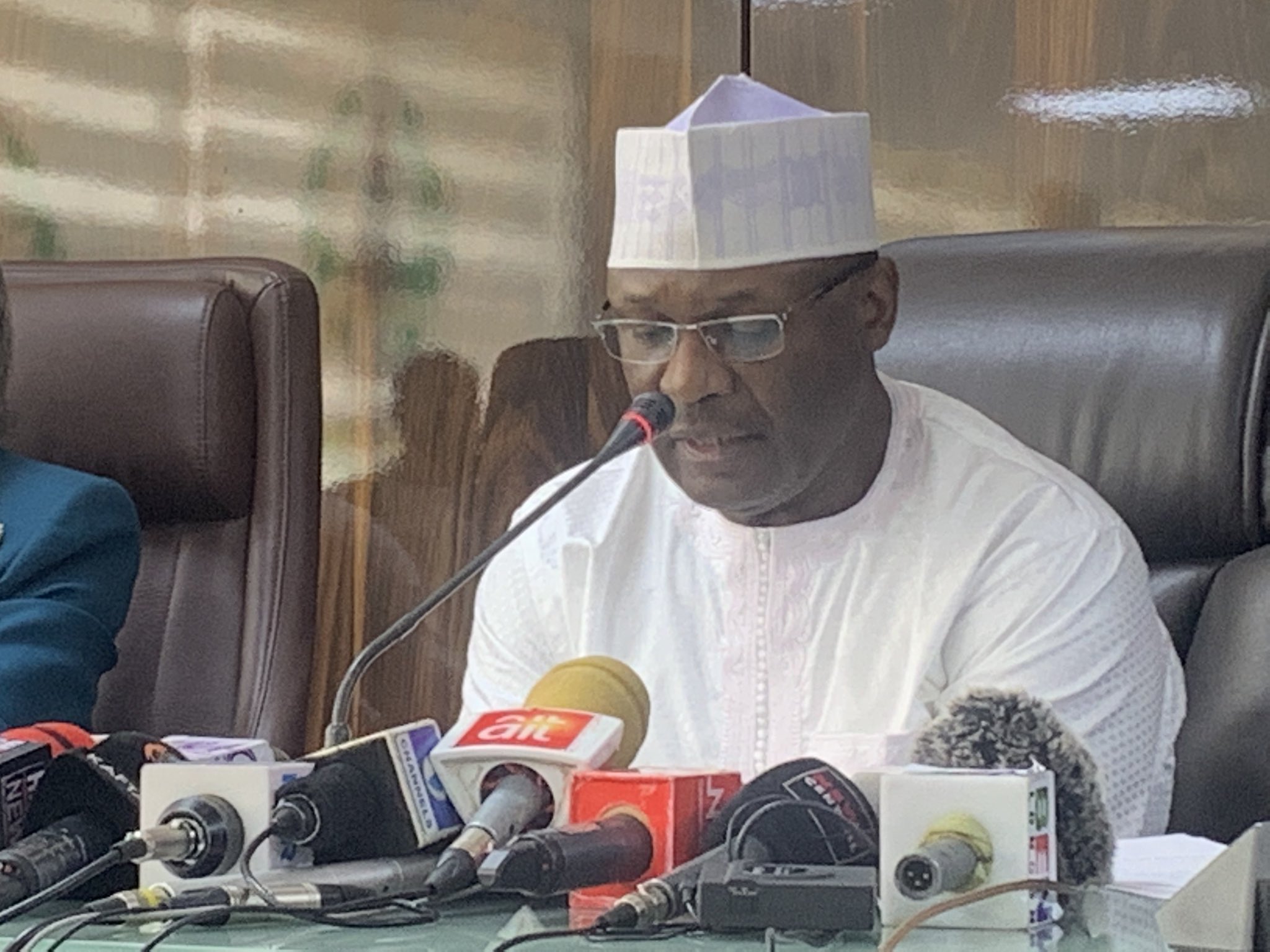

INEC To Unveil New Party Registration Portal As Applications Hit 129

The Independent National Electoral Commission (INEC) has announced that it has now received a total of 129 applications from associations seeking registration as political parties.

The update was provided during the commission’s regular weekly meeting held in Abuja, yesterday.

According to a statement signed by the National Commissioner and Chairman of the Information and Voter Education Committee, Sam Olumekun, seven new applications were submitted within the past week, adding to the previous number.

“At its regular weekly meeting held today, Thursday 10th July 2025, the commission received a further update on additional requests from associations seeking registration as political parties.

“Since last week, seven more applications have been received, bringing the total number so far to 129. All the requests are being processed,” the commission stated.

The commission revealed the introduction of a new digital platform for political party registration. The platform is part of the Party Financial Reporting and Auditing System and aims to streamline the registration process.

Olumekun disclosed that final testing of the portal would be completed within the next week.

“INEC also plans to release comprehensive guidelines to help associations file their applications using the new system.

“Unlike the manual method used in previous registration, the Commission is introducing a political party registration portal, which is a module in our Party Financial Reporting and Auditing System.

“This will make the process faster and seamless. In the next week, the commission will conclude the final testing of the portal before deployment.

“Thereafter, the next step for associations that meet the requirements to proceed to the application stage will be announced. The commission will also issue guidelines to facilitate the filing of applications using the PFRAS,” the statement added.

In the meantime, the list of new associations that have submitted applications has been made available to the public on INEC’s website and other official platforms.

Featured

Tinubu Signs Four Tax Reform Bills Into Law …Says Nigeria Open For Business

President Bola Tinubu yesterday signed into law four tax reform bills aimed at transforming Nigeria’s fiscal and revenue framework.

The four bills include: the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

They were passed by the National Assembly after months of consultations with various interest groups and stakeholders.

The ceremony took place at the Presidential Villa, yesterday.

The ceremony was witnessed by the leadership of the National Assembly and some legislators, governors, ministers, and aides of the President.

The presidency had earlier stated that the laws would transform tax administration in the country, increase revenue generation, improve the business environment, and give a boost to domestic and foreign investments.

“When the new tax laws become operational, they are expected to significantly transform tax administration in the country, leading to increased revenue generation, improved business environment, and a boost in domestic and foreign investments,” Special Adviser to the President on Media, Bayo Onanuga said on Wednesday.

Before the signing of the four bills, President Tinubu had earlier yesterday, said the tax reform bills will reset Nigeria’s economic trajectory and simplify its complex fiscal landscape.

Announcing the development via his official X handle, yesterday, the President declared, “In a few hours, I will sign four landmark tax reform bills into law, ushering in a bold new era of economic governance in our country.”

Tinubu made a call to investors and citizens alike, saying, “Let the world know that Nigeria is open for business, and this time, everyone has a fair shot.”

He described the bills as not just technical adjustments but a direct intervention to ease burdens on struggling Nigerians.

“These reforms go beyond streamlining tax codes. They deliver the first major, pro-people tax cuts in a generation, targeted relief for low-income earners, small businesses, and families working hard to make ends meet,” Tinubu wrote.

According to the President, “They will unify our fragmented tax system, eliminate wasteful duplications, cut red tape, restore investor confidence, and entrench transparency and coordination at every level.”

He added that the long-standing burden of Nigeria’s tax structure had unfairly weighed down the vulnerable while enabling inefficiency.

The tax reforms, first introduced in October 2024, were part of Tinubu’s post-subsidy-removal recovery plan, aimed at expanding revenue without stifling productivity.

However, the bills faced turbulence at the National Assembly and amongst some state governors who rejected its passing in 2024.

At the NASS, the bills sparked heated debate, particularly around the revenue-sharing structure, which governors from the North opposed.

They warned that a shift toward derivation-based allocations, especially with VAT, could tilt fiscal balance in favour of southern states with stronger consumption bases.

After prolonged dialogue, the VAT rate remained at 7.5 per cent, and a new exemption was introduced to shield minimum wage earners from personal income tax.

By May 2025, the National Assembly passed the harmonised versions with broad support, driven in part by pressure from economic stakeholders and international observers who welcomed the clarity and efficiency the reforms promised.

In his tweet, Tinubu stressed that this is just the beginning of Nigeria’s tax evolution.

“We are laying the foundation for a tax regime that is fair, transparent, and fit for a modern, ambitious Nigeria.

“A tax regime that rewards enterprise, protects the vulnerable, and mobilises revenue without punishing productivity,” he stated.

He further acknowledged the contributions of the Presidential Fiscal Policy and Tax Reform Committee, the National Assembly, and Nigeria’s subnational governments.

The President added, “We are not just signing tax bills but rewriting the social contract.

“We are not there yet, but we are firmly on the road.”

-

Business1 day ago

2027: Group Vows To Prevail On Diri To Dump PDP For APC

-

City Crime24 hours ago

RSG Tasks Federal Government On Maternal Deaths

-

News1 day ago

South-South Contributes N34trn To Nigeria’s Economy In 2024 – Institute

-

Featured22 hours ago

Featured22 hours agoRivers A Strategic Hub for Nigeria’s Blue Economy -Ibas …Calls For Innovation-Driven Solutions

-

Rivers1 day ago

Rivers1 day agoNDDC Inaugurates Ultra-Modern Market In Rivers Community

-

Opinion1 day ago

Welcome! Worthy Future For R/S

-

News24 hours ago

Nigeria’s Inflation Rate Dropped To 22.22% In June -NBS

-

News1 day ago

NOA Set To Unveil National Values Charter — D-G