News

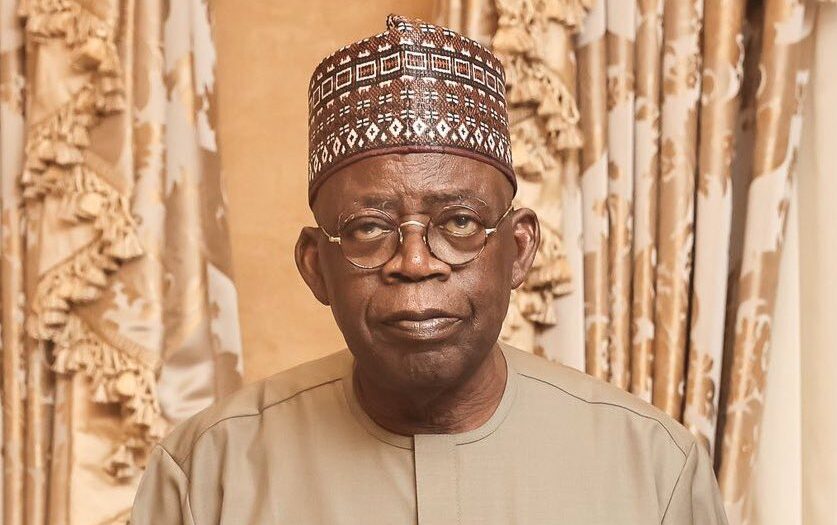

SERAP Sues Tinubu Over Failure To Probe Fuel Subsidy Funds

The Socio-Economic Rights and Accountability Project (SERAP) has sued President Bola Tinubu, over the failure to probe the allegations that USD$2.1 billion and N3.1 trillion public funds of oil revenues budgeted as fuel subsidy payments are missing and unaccounted for between 2016 and 2019.

SERAP filed a lawsuit against Tinubu at the Federal High Court in Lagos, seeking an order of mandamus to compel the President to promptly investigate allegations that USD$2.1 billion and N3.1 trillion in public funds are missing and unaccounted for between 2016 and 2019.

The group is also seeking an order of mandamus to compel President Tinubu to direct anti-corruption agencies to promptly investigate fuel subsidy payments made by governments since 1999, name and prosecute suspected perpetrators and recover any proceeds of crimes.

SERAP is also seeking: “an order of mandamus to direct and compel President Tinubu to use any recovered proceeds of crime as palliatives to address the impact of the subsidy removal on poor Nigerians, and to put in place mechanisms for transparency and accountability in the oil sector.”

In the suit, SERAP argues that: “The allegations that US$2.1 billion and N3.1 trillion of public funds are missing and unaccounted amount to a fundamental breach of national anti-corruption laws and the country’s international obligations including under the UN Convention against Corruption to which Nigeria is a state party.”

It stated that “The Tinubu government has constitutional and international legal obligations to get to the bottom of these allegations and ensure accountability for these serious crimes against the Nigerian people.”

According to SERAP, “Directing and compelling President Tinubu to promptly probe, name and shame and bring to justice the perpetrators and to recover any missing public funds would advance the right of Nigerians to restitution, compensation, and guarantee of non-repetition.”

It noted that “Allegations of corruption in fuel subsidy payments suggest that the poor have rarely benefited from the use and management of the payments.”

According to the lawsuit filed by SERAP’s lawyers, Kolawole Oluwadare, Ms Adelanke Aremo, Ms Valentina Adegoke, and Ayomide Johnson, there can be no economic growth or sustainability without accountability for human rights crimes. Poor and socio-economically vulnerable Nigerians should not be made to pay for the stealing of the country’s oil wealth while state and non-state actors pocket public funds.

The statement read in part; “Investigating and prosecuting the allegations, and recovering any missing public funds would serve the public interest, ensure justice and accountability, and end the entrenched impunity of perpetrators.

“According to the audited reports between 2016 and 2019 by the Auditor General of the Federation (AGF), the Nigerian National Petroleum Corporation (NNPC) failed to remit N663,896,567,227.58 into the Federation Account. The Auditor-General fears that the money may be missing.

“The NNPC also reportedly failed to account for the allocation of crude oil to refineries in 2019. 107,239,436.00 barrels of crude oil were lifted as domestic crude without any document. The Auditor-General fears that the crude valued at N55,891,009,960.63 may have been diverted.

“The NNPC in 2019 also failed to remit N1,955,354,671,268.66 and N55,157,702,848.74 of generated revenues into the Federation Account, contrary to Section 162(1) of the Nigerian Constitution 1999 [as amended]. The Auditor-General fears that the money may have been diverted.

“The NNPC also failed to account for N4,572,844,962.25 of ‘domestic gas receipts’, thereby ‘reducing the distributable revenue in the Federation account.’ The NNPC also in 2019 failed to account for 22,929.84 litres of PMS pumped from refineries and valued at N7,056,137,180.00.

“The NNPC also ‘illegally classified’ 239,800 barrels of crude oil valued at N5,498,045,220 as ‘crude oil losses.’

“The Department of Petroleum Resources (DPR) in 2019 also reportedly failed to remit US$1,278,364,595.49 in revenue to the Federation Account. The money was deducted by the NNPC from the Oil and Gas Royalty assessed by the DPR.

“The DPR in 2019 also deducted N19,840,081.29 as ‘stamp duty’ payments from contractors and consultants but the DPR instantly paid back the money to the contractors and consultants instead of remitting it to the treasury.

“The DPR in 2019 also paid N137,225,973.35 to contractors and consultants for various contracts and consultancies but failed to deduct stamp duty.

“The DPR also paid N11,856,088,271.92 as salaries for 2019 but failed to deduct N118,560,882.72 as the contribution of 1% Industrial Training Fund (ITF). The DPR in 2019 also failed to transfer US$35,738,342.95 year balance.

“The DPR in 2018 also withdrew without any explanation US$759,387,755.10 from DPR Signature Bonus Account rather than paid the money into the Federation Account.

“Subsidy records show that N443,940,559,974.80 was paid as total subsidy for 2016 but the money was not budgeted for. The payments were for outstanding Petroleum Support Fund (PSF) commitments for the year 2015. However, there was no payment in 2016. Only outstanding payments for previous years 2014 and 2015 and interest payments were made in 2016.

“The Auditor-General fears that the oil marketers that received the subsidy payments may not have been ‘eligible to draw from the Petroleum Support Fund as the Petroleum Products Pricing and Regulatory Authority (PPPRA) failed to provide any document on the payments.

“N39,141,210,181.74 was also paid from the Federation Account in 2016 to different Oil Marketers in 26 transactions, being Payments of Interest and Foreign Exchange Differential on Subsidy but without any document.

“The NNPC also made ‘zero profit’ and recorded ‘losses from its joint ventures in 2016. This is contrary to expectations that profits should be made from the joint ventures.

“The Ministry of Petroleum Resources, Abuja in 2016 paid N14,490,000.00 for the supply of 3 Nissan Almera Saloon vehicles 1.5 to the Ministry without proper documentation. The purchase of ‘the vehicles were made through direct procurement without competitive bidding by at least three companies, as required by Financial Regulations. There was no advertisement and bidding for this contract.

“Although ‘N12,442,500.00 was approved by the Bureau of Public Procurement for the vehicles, the Ministry made an overpayment of N2,047,500.00 to the car company.

News

Shettima In Ethiopia For State Visit

Vice President Kashim Shettima has arrived in Addis Ababa, Ethiopia, for an official State visit at the invitation of the Prime Minister, Dr. Abiy Ahmed.

Upon arrival yesterday, Shettima was received at the airport by the Minister of Foreign Affairs of Ethiopia, Dr. Gedion Timothewos, and other members of the Ethiopian and Nigerian diplomatic corps.

Senior Special Assistant to the Vice President on Media and Communication, Stanley Nkwocha, revealed this in a statement he signed yesterday, titled: “VP Shettima arrives in Ethiopia for official state visit.”

During the visit, Vice President Shettima will participate in the official launch of Ethiopia’s Green Legacy Programme, a flagship environmental initiative.

The programme designed to combat deforestation, enhance biodiversity, and mitigate the adverse effects of climate change targets the planting of 20 billion tree seedlings over a four-year period.

In line with strengthening bilateral ties in agriculture and industrial development, the Vice President will also embark on a strategic tour of key industrial zones and integrated agricultural facilities across selected regions of Ethiopia.

News

RSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

The Rivers State Government has called on the people of the state especially farmers to access the ?4billion agricultural loans made available by the State and domiciled in the Bank of Industry.

This is as the State Project Implementation Unit (SPIU) of Rural Access and Agricultural Marketing Project (RAAMP), a World Bank project, took its sensitization campaign to Opobo/Nkoro, Andoni, Port Harcourt City and Obio/Akpor local government areas.

The campaign was aimed at enlightening community dwellers and other stakeholders in the various local government areas on the RAAMP project implementation and programme activities.

The Permanent Secretary, Rivers State Ministry of Agriculture, Mr Maurice Ogolo, said this at Opobo town, Ngo, Port Harcourt City and Rumuodumanya, headquarters of the four local government areas respectively, during the sensitization campaign.

Ogolo said apart from the ?4billion, the government has also made available fertilizers and other farm inputs to farmers in the various local government areas.

The Permanent Secretary who is the Chairman, State Steering Committee for the project, said RAAMP will construct roads that will connect farms to markets to enable farmers and fishermen sell their farms produce and fishes.

He also said rural roads would be constructed to farms and fishing settlements, and warned against any act that will lead to the cancellation of the projects in the four local government areas.

According to him, the World Bank and Federal Government which are the financiers of the programme will not condone such acts like kidnapping, marching ground and other acts inimical to the successful implementation of the projects in their respective areas.

At PHALGA, Ogolo asserted that the city will benefit in the areas of roads and bridge construction.

He noted that RAAMP was thriving in both the Federal Capital Territory, Abuja; Lagos and other states in the country, stressing that the project should also be given the seriousness it deserves in Rivers State.

Speaking at Opobo town, the headquarters of Opobo/Nkoro Local Government Area, the project coordinator, RAAMP, Mr.Joshua Kpakol, said the programme would reduce poverty in the state.

According to him, both fishermen and farmers will maximally benefit from the programme.

At Ngo which is the headquarters of Andoni Local Government Area, Kpakol said roads will be constructed to all remote fishing settlements.

He said Rivers State is lucky to be among the states implementing the project, and stressed the need for the people to embrace it.

Meanwhile, Kpakol said at PHALGA that RAAMP is a project that will transform the lives of farmers, traders and other stakeholders in the area.

He urged the stakeholders to spread the information to their various communities.

However, some of the stakeholders at Opobo town complained about the destruction of their farms by bulls allegedly owed by traditional rulers in the area, as well as incessant stealing of their canoes at waterfronts.

At Ngo, Archbishop Elkanah Hanson, founder of El-Shaddai Church, commended the World Bank and the Federal Government for bringing the projects to Andoni.

He stressed the need for the construction of roads to fishing settlements in the area.

Also, a former Commissioner for Agriculture in the state and Okan Ama of Ekede, HRH King Gad Harry, noted that storage facilities have become necessary for a successful agricultural programme.

Harry also stressed the need for the programme to be made sustainable.

In their separate speeches, the administrators of Andoni and Opobo/Nkoro Local Government Areas, pledged their readiness to support the programme.

At Port Harcourt City, the Administrator, Dr Arthur Kalagbor, represented by the Head of Local Government Administration, Port Harcourt City, Mr Clifford Paul, said the city would support the implementation of the programme in the area.

Also, the administrator of Obio/Akpor Local Government Area, Dr Clifford Ndu Walter, represented by Mr Michael Elenwo, pledged to support the programme in his local government area.

Among dignitaries at the Obio/Akpor stakeholders engagement is the chairman, Rivers State Traditional Rulers Council and paramount ruler of Apara Kingdom, HRM Eze Chike Wodo, amongst others.

John Bibor

News

Tinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

President Bola Tinubu has ordered the commencement of personnel audit and skill gap analysis across all cadres of federal civil servants.

The president gave this directive in Abuja, yesterday, while speaking at the International Civil Service Conference, reaffirming his resolve to achieve efficiency and professional service delivery in the civil service.

“I have authorized the comprehensive personnel audit and skill gap analysis across the federal civil service to deepen capacity. I urge all responsible stakeholders to prioritize timely completion of this critical exercise, to begin implementing targeted reforms, to realize the full benefit of a more agile, competent and responsive civil service,” the president announced.

Tinubu further directed all Ministries, Departments and Agencies (MDAs), to prioritise data integrity and sovereignty in national interest.

He called for the capture, protection and strategic publication of public sector data in line with the Nigeria Data Protection Act of 2023.

“We must let our data speak for us. We must publish verified data assets within Nigeria and share them internationally recognized as fruitful. This will allow global benchmarking organisation to track our progress in real time and help us strengthen our position on the world stage. This will preserve privacy and uphold data sovereignty,” Tinubu added.

President Tinubu hailed the federal civil service as the “engine” driving his Renewed Hope Agenda, and the vehicle for delivering sustainable national development.

He submitted that the roles of civil servants remain indispensable in modern governance, declaring that in the face of a fast-evolving digital and economic landscape, the civil service must remain agile, future-ready, and results-driven.

“This maiden conference is a bold step toward redefining governance in an era of rapid transformation. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“It captures our collective ambition to reimagine and reposition the civil service. In today’s rapid, evolving world of technology, innovation remains critical in ensuring that the civil service is dynamic, digital” the President said.

Head of the Civil Service of the Federation, Didi Walson-Jack in her welcome address told the President that his presence and strong words of commendation at the conference has renewed the morale and mandate of public servants across the country.

Walson-Jack described Tinubu as the backbone of driving transformation in the Nigerian civil service, and noted that the takeaways from past study tours undertaken to understudy the civil service in Singapore, the UK and US under her leadership, is already yielding multiplier effects.

Walson-Jack assured Tinubu that her office, in collaboration with reform-minded stakeholders, will not relent in accelerating the implementation of the Federal Civil Service Strategy and Implementation Plan, FCSSIP 25.

She affirmed that digitalisation, performance management, and continuous learning remain key pillars in strengthening accountability, transparency, and service delivery across MDAs.

Walson-Jack reaffirmed that the civil service is determined to exceed expectations by embedding a culture of innovation, ethical leadership, and citizen-centred governance in the heart of public administration.