Business

Subsidy Removal: ‘Good For Investment, To Check Rising Debt’

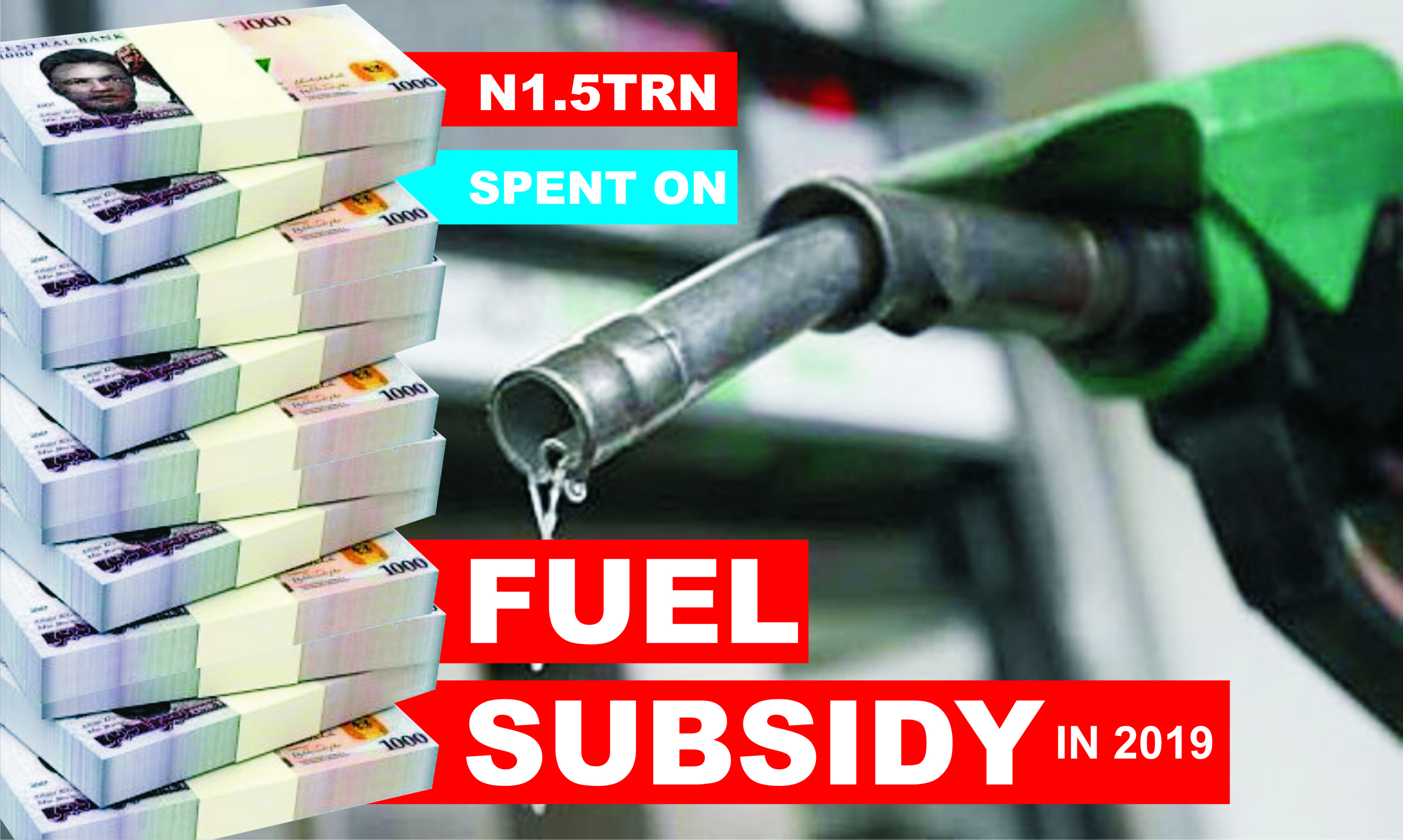

The Lagos Chamber of Commerce and Industry (LCCI) has said the Federal Government’s planned removal of petrol subsidy remains one of the best economic decisions that will not only reduce Nigeria’s debts, but will also tackle widespread corruption in the oil sector.

President of LCCI, Dr Michael Olawale-Cole, stated this during the chamber’s second quarter state of the economy conference yesterday in Lagos.

Recall that Nigeria secured an $800 million relief package from the World Bank to minimise the effect of subsidy removal on the most vulnerable in the society.

Recent data by the Debt Management Office puts Nigeria’s public debt at N46.25 trillion ($103.11 billion) as at end-December 2022, compared to N39.56 trillion ($95.77 billion) in 2021.

Olawale-Cole urged the Federal Government to begin to roll out several cushioning measures ahead of the subsidy removal in the second half of the year to mitigate any likely disruptions to the economy.

“Removal of fuel subsidies is, amongst others, expected to spur investments in domestic refining and petrochemicals and create a significant value chain for the various stakeholders.

“Though the planned removal of fuel subsidies may cause further northward movement of inflation in the short term, it is arguably one of the best economic decisions to reduce our unsustainable debts and widespread corruption in that sector.

“The government must, however, take cognisance of its socio-economic implications, especially with unemployment at the unwholesome rate of about 40 per cent”, he said.

The LCCI’s boss picked holes in borrowing to fund subsidies or support uneconomic ventures, saying the government’s fixation on debt accumulation was unhealthy.

He said the government must prioritise exploring other avenues, including opening equity opportunities, offloading/selling of its real estate holdings and tackling oil theft to create room for fiscal manipulation.

Olawale-Cole stressed the need to importantly follow the recently launched and restructured Ministry of Finance Incorporated (MOFI) by President Muhammadu Buhari on February 1, to optimise national assets.

He advised that copious references should henceforth be made on the growth and returns of the country’s stock of financial assets in corporate equities, real estate and infrastructure spaces.

This, he said, would provide local and global observers a balanced picture of our financial position.

“It would also motivate national asset managers, led by MOFI, to grow our assets and the returns on them as well as motivate our national liability managers, led by the DMO, to minimise our liabilities and the costs we incur on them with equal vigour.

“Indeed, issuance of joint reports by MOFI and DMO would be most ideal going forward.

“One-sided updates on liabilities with no updates on assets when such updates were adequately available could well be blamed for some of the downgrades of Nigeria’s debt issuance risk profile and outlook.

“The rating outcomes would have been more favourable, had updates on assets been provided side-by-side with updates about liabilities”, he stated.

Addressing inflationary pressure which inched upwards in March to 22.04 per cent, Olawale-Cole noted that hiking monetary policy rate had thus far proven to be ineffective and insufficient in taming inflation.

He stated that in most economies, amid the cost-of-living crisis, the priorities remained achieving sustained disinflation and reasonable real growth.

Business

NCDMB, Dangote Refinery Unveil JTC On Deepening Local Content

Business

Food Security: NDDC Pays Counterpart Fund For LIFE-ND Project

Business

Replace Nipa Palms With Mangroove In Ogoni, Group Urges FG, HYPREP

-

Rivers3 days ago

Four Internet Fraudstars Get Different Jail Terms In PH

-

Business3 days ago

Food Security: NDDC Pays Counterpart Fund For LIFE-ND Project

-

Business3 days ago

PH Women Plan Alternative Stew, Shun Tomato High Prices

-

Sports3 days ago

Nigerian Athletes Serving Doping Bans

-

Niger Delta3 days ago

Niger Delta3 days agoEx-IYC President Lampoons Atiku’s Presidential Ambition … Declares It Negative Impact On N’Delta

-

News3 days ago

Tinubu Never Stopped 5-year Visa For U S. Citizens – Presidency ?

-

Featured3 days ago

Featured3 days agoINEC To Unveil New Party Registration Portal As Applications Hit 129

-

Business3 days ago

Industry Leaders Defend Local Content, … Rally Behind NCDMB