News

‘Decision To Redesign Naira Positive For Economy’ …As EFCC Swoops On BDC Operators

Some financial experts have commended the Central Bank of Nigeria (CBN) for its decision to redesign the Naira, saying that it would have positive effect on the economy.

The experts spoke in separate interviews with newsmen in Abuja, yesterday.

They spoke against the backdrop of announcement by the CBN that new designs of the N200, N500 and N1,000 denominations would be produced and circulated on December 15.

According to a financial economist and professor of capital market at the Nasarawa State University, Keffi, Prof. Umhe Uwaleke, the decision would be positive for the economy in the medium to long term.

Uwaleke said the measure would go a long way to ensure that the Naira in circulation outside the banking system were brought into the banking system.

He said the measure would also provide enough liquidity for banks, and more money for the banks to lend.

“The measure does not amount to demonetisation of big currency notes often carried out by central banks to curb black money and corruption.

“But it will go a long way in ensuring that a lot of naira notes circulating outside the banks are crowded in.

“If it leads to large deposits in banks, it means the banks will have more money to lend which may reduce interest rates.

“Perhaps, more importantly, with increased currency in circulation now in the vault of banks, I expect to see improvement in monetary policy transmission,” he said.

Uwaleke said it might also have the effect of reducing speculative attacks on the Naira in the parallel market in the medium term.

“I expect that the Financial Intelligence Unit will be on the lookout for huge deposits as a way of monitoring illegitimate transactions.

“Despite the huge cost involved in changing currency notes, I think it’s time to sanitise the system, especially now that electioneering activities have kicked off,” he said.

He, however, said the deadline of January 31, 2023 was too short, considering the number of Naira denominations involved, urging the CBN to consider extending it.

An economist, Dr Tope Fasua, also said the measure would have significant effect on the economy, adding that it was essentially about “black money.”

He suggested that the CBN should take such measures more frequently.

“When central banks do this, they try to pull in monies people are hiding; illegal money, corruption money, kidnapping money. Nigeria has managed to become a hub for these kinds of illegalities.

“I will even suggest that the CBN does this more often, maybe every 10 years. You will see a scenario where the banks are awash with liquidity.

“There are many people sitting on billions in naira, and even in dollars. The CBN should also see how it can pull in the dollars,” he said.

Fasua advised that the idea of individuals operating personal domiciliary bank accounts should be banned, adding that nobody needed it.

“People are speculating against their own currency in their own country. That is not allowed in any economy.

“They should pull in illegal, black naira and then see how they can pull in illegal dollars. The CBN can control these things through the Deposit Money Banks,” he said.

However, a financial expert, and past President of the Chattered Institute of Bankers of Nigeria (CIBN), Mr Okechukwu Unegbu, said redesigning the Naira was not the most important problem facing the economy.

Unegbu, said the apex bank should have simply ensured that the scarce lower naira denominations, like N100 and N200 were readily available by printing more.

However, the Economic and Financial Crimes Commission (EFCC) has said it would monitor the redesign of Naira notes by the Central Bank of Nigeria (CBN) to ensure that currency hoarders do not undermine the exercise.

The CBN Governor, Godwin Emefiele, had announced that the apex bank obtained the approval of President Muhammadu Buhari to redesign and issue new N200, N500, and N1000 notes that would come into circulation on December 15, 2022.

Speaking on the development, the Executive Chairman of the EFCC, Abdulrasheed Bawa, in a statement issued, yesterday by the spokesperson of the anti-graft agency, Wilson Uwujaren, described the move by the apex bank as “a well-considered and timely response” to the challenges of currency management which has negatively impacted the country’s monetary policy and security imperatives.

Bawa, however, warned that the EFCC would monitor the process to ensure that unscrupulous players and currency speculators and their cohorts among the bureau de change operators do not undermine the exercise.

He also charged banks to be alive to their reporting obligations and not assist unscrupulous customers in laundering suspected proceeds of crimes through their system.

The EFCC boss added that the objectives which the CBN seeks to achieve with the redesign and reissue of the higher denomination naira notes, were in tandem with the objectives of the Money Laundering Prevention Prohibition Act 2022, which criminalises the conduct of cash transactions above a certain threshold.

“According to Section 2 (1) of the Money Laundering Act 2022: No person or body corporate shall, except in a transaction through a financial institution, make or accept cash payment of a sum exceeding— (a) N5,000,000 or its equivalent, in the case of an individual; or (b) N10,000,000 or its equivalent, in the case of a body corporate,” he noted.

Bawa expressed hope that the new currency measure would further boost Nigerians’ embrace of banking culture and encourage the acceptance of cashless transactions, adding that the anti-graft agency had recently taken operational action against currency hoarders in major commercial cities of Nigeria.

“It is, therefore, pertinent to issue this stern warning to Bureau de Change operators to be wary of currency hoarders who would attempt to seize this opportunity to offload the currencies they had illegally stashed away,” he said.

Noting that currency hoarders readily made their hoard available to criminal enterprise, the EFCC boss further stated that the commission will spare no effort to bring to book any financial services operator who runs afoul of extant laws and regulations.

Earlier, the Central Bank Governor, Godwin Emefiele, had said that the apex bank would redesign the country’s currency.

Emefiele, who announced this at a press briefing in Abuja, said that the exercise would affect the highest denominations: 200, 500, 1000 notes.

He said that the action was taken in order to take control of the currency in circulation.

According to him, the bulk of the nation’s currency notes were outside bank vaults and that the CBN would not allow the situation to continue.

Emefiele said that the new notes would be released for public use on December 15, 2022.

He also said that the old notes and the new notes would circulate together until January 31, 2023 when the old notes would cease to be legal tender.

Emefiele said that there have been persisting concerns with the management of current series of banknotes, and currency in circulation, particularly those outside the banking system in the country.

He said, “As you all may be aware, currency management is a key function of the Central Bank of Nigeria, as enshrined in Section 2 (b) of the CBN Act 2007. Indeed, the integrity of a local legal tender, the efficiency of its supply, as well as its efficacy in the conduct of monetary policy are some of the hallmarks of a great Central Bank.

“In recent times, however, currency management has faced several daunting challenges that have continued to grow in scale and sophistication with attendant and unintended consequences for the integrity of both the CBN and the country.”

The challenges he said included hoarding of banknotes by members of the public, with statistics showing that over 80percent of currency in circulation was outside the vaults of commercial banks.

He added that the worsening shortage of clean and fit banknotes with attendant negative perception of the CBN and increased risk to financial stability as well as, increasing ease and risk of counterfeiting evidenced by several security reports were reasons for redesigning the notes.

He said that recent development in photographic technology and advancements in printing devices have made counterfeiting relatively easier and that in recent years, the CBN has recorded significantly higher rates of counterfeiting especially at the higher denominations of N500 and N1,000 banknotes.

The CBN boss noted that although global best practice was for central banks to redesign, produce and circulate new local legal tender every 5–8 years, the Naira has not been redesigned in the last 20 years.

He said, “On the basis of these trends, problems, and facts, and in line with Sections 19, Subsections a and b of the CBN Act 2007, the Management of the CBN sought and obtained the approval of President Muhammadu Buhari to redesign, produce, and circulate new series of banknotes at N200, N500, and N1,000 levels.

“In line with this approval, we have finalized arrangements for the new currency to begin circulation from December 15, 2022. The new and existing currencies shall remain legal tender and circulate together until January 31, 2023 when the existing currencies shall seize to be legal tender.

“Accordingly, all Deposit Money Banks currently holding the existing denominations of the currency may begin returning these notes back to the CBN effective immediately. The newly designed currency will be released to the banks in the order of First-come-First-serve basis.

“Customers of banks are enjoined to begin paying into their bank accounts the existing currency to enable them withdraw the new banknotes once circulation begins in mid-December 2022. All banks are therefore expected to keep open, their currency processing centres from Monday to Saturday so as to accommodate all cash that will be returned by their customers.

“For the purpose of this transition from existing to new notes, bank charges for cash deposits are hereby suspended with immediate effect. Therefore, DMBs are to note that no bank customer shall bear any charges for cash returned/paid into their accounts.

“Members of the public are to please note that the present notes remain legal tender and should not be rejected as a means of exchange for purchase of goods and services.”

The governor said that his team was mindful of those in rural areas and that facilities would be provided for them where bank accounts could be opened for them or their old notes exchanged for the new ones.

He added that the action would also raise its stake in addressing the challenge of inflation.

Reminded that the current regulation allows only N150, 000 free cash deposit, he said that even if a customer wanted to deposit N1billion, the person would be allowed to do so.

Emefiele assured that the CBN would continue to monitor both the financial system in particular, and the economy in general, and always act in good faith for the achievement of the Bank’s objectives and the betterment of the country.

There had been claims even by top government officials that some unscrupulous members of the society were hoarding large volumes of currency notes in warehouse, farms, septic tanks.

Very dirty and smelly Naira notes have been in circulation, especially since political activities heightened across the country.

News

Shettima In Ethiopia For State Visit

Vice President Kashim Shettima has arrived in Addis Ababa, Ethiopia, for an official State visit at the invitation of the Prime Minister, Dr. Abiy Ahmed.

Upon arrival yesterday, Shettima was received at the airport by the Minister of Foreign Affairs of Ethiopia, Dr. Gedion Timothewos, and other members of the Ethiopian and Nigerian diplomatic corps.

Senior Special Assistant to the Vice President on Media and Communication, Stanley Nkwocha, revealed this in a statement he signed yesterday, titled: “VP Shettima arrives in Ethiopia for official state visit.”

During the visit, Vice President Shettima will participate in the official launch of Ethiopia’s Green Legacy Programme, a flagship environmental initiative.

The programme designed to combat deforestation, enhance biodiversity, and mitigate the adverse effects of climate change targets the planting of 20 billion tree seedlings over a four-year period.

In line with strengthening bilateral ties in agriculture and industrial development, the Vice President will also embark on a strategic tour of key industrial zones and integrated agricultural facilities across selected regions of Ethiopia.

News

RSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

The Rivers State Government has called on the people of the state especially farmers to access the ?4billion agricultural loans made available by the State and domiciled in the Bank of Industry.

This is as the State Project Implementation Unit (SPIU) of Rural Access and Agricultural Marketing Project (RAAMP), a World Bank project, took its sensitization campaign to Opobo/Nkoro, Andoni, Port Harcourt City and Obio/Akpor local government areas.

The campaign was aimed at enlightening community dwellers and other stakeholders in the various local government areas on the RAAMP project implementation and programme activities.

The Permanent Secretary, Rivers State Ministry of Agriculture, Mr Maurice Ogolo, said this at Opobo town, Ngo, Port Harcourt City and Rumuodumanya, headquarters of the four local government areas respectively, during the sensitization campaign.

Ogolo said apart from the ?4billion, the government has also made available fertilizers and other farm inputs to farmers in the various local government areas.

The Permanent Secretary who is the Chairman, State Steering Committee for the project, said RAAMP will construct roads that will connect farms to markets to enable farmers and fishermen sell their farms produce and fishes.

He also said rural roads would be constructed to farms and fishing settlements, and warned against any act that will lead to the cancellation of the projects in the four local government areas.

According to him, the World Bank and Federal Government which are the financiers of the programme will not condone such acts like kidnapping, marching ground and other acts inimical to the successful implementation of the projects in their respective areas.

At PHALGA, Ogolo asserted that the city will benefit in the areas of roads and bridge construction.

He noted that RAAMP was thriving in both the Federal Capital Territory, Abuja; Lagos and other states in the country, stressing that the project should also be given the seriousness it deserves in Rivers State.

Speaking at Opobo town, the headquarters of Opobo/Nkoro Local Government Area, the project coordinator, RAAMP, Mr.Joshua Kpakol, said the programme would reduce poverty in the state.

According to him, both fishermen and farmers will maximally benefit from the programme.

At Ngo which is the headquarters of Andoni Local Government Area, Kpakol said roads will be constructed to all remote fishing settlements.

He said Rivers State is lucky to be among the states implementing the project, and stressed the need for the people to embrace it.

Meanwhile, Kpakol said at PHALGA that RAAMP is a project that will transform the lives of farmers, traders and other stakeholders in the area.

He urged the stakeholders to spread the information to their various communities.

However, some of the stakeholders at Opobo town complained about the destruction of their farms by bulls allegedly owed by traditional rulers in the area, as well as incessant stealing of their canoes at waterfronts.

At Ngo, Archbishop Elkanah Hanson, founder of El-Shaddai Church, commended the World Bank and the Federal Government for bringing the projects to Andoni.

He stressed the need for the construction of roads to fishing settlements in the area.

Also, a former Commissioner for Agriculture in the state and Okan Ama of Ekede, HRH King Gad Harry, noted that storage facilities have become necessary for a successful agricultural programme.

Harry also stressed the need for the programme to be made sustainable.

In their separate speeches, the administrators of Andoni and Opobo/Nkoro Local Government Areas, pledged their readiness to support the programme.

At Port Harcourt City, the Administrator, Dr Arthur Kalagbor, represented by the Head of Local Government Administration, Port Harcourt City, Mr Clifford Paul, said the city would support the implementation of the programme in the area.

Also, the administrator of Obio/Akpor Local Government Area, Dr Clifford Ndu Walter, represented by Mr Michael Elenwo, pledged to support the programme in his local government area.

Among dignitaries at the Obio/Akpor stakeholders engagement is the chairman, Rivers State Traditional Rulers Council and paramount ruler of Apara Kingdom, HRM Eze Chike Wodo, amongst others.

John Bibor

News

Tinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

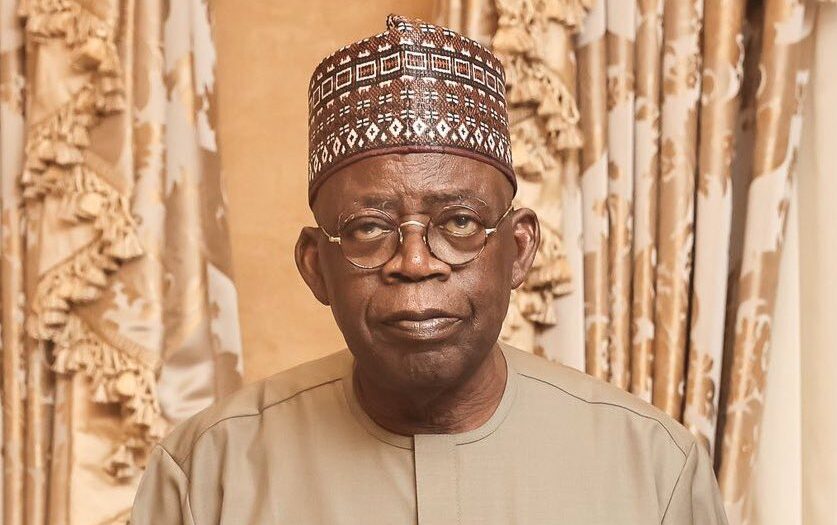

President Bola Tinubu has ordered the commencement of personnel audit and skill gap analysis across all cadres of federal civil servants.

The president gave this directive in Abuja, yesterday, while speaking at the International Civil Service Conference, reaffirming his resolve to achieve efficiency and professional service delivery in the civil service.

“I have authorized the comprehensive personnel audit and skill gap analysis across the federal civil service to deepen capacity. I urge all responsible stakeholders to prioritize timely completion of this critical exercise, to begin implementing targeted reforms, to realize the full benefit of a more agile, competent and responsive civil service,” the president announced.

Tinubu further directed all Ministries, Departments and Agencies (MDAs), to prioritise data integrity and sovereignty in national interest.

He called for the capture, protection and strategic publication of public sector data in line with the Nigeria Data Protection Act of 2023.

“We must let our data speak for us. We must publish verified data assets within Nigeria and share them internationally recognized as fruitful. This will allow global benchmarking organisation to track our progress in real time and help us strengthen our position on the world stage. This will preserve privacy and uphold data sovereignty,” Tinubu added.

President Tinubu hailed the federal civil service as the “engine” driving his Renewed Hope Agenda, and the vehicle for delivering sustainable national development.

He submitted that the roles of civil servants remain indispensable in modern governance, declaring that in the face of a fast-evolving digital and economic landscape, the civil service must remain agile, future-ready, and results-driven.

“This maiden conference is a bold step toward redefining governance in an era of rapid transformation. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“It captures our collective ambition to reimagine and reposition the civil service. In today’s rapid, evolving world of technology, innovation remains critical in ensuring that the civil service is dynamic, digital” the President said.

Head of the Civil Service of the Federation, Didi Walson-Jack in her welcome address told the President that his presence and strong words of commendation at the conference has renewed the morale and mandate of public servants across the country.

Walson-Jack described Tinubu as the backbone of driving transformation in the Nigerian civil service, and noted that the takeaways from past study tours undertaken to understudy the civil service in Singapore, the UK and US under her leadership, is already yielding multiplier effects.

Walson-Jack assured Tinubu that her office, in collaboration with reform-minded stakeholders, will not relent in accelerating the implementation of the Federal Civil Service Strategy and Implementation Plan, FCSSIP 25.

She affirmed that digitalisation, performance management, and continuous learning remain key pillars in strengthening accountability, transparency, and service delivery across MDAs.

Walson-Jack reaffirmed that the civil service is determined to exceed expectations by embedding a culture of innovation, ethical leadership, and citizen-centred governance in the heart of public administration.

-

News5 days ago

News5 days agoSenate Confirms Odey As RISEIC Chairman

-

Sports5 days ago

‘Ofili Still Representing Nigeria’

-

News5 days ago

Immigration Plays Strategic Role In Nation Building -Worika

-

Niger Delta5 days ago

NDLEA Apprehends 312 Suspects … Seizes 803.672 kg Of Drugs In A’Ibom

-

Women4 days ago

How Women Can Manage Issues In Marriage

-

Business5 days ago

Coy Expands Pipeline Network In Rivers

-

Sports5 days ago

NBBF Releases D’Tigress Provisional Roster

-

News5 days ago

News5 days agoCourt Arraigns Rivers Traditional Ruler Over Impersonation, Other Charges