News

Revitalising Nigerian Universities For Export

According to the World Bank, there is a direct correlation between sustainable development and poverty reduction; however, it has also been established that education and knowledge capacity building are the key accelerators of sustainable development. In spite of the abundance of verifiable global evidences trumpeting the power of education, we have been plagued by visionless leaders at the national stage since 1999, whose short sightedness has dislocated our educational system. As a consequence, only the rich in Nigeria can truly afford quality basic education in the country, and saleable tertiary education abroad. I believe in this country, even with our religious and tribal fault lines, I keep faith with the promise in a statement Prof. Pat Utomi made a few years ago, that, “our future is so bright that one might need sun glasses to look at it”. I believe that inherent in the conundrum of the Academic Staff Union of Universities’ ( ASUU) struggle is the seed for a thriving world-class tertiary ecosystem. But that is only if our leaders rouse themselves from their political doldrums.

The position of the Federal Government, as espoused by the Minister of State for Labour, Bar. Festus Kyamo, (SAN), that there is no money to meet the demand of ASUU, is not only lame and unfortunate, it is also a confirmation of the lack of capacity for vision, and the ability to think outside the box.

The unfounded assertion of the present administration, especially those who ought to know, smacks of pure ignorance of available data and their implications. For instance, recent data from the National Association of Nigerian Nurses and Midwives revealed that more than 11000 nurses have departed the shores of this country since 2019. This data maybe interpreted as brain drain at an unprecedented level, but what if it is viewed as human capital export instead? Can you imagine how much diaspora remittance has emanated from these nurses? The data highlights something very significant, that even with a broken tertiary education sector; we are still able to churn out nurses able to pass qualifying exams to work internationally.

The same applies to Nigerian trained doctors who are now like hotcakes in the global market. Currently, our doctors are being recruited by firms from the United Kingdom, UK, United States of America, USA, Canada and Saudi Arabia. In fact, a doctor friend of mine; a lecturer in one of our state universities, confided in me that she and many of her colleagues regularly receive invitations for job openings by foreign recruiters.

Now is this brain drain, or human capital export? It depends on your perspective. But you must remember that inflows from diaspora remittance before the impact of the COVID-19 pandemic was already competing with our annual national budget. For instance, in 2020, diaspora remittance stood at $23.45 billion. The implication is that most families in the country are able to meet their daily needs because of a family member working abroad. If these are established facts, how is it that we approach the funding of education with the mindset of expenditure, rather than investment?

How can we say we have no money to meet ASUU’s public universities revitalisation fund, when available data from the CBN show that between 2010 and 2020 Nigerians spent a whopping $28.65 billion in foreign universities as tuition. In the current exchange rate, it translates to about N11.62 trillion. Also, recent data from the CBN reveal that between January and May of this year alone, Nigerians have spent $378.77 million on foreign universities. Our appetite for foreign education ranked us as the country with the highest number of students abroad in Africa, with an estimated 76,338 students in 2018 according to United Nations Educational Scientific and Cultural Organization (UNESCO). It is indeed a hard sell for the FG to tell Nigerians there is no money for ASUU, when it can afford to use Chinese loans to build rail lines to the Niger Republic. Granted, Nigeria may not be as rich as it was when I was a little boy, when a certain head of state was heard saying, ‘we have so much money that we don’t know what to do with it”. However, we are being inebriated by various cancers, including, corruption, outright thievery, incompetence, lack of vision and patriotism.

ASUU president, Prof. Emmanuel Osodeke, stated the situation very succinctly in his response to FG’s claim of paucity of funds, when he said, “the major reason given by the Federal Government for the miserly offer; paucity of revenue, is not tenable. This is because of several reasons, chief of which, is poor management of the economy. This has given rise to leakages in the revenue of governments at all levels.”

“There is wasteful spending, misappropriation of funds, and outright stealing of our collective patrimony. ASUU believes that if the leakages in the management of the country’s resources are stopped, there will be more than enough to meet the nation’s revenue and expenditure targets without borrowing and plunging the country into a debt crisis as is the case now.”

Even though I align myself with the Professor in most part, I have a contrary view regarding the issue of loan for our universities.

In my opinion, if the loan will not be eaten by monkeys, swallowed by snakes, or consumed by termites, then the Federal Government should borrow for the improvement of university infrastructure, and the enhancement of learning environment. The goal should be return on investment, in terms of improved global ranking for our universities; human capital export, and the associated diaspora remittance; global knowledge centres capable of attracting foreign direct investment; attraction of both foreign faculty, and foreign students; and the development of home grown solutions for national challenges. Currently, and thankfully, the 2021 – 2027 Strategic Plan on ranking, and the 2019 – 2023 Blue Print on the Rapid Revitalisation of University Education in Nigeria implemented by the National University Commission is already bearing fruit. The latest Academic Ranking of World Universities (ARWU) indicates a marked improvement with the University of Ibadan (UI), Obafemi Awolowo University (OAU), and the Federal University of Agriculture Abeokuta (FUNAAB) appearing in top positions.

This is the first time since the inception of the ranking in 2003 that UI is appearing in the 800 – 901 band. Last week, the latest Shanghai Global Ranking of Academic Subject (GRAS) was released showing more positive results for Nigeria; with FUNAAB in the 201 – 300 band in Veterinary Sciences, while OAU appeared in the 201 – 300 band in Dentistry and Oral Sciences, and the University of Nigeria Nsuka appeared in the 401 – 500 band in Psychology.The argument is clear, tertiary education in Nigeria is not dead. But we can do better. While the vision for global ranking is clear, and on course, other deliverables must be clearly articulated and accelerated. The issue of funding tertiary education must be put in the front burner. The current administration should follow the advice of ASUU and fully deploy revenue from the increased telecommunication tax of 12.5 per cent to tertiary education. As usual, all we need to do well as a country is at our disposal, but we are our own nemesis. Nevertheless, I have hope that the current ASUU strike would not be suspended but be brought to an end for good, which is ASUU’s desire, as well as the parents’ and students’.

By: Raphael Pepple

News

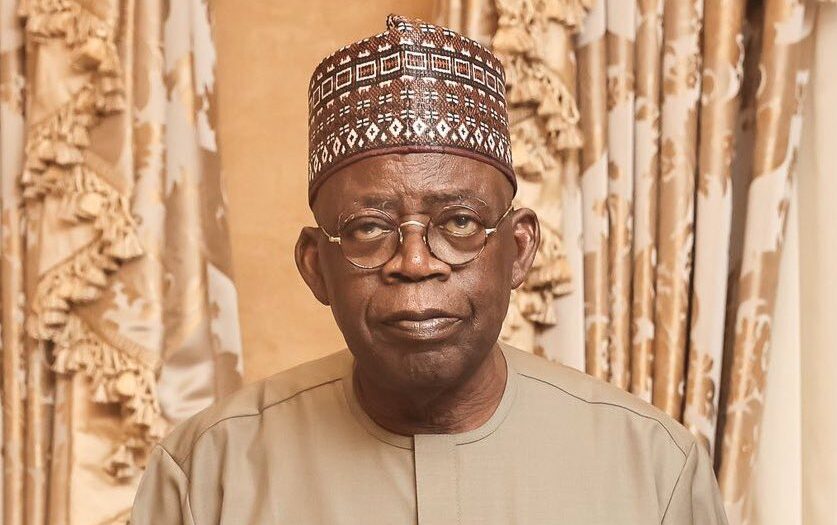

Shettima In Ethiopia For State Visit

Vice President Kashim Shettima has arrived in Addis Ababa, Ethiopia, for an official State visit at the invitation of the Prime Minister, Dr. Abiy Ahmed.

Upon arrival yesterday, Shettima was received at the airport by the Minister of Foreign Affairs of Ethiopia, Dr. Gedion Timothewos, and other members of the Ethiopian and Nigerian diplomatic corps.

Senior Special Assistant to the Vice President on Media and Communication, Stanley Nkwocha, revealed this in a statement he signed yesterday, titled: “VP Shettima arrives in Ethiopia for official state visit.”

During the visit, Vice President Shettima will participate in the official launch of Ethiopia’s Green Legacy Programme, a flagship environmental initiative.

The programme designed to combat deforestation, enhance biodiversity, and mitigate the adverse effects of climate change targets the planting of 20 billion tree seedlings over a four-year period.

In line with strengthening bilateral ties in agriculture and industrial development, the Vice President will also embark on a strategic tour of key industrial zones and integrated agricultural facilities across selected regions of Ethiopia.

News

RSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

The Rivers State Government has called on the people of the state especially farmers to access the ?4billion agricultural loans made available by the State and domiciled in the Bank of Industry.

This is as the State Project Implementation Unit (SPIU) of Rural Access and Agricultural Marketing Project (RAAMP), a World Bank project, took its sensitization campaign to Opobo/Nkoro, Andoni, Port Harcourt City and Obio/Akpor local government areas.

The campaign was aimed at enlightening community dwellers and other stakeholders in the various local government areas on the RAAMP project implementation and programme activities.

The Permanent Secretary, Rivers State Ministry of Agriculture, Mr Maurice Ogolo, said this at Opobo town, Ngo, Port Harcourt City and Rumuodumanya, headquarters of the four local government areas respectively, during the sensitization campaign.

Ogolo said apart from the ?4billion, the government has also made available fertilizers and other farm inputs to farmers in the various local government areas.

The Permanent Secretary who is the Chairman, State Steering Committee for the project, said RAAMP will construct roads that will connect farms to markets to enable farmers and fishermen sell their farms produce and fishes.

He also said rural roads would be constructed to farms and fishing settlements, and warned against any act that will lead to the cancellation of the projects in the four local government areas.

According to him, the World Bank and Federal Government which are the financiers of the programme will not condone such acts like kidnapping, marching ground and other acts inimical to the successful implementation of the projects in their respective areas.

At PHALGA, Ogolo asserted that the city will benefit in the areas of roads and bridge construction.

He noted that RAAMP was thriving in both the Federal Capital Territory, Abuja; Lagos and other states in the country, stressing that the project should also be given the seriousness it deserves in Rivers State.

Speaking at Opobo town, the headquarters of Opobo/Nkoro Local Government Area, the project coordinator, RAAMP, Mr.Joshua Kpakol, said the programme would reduce poverty in the state.

According to him, both fishermen and farmers will maximally benefit from the programme.

At Ngo which is the headquarters of Andoni Local Government Area, Kpakol said roads will be constructed to all remote fishing settlements.

He said Rivers State is lucky to be among the states implementing the project, and stressed the need for the people to embrace it.

Meanwhile, Kpakol said at PHALGA that RAAMP is a project that will transform the lives of farmers, traders and other stakeholders in the area.

He urged the stakeholders to spread the information to their various communities.

However, some of the stakeholders at Opobo town complained about the destruction of their farms by bulls allegedly owed by traditional rulers in the area, as well as incessant stealing of their canoes at waterfronts.

At Ngo, Archbishop Elkanah Hanson, founder of El-Shaddai Church, commended the World Bank and the Federal Government for bringing the projects to Andoni.

He stressed the need for the construction of roads to fishing settlements in the area.

Also, a former Commissioner for Agriculture in the state and Okan Ama of Ekede, HRH King Gad Harry, noted that storage facilities have become necessary for a successful agricultural programme.

Harry also stressed the need for the programme to be made sustainable.

In their separate speeches, the administrators of Andoni and Opobo/Nkoro Local Government Areas, pledged their readiness to support the programme.

At Port Harcourt City, the Administrator, Dr Arthur Kalagbor, represented by the Head of Local Government Administration, Port Harcourt City, Mr Clifford Paul, said the city would support the implementation of the programme in the area.

Also, the administrator of Obio/Akpor Local Government Area, Dr Clifford Ndu Walter, represented by Mr Michael Elenwo, pledged to support the programme in his local government area.

Among dignitaries at the Obio/Akpor stakeholders engagement is the chairman, Rivers State Traditional Rulers Council and paramount ruler of Apara Kingdom, HRM Eze Chike Wodo, amongst others.

John Bibor

News

Tinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

President Bola Tinubu has ordered the commencement of personnel audit and skill gap analysis across all cadres of federal civil servants.

The president gave this directive in Abuja, yesterday, while speaking at the International Civil Service Conference, reaffirming his resolve to achieve efficiency and professional service delivery in the civil service.

“I have authorized the comprehensive personnel audit and skill gap analysis across the federal civil service to deepen capacity. I urge all responsible stakeholders to prioritize timely completion of this critical exercise, to begin implementing targeted reforms, to realize the full benefit of a more agile, competent and responsive civil service,” the president announced.

Tinubu further directed all Ministries, Departments and Agencies (MDAs), to prioritise data integrity and sovereignty in national interest.

He called for the capture, protection and strategic publication of public sector data in line with the Nigeria Data Protection Act of 2023.

“We must let our data speak for us. We must publish verified data assets within Nigeria and share them internationally recognized as fruitful. This will allow global benchmarking organisation to track our progress in real time and help us strengthen our position on the world stage. This will preserve privacy and uphold data sovereignty,” Tinubu added.

President Tinubu hailed the federal civil service as the “engine” driving his Renewed Hope Agenda, and the vehicle for delivering sustainable national development.

He submitted that the roles of civil servants remain indispensable in modern governance, declaring that in the face of a fast-evolving digital and economic landscape, the civil service must remain agile, future-ready, and results-driven.

“This maiden conference is a bold step toward redefining governance in an era of rapid transformation. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“It captures our collective ambition to reimagine and reposition the civil service. In today’s rapid, evolving world of technology, innovation remains critical in ensuring that the civil service is dynamic, digital” the President said.

Head of the Civil Service of the Federation, Didi Walson-Jack in her welcome address told the President that his presence and strong words of commendation at the conference has renewed the morale and mandate of public servants across the country.

Walson-Jack described Tinubu as the backbone of driving transformation in the Nigerian civil service, and noted that the takeaways from past study tours undertaken to understudy the civil service in Singapore, the UK and US under her leadership, is already yielding multiplier effects.

Walson-Jack assured Tinubu that her office, in collaboration with reform-minded stakeholders, will not relent in accelerating the implementation of the Federal Civil Service Strategy and Implementation Plan, FCSSIP 25.

She affirmed that digitalisation, performance management, and continuous learning remain key pillars in strengthening accountability, transparency, and service delivery across MDAs.

Walson-Jack reaffirmed that the civil service is determined to exceed expectations by embedding a culture of innovation, ethical leadership, and citizen-centred governance in the heart of public administration.