The Nigerian Content Development and Monitoring Board (NCDMB) and the Dangote Petroleum Refinery and Petrochemical Company have inaugurated a Joint Technical Committee (JrefineryTC) aimed at advancing local content implementation during the operational phase of the 650,000 barrels per day plant.

A statement from the Directorate of Corporate Communications of the Board noted that the inauguration ceremony took place at the Dangote Free Trade Zone, Ibeju-Lekki, Lagos State.

The statement also said the inauguration marks a pivotal moment in fostering strategic collaboration between the both institutions, and was a significant move to reinforce local content development in the oil and gas sector.

Presided over by the Executive Secretary of the NCDMB, Engr. Felix Omatsola Ogbe, and the Group Vice President, Oil and Gas, Dangote Group, Chief Edwin Devakumar, the event featured the formal sign-off of the Committee’s Terms of Reference (ToR), a guided tour of the refinery, other critical facilities, and the official commencement of the JTC’s responsibilities.

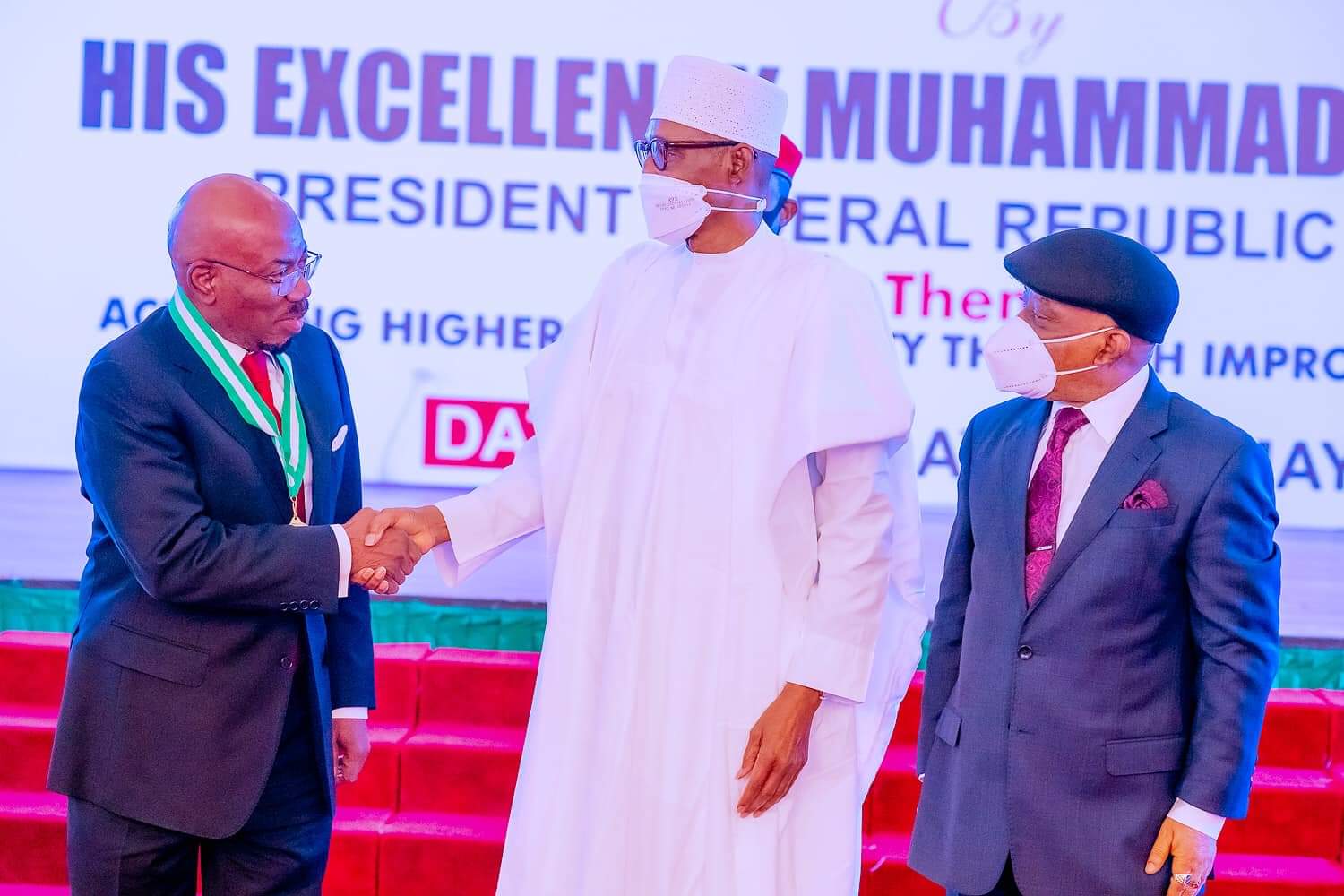

According to the Board, the visit also featured the presentation of the certificate of the Nigerian Content Downstream Operator of the Year Award won by the Dangote Petroleum Refinery and Petrochemical Company at the inaugural ‘Champions of Nigerian Content Awards’ held recently in May.

The NCDMB’s boss made the presentation to the President of the Dangote Group, Alhalji Aliko Dangote, who expressed delight at the recognition, noting that he would display the certificate proudly at his office.

Ogbe congratulated the Dangote Group on the successful development and commissioning of the largest single train refinery in the world, as well as petrochemical and fertiliser plants, describing the projects as a historic milestone not for Nigeria alone, but for the entire continent.

He emphasized that the Dangote Refinery stands as a testament to the success of the Nigerian Oil and Gas Industry Content Development (NOGICD) Act of 2010 and the transformative potential of Nigerian-led industrial projects.

“At an optimal daily production capacity of 650,000 barrels, this refinery will significantly enhance Nigeria’s energy security and contribute to the supply of refined petroleum products across West Africa.

“Nigerians, have to own the plant, we have to make sure that the plant works well. We have to secure it, we have to maintain it. The NCDMB would continue to collaborate with Dangote Petroleum Refinery”, Engr Ogbe said.

Highlighting the need to ensure more value retention in the sector, as mandated by the Nigerian Oil and Gas Industry Content Development Act (NOGICD) 2010, the Board’s helmsman demanded compliance with Sections 32 and 33 of the NOGICD Act, with particular reference to local manpower utilization and requirements for NCDMB’s approval prior to the engagement of expatriates.

“The NOGICD Act stipulates that no expatriate can be employed in any organization in the oil and gas industry without the prior approval of the NCDMB. We will work with you, We’ve to protect jobs for Nigerians. It’s critical to job creation, skills development, and national capacity building in line with the ‘Renewed Hope Agenda’ of President Bola Ahmed Tinubu”, he said.

He commended the firm for training and employing Nigerian engineers, saying the collaboration will ensure that qualified Nigerians were given opportunities across all operational roles, while also urging the Dangote Petroleum Refinery and Petrochemicals to support the Board’s initiative which aims at developing oil and gas industrial parks across the country to foster local content and manufacturing in the sector.

He noted that the Nigerian Oil and Gas Parks Scheme (NOGaPS) seeks to create an enabling environment for Small and Medium Enterprises in the sector.

“NOGaPS was conceived by the Board to develop facilities close to oil fields where manufacturing of oil and gas components, as well as research and development, can be carried out.

“We would like Dangote to support one of our major activities, which is the oil and gas industrial parks scheme. The parks are aimed at creating an enabling environment for SMEs in the industry to do fabrications and create more jobs for Nigerians”, the NCDMB’S boss stated.

In his welcome address, the Dangote Group Vice President, Devakumar, highlighted that the refinery project and NCDMB have been working together, promoting local content development during the construction stages of the project.

“We can’t say we have achieved everything, because there is opportunity to do more. We’re grateful to the NCDMB for all their support and advice. As entrepreneurs, we’re trying to optimise costs. It’s a Nigerian company, it’s also an entrepreneur-driven company. As a Nigerian company, the focus will be on Nigerian content. As an entrepreneur-driven company, it will be cost-focused”, he noted.

Devakumar underscored the long-standing commitment of the Dangote Group to national development and capacity building, saying that the Group’s vision is to grow Nigeria’s industrial landscape.

High points of the visit, according to the Corporate Communications Directorate of the NCDMB, was the inauguration of the Committee members.

The statement from the NCDMB further added that the committee is to ensure the implementation of local content in the refinery’s operations, while its core objectives include promoting the use of Nigerian skilled manpower, services, and locally sourced materials in compliance with Section 3 of the NOGICD Act.

The Tide learnt that the committee will also support Dangote Refinery in aligning its operational procedures with the Act’s requirements.

In his acceptance remarks, Director of Corporate Services at NCDMB and Chairman of the Committee, Mr. Abdulmalik Halilu, expressed gratitude to the leadership of both organizations, reiterating the Committee’s dedication to upholding the highest standards of local content enforcement and fostering measurable outcomes that will benefit the nation’s economy.

Ariwera Ibibo-Howells, Yenagoa