News

NASS Passes Finance Bill Two Weeks After Transmission

The National Assembly has passed the Finance Bill 2021, transmitted to the National Assembly by President Muhammadu Buhari, on December 7, 2021.

The passage of the bill two weeks later was sequel to the consideration of a report by Senator Olamilekan Adeola, All Progressives Congress (APC), Lagos West-led Senate Joint Committee on Finance; Customs, Excise and Tariff; Trade and Investment.

The passage of the Finance Bill in the House of Representatives was sequel to the consideration of the report presented by the Chairman, House Committee on Finance, Hon. James Faleke.

“Report on a Bill for an Act to Amend the Capital Gains Tax Act, Companies Income Tax Act, Federal Inland Revenue Service (Establishment) Act, Personal Income Tax Act, Stamp Duties Act, Tertiary Education Trust Fund (Establishment) Act, Value Added Tax Act, Insurance Act, Nigerian Police Trust Fund (Establishment) Act, National Agency for Science and Engineering Infrastructure Act, Finance Control and management Act, Fiscal responsibility Act; and for Related Matters”, he said.

In his presentation, Chairman of the Senate Joint Committee, Senator Solomon Olamilekan Adeola, said that the bill seeks to support the implementation of the 2022 Federal Budget of Economic Growth and Sustainability by proposing key specific taxation, customs, excise, fiscal and other relevant laws.

According to Adeola, a total of 12 Acts were amended under the finance bill which contains 39 clauses, adding that the bill seeks to promote fiscal equity, align domestic tax laws with global best practice, introduce tax incentives for infrastructure and capital markets, support small businesses and promote increase government revenue.

Adeola said, “The Finance Act 2020 was predicated essentially on having no new taxes and no new incentives due to the COVID -19’s impact on the economy as such it was structured across four broad thematic areas; Enacting counter-cyclical measures and crisis intervention initiatives; Tax, fiscal responsibility, and public procurement reforms; Reforming fiscal incentives policies for job creation; Ensuring closer coordination of monetary, trade and fiscal policies; and Enhancing tax administration.”

The Joint Committee, based on its observations, accordingly, recommended 5per cent Capital Gains Tax to be imposed on shares’ disposal transactions where gains exceed N250million in 12 calendar months.

It recommended that Gaming and Lottery Companies be taxable, as well as Oil and Gas Companies.

It underscored the need for Midstream and Downstream Oil and Gas Companies to be made liable to corporate tax without the benefit of tax exemptions for firms exporting goods to earn foreign exchange.

The committee observed that doing so would prevent Double-Dipping by Gas Utilisation Companies such that they cannot claim both (1) 3-year Tax Holidays; as well as (2) Petroleum Profit Tax Act Incentives or (3) pioneer tax holidays under IDITRA.

The Joint Committee advocated for qualifying Capital Expenditure rules for small and pioneer companies, to prevent double-dipping by mandating that companies cannot deduct qualifying Capital Expenditure to reduce their taxable profits where the relevant qualifying Capital Expenditure is used to generate tax-exempt income.

It sought more powers for the Federal Inland Revenue Service (FIRS) to collect NPTF levies on Nigerian companies on behalf of the fund and to streamline tax levy collection from Nigerian companies in line with President Buhari administration’s ease of doing business reforms.

The Joint Committee also harped on the need for the Federal Government to ensure that FIRS deploys both proprietary and third-party tech applications to collect information from taxpayers, enhance confidentiality and non-disclosure and to enable them to investigate tax evasion and other crimes and sanction non-compliant taxpayers.

It further called for FIRS to be empowered to assess Non-Resident Firms to tax on a fair and reasonable turnover basis on turnover earned from digital services to Nigerian customers, with a further mandate to appoint persons for the purpose of collection and remittance of non-resident taxes.

The committee demanded necessary reforms on securities lending transactions, minimum Tax for Insurance Companies and Companies in general, Taxation of Unit Trust Income, Real Estate Investment Trust, and Insurance Companies Capitalisation by NAICOM in line with Tax Equity.

It urged the government to mandate FIRS as Principal Tax Revenue Collection Agency to collaborate with other law enforcement MDAs in streamlining tax collections by enhancing Public Financial Management reforms.

According to the Joint Committee, doing so would reduce revenue leakages and better track actual expenditure to revenue performance in line with the provision of the Constitution of the Federal Republic of Nigeria 1999 (as Amended), Fiscal Rules and other Extant Money Acts.

It also called for the diversification of Nigeria’s revenue from oil sector to other sectors to fund critical expenditures.

The committee while demanding an increase of 0.5per cent in educational tax, pushed for close monitoring of unfolding development and policies on VAT, tax incentives, projected increase tariff on tobacco, alcohol and carbonated drinks to fund vital expenditure on health, education and security, with a possibility of introduction of new taxes, tariffs and levies as the economy recovers.

News

Shettima In Ethiopia For State Visit

Vice President Kashim Shettima has arrived in Addis Ababa, Ethiopia, for an official State visit at the invitation of the Prime Minister, Dr. Abiy Ahmed.

Upon arrival yesterday, Shettima was received at the airport by the Minister of Foreign Affairs of Ethiopia, Dr. Gedion Timothewos, and other members of the Ethiopian and Nigerian diplomatic corps.

Senior Special Assistant to the Vice President on Media and Communication, Stanley Nkwocha, revealed this in a statement he signed yesterday, titled: “VP Shettima arrives in Ethiopia for official state visit.”

During the visit, Vice President Shettima will participate in the official launch of Ethiopia’s Green Legacy Programme, a flagship environmental initiative.

The programme designed to combat deforestation, enhance biodiversity, and mitigate the adverse effects of climate change targets the planting of 20 billion tree seedlings over a four-year period.

In line with strengthening bilateral ties in agriculture and industrial development, the Vice President will also embark on a strategic tour of key industrial zones and integrated agricultural facilities across selected regions of Ethiopia.

News

RSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

The Rivers State Government has called on the people of the state especially farmers to access the ?4billion agricultural loans made available by the State and domiciled in the Bank of Industry.

This is as the State Project Implementation Unit (SPIU) of Rural Access and Agricultural Marketing Project (RAAMP), a World Bank project, took its sensitization campaign to Opobo/Nkoro, Andoni, Port Harcourt City and Obio/Akpor local government areas.

The campaign was aimed at enlightening community dwellers and other stakeholders in the various local government areas on the RAAMP project implementation and programme activities.

The Permanent Secretary, Rivers State Ministry of Agriculture, Mr Maurice Ogolo, said this at Opobo town, Ngo, Port Harcourt City and Rumuodumanya, headquarters of the four local government areas respectively, during the sensitization campaign.

Ogolo said apart from the ?4billion, the government has also made available fertilizers and other farm inputs to farmers in the various local government areas.

The Permanent Secretary who is the Chairman, State Steering Committee for the project, said RAAMP will construct roads that will connect farms to markets to enable farmers and fishermen sell their farms produce and fishes.

He also said rural roads would be constructed to farms and fishing settlements, and warned against any act that will lead to the cancellation of the projects in the four local government areas.

According to him, the World Bank and Federal Government which are the financiers of the programme will not condone such acts like kidnapping, marching ground and other acts inimical to the successful implementation of the projects in their respective areas.

At PHALGA, Ogolo asserted that the city will benefit in the areas of roads and bridge construction.

He noted that RAAMP was thriving in both the Federal Capital Territory, Abuja; Lagos and other states in the country, stressing that the project should also be given the seriousness it deserves in Rivers State.

Speaking at Opobo town, the headquarters of Opobo/Nkoro Local Government Area, the project coordinator, RAAMP, Mr.Joshua Kpakol, said the programme would reduce poverty in the state.

According to him, both fishermen and farmers will maximally benefit from the programme.

At Ngo which is the headquarters of Andoni Local Government Area, Kpakol said roads will be constructed to all remote fishing settlements.

He said Rivers State is lucky to be among the states implementing the project, and stressed the need for the people to embrace it.

Meanwhile, Kpakol said at PHALGA that RAAMP is a project that will transform the lives of farmers, traders and other stakeholders in the area.

He urged the stakeholders to spread the information to their various communities.

However, some of the stakeholders at Opobo town complained about the destruction of their farms by bulls allegedly owed by traditional rulers in the area, as well as incessant stealing of their canoes at waterfronts.

At Ngo, Archbishop Elkanah Hanson, founder of El-Shaddai Church, commended the World Bank and the Federal Government for bringing the projects to Andoni.

He stressed the need for the construction of roads to fishing settlements in the area.

Also, a former Commissioner for Agriculture in the state and Okan Ama of Ekede, HRH King Gad Harry, noted that storage facilities have become necessary for a successful agricultural programme.

Harry also stressed the need for the programme to be made sustainable.

In their separate speeches, the administrators of Andoni and Opobo/Nkoro Local Government Areas, pledged their readiness to support the programme.

At Port Harcourt City, the Administrator, Dr Arthur Kalagbor, represented by the Head of Local Government Administration, Port Harcourt City, Mr Clifford Paul, said the city would support the implementation of the programme in the area.

Also, the administrator of Obio/Akpor Local Government Area, Dr Clifford Ndu Walter, represented by Mr Michael Elenwo, pledged to support the programme in his local government area.

Among dignitaries at the Obio/Akpor stakeholders engagement is the chairman, Rivers State Traditional Rulers Council and paramount ruler of Apara Kingdom, HRM Eze Chike Wodo, amongst others.

John Bibor

News

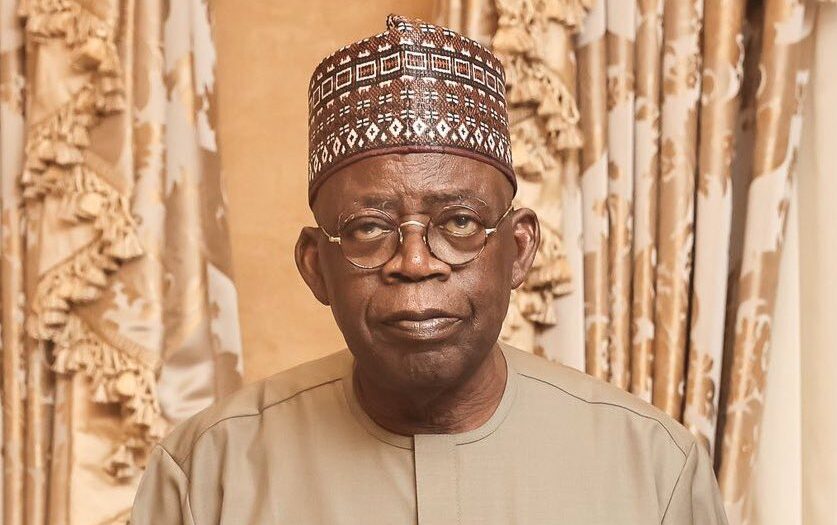

Tinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

President Bola Tinubu has ordered the commencement of personnel audit and skill gap analysis across all cadres of federal civil servants.

The president gave this directive in Abuja, yesterday, while speaking at the International Civil Service Conference, reaffirming his resolve to achieve efficiency and professional service delivery in the civil service.

“I have authorized the comprehensive personnel audit and skill gap analysis across the federal civil service to deepen capacity. I urge all responsible stakeholders to prioritize timely completion of this critical exercise, to begin implementing targeted reforms, to realize the full benefit of a more agile, competent and responsive civil service,” the president announced.

Tinubu further directed all Ministries, Departments and Agencies (MDAs), to prioritise data integrity and sovereignty in national interest.

He called for the capture, protection and strategic publication of public sector data in line with the Nigeria Data Protection Act of 2023.

“We must let our data speak for us. We must publish verified data assets within Nigeria and share them internationally recognized as fruitful. This will allow global benchmarking organisation to track our progress in real time and help us strengthen our position on the world stage. This will preserve privacy and uphold data sovereignty,” Tinubu added.

President Tinubu hailed the federal civil service as the “engine” driving his Renewed Hope Agenda, and the vehicle for delivering sustainable national development.

He submitted that the roles of civil servants remain indispensable in modern governance, declaring that in the face of a fast-evolving digital and economic landscape, the civil service must remain agile, future-ready, and results-driven.

“This maiden conference is a bold step toward redefining governance in an era of rapid transformation. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“It captures our collective ambition to reimagine and reposition the civil service. In today’s rapid, evolving world of technology, innovation remains critical in ensuring that the civil service is dynamic, digital” the President said.

Head of the Civil Service of the Federation, Didi Walson-Jack in her welcome address told the President that his presence and strong words of commendation at the conference has renewed the morale and mandate of public servants across the country.

Walson-Jack described Tinubu as the backbone of driving transformation in the Nigerian civil service, and noted that the takeaways from past study tours undertaken to understudy the civil service in Singapore, the UK and US under her leadership, is already yielding multiplier effects.

Walson-Jack assured Tinubu that her office, in collaboration with reform-minded stakeholders, will not relent in accelerating the implementation of the Federal Civil Service Strategy and Implementation Plan, FCSSIP 25.

She affirmed that digitalisation, performance management, and continuous learning remain key pillars in strengthening accountability, transparency, and service delivery across MDAs.

Walson-Jack reaffirmed that the civil service is determined to exceed expectations by embedding a culture of innovation, ethical leadership, and citizen-centred governance in the heart of public administration.