Oil & Energy

Stakeholders And Oil, Gas Exploration

Some stakeholders in the oil and gas industry have advised the Federal Government to make provision in subsequent national budgets for offshore and onshore exploration activities to encourage new discoveries.

They gave the advice in separate interviews with newsmen in Lagos last Friday while reviewing the oil and gas sector for 2018.

The former President, Nigerian Association of Petroleum Explorationists (NAPE), Mr Biodun Adesanya, said in 2018, there was noticeable improvement in the revenue generation occasioned by better oil price and less disruption in export volumes.

“In 2019, we should work harder to sustain and improve on the modest gains of 2018 especially the production and export infrastructures.

“They also need to conduct licensing round.”

Adesanya, who is also the Managing Director, Degeconek Nig. Ltd., urged government to develop the country’s modular refineries to reduce importation of refine petroleum products.

“The modular refinery concept is a good idea but its implementation will be difficult under the existing structure.

“How would it resolve the challenges of the Niger Delta region, how will it be funded?

“How can the crude supply be guaranteed, what currency will the crude be sold to the refineries given that products will be sold in Naira,” he said.

The former Chairman, Society of Petroleum Engineers (SPE), Nigeria Council, Mr Chikezie Nwosu, said establishing fairly comfortable oil price should be of particular interest to the oil and gas industry in 2019 and beyond.

He said the current uncertainty in global politics had effects on the global economy and that prediction of market trends was becoming increasingly difficult.

According to him, global political tensions add significant uncertainty to an already challenged oil and gas industry; demand versus supply economics.

“The tensions between the USA and Iran, the Saudi Arabian issues with the killing of the journalist Jamal Khashoggi and the withdrawal of Qatar from OPEC.

“The trade tariff skirmishes between China and the USA, BREXIT and the sudden announcement of the total withdrawal of the USA from Syria, all added to the global tensions,” he said.

Predicating the budget, Nwosu said it depended to a large extent on oil revenues, adding that an oil price of 60 dollars per barrel seemed a bit optimistic.

“A more realistic range will probably be between 40 dollars and 45 dollars per barrel, allowing for windfall receipts if higher, but also providing a hedge against lower oil prices.

“Oil production from the current data as at September stood between 2.03 million barrels per day and 2.3 million barrels per day is possible.

“This, however, provided the 2019 elections are peaceful and the results do not aggravate the Niger-Delta and host and impacted communities.

“It will be good if all four key component bills of the Petroleum Industry Bill are passed by the National Assembly, and assented to by the Presidency, early enough in the year before mid-year 2019.”

Nwosu said that would bring the needed peace to the host and impacted communities, as they become partners in the exploitation of oil and gas resources.

According to him, it will also restructure the industry and NNPC to be more effective, with a world class governance structure.

He said the bill would also attract the necessary direct investments, both local and foreign.

“Markets, including the oil and gas industry, do not like uncertainty and the PIB will go a long way to address the framework for doing business in the Nigerian oil and gas industry,” he said.

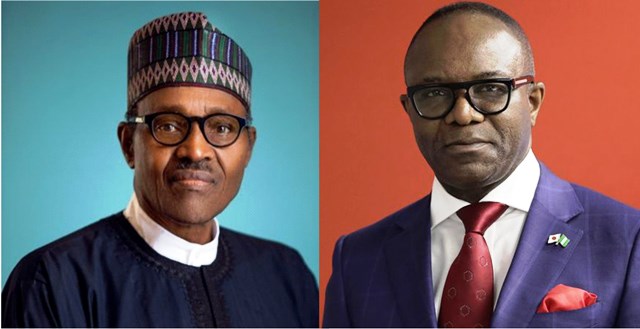

Nwosu said of particular importance was the full implementation of the seven big must wins initiated by Dr Ibe Kachikwu and supported by Dr Maikanti Baru which addresses many policy challenges in the industry.

He said unlocking the huge potential of the gas resources would also help in diversifying and growing the Nigerian economy through its impact on power, agriculture and other industry.

He said integrated Oil and Gas Field Development Plans (FDPs) must be emphasised by NNPC and some urban planning concepts must be encouraged.

This, he said was to ensure that there was leverage on synergies of development by the various operators, especially in offshore developments, and significantly lowering unit technical costs.

He said to encourage investments in exploration, it was important for NNPC to insist that exploration and appraisal plans are an integral part of all FDPs.

The Chairman, Integrated Oil and Gas Ltd., Mr Emmanuel Iheanacho, said that in the last 10 years, the demand for refined products had always been on the increase.

Iheanacho said that building a modular refinery of about 1,000 barrel cost over 1.2 billion dollars.

“Building a modular refinery is not easy, apart from citing your refinery beside the sea, one can as well site it near a marginal oil field.

“Finance is the major reasons why most investors in the modular refineries abandoned it.

“No bank is ready to give loan to any investor in modular refineries that is why it is just only two out of 40 investors given licences that were able to build it.

“Government should engage the banks to provide the finance needed for building modular refineries,” he said.

In his views, the Director-General, Lagos Chamber of Commerce and Industry, Mr Muda Yusuf, urged the Federal Government to review its policy on refined products to encourage investors into the sector.

Yusuf said: “It is a pity that after many years of oil discovery, the country is still importing its refined products for consumption.

“As long as we have oil and gas sector link with the government, private investors will continue to evade the sector.”

The chamber’s director-general also urged the government to overhaul the sector to encourage private investors.

The former Chairman, Nigerian Council of Society of Petroleum Engineers, Dr Saka Matemilola, urged NNPC to repair the existing refineries to improve its production.

Matemilola also urged Department of Petroleum Resources not to revoke the licences of investors who were unable to build modular refineries.

According to him, withdrawing the licences will not solve the problems facing the sector.

He said that there was need to work with the licence owners to address the issue of sourcing for finance from the banks to build the refineries.

Reports say that the Vice President, Prof. Yemi Osinbajo, in June, confirmed that 10 modular refineries were at advanced stages of development in the Niger Delta.

The 10 modular refineries are located in five out of the nine states in the Niger Delta region.

The states include Akwa Ibom, Cross River, Delta, Edo and Imo states.

Osinbajo said that two of the refineries, Amakpe Refinery (Akwa Ibom) and OPAC Refinery (Delta State), have had their mini-refinery modules already fabricated, assembled and containerised overseas and ready for shipment to Nigeria for installation.

The total proposed refining capacities of the 10 licensed refineries stands at 300,000 barrels.

Similarly, in November, the Minister of State for Petroleum Resources, Dr Ibe Kachikwu, said there were strong indications that three out of the 40 planned modular refineries would come on stream by end of 2019.

“Out of the 40 licenses issued, only 10 have shown progress by submitting their programmes and putting something on the ground.

“By end of 2019, we are assured that three private modular refineries would come on stream,’’ he said.

Yusuf writes for News Agency of Nigeria.

Yunus Yusuf

Oil & Energy

Nigeria Loses More Crude Oil Than Some OPEC Members – Nwoko

Nigeria’s losses due to crude oil theft has been said to be more significant than those of some other members of the Organisation of Petroleum Exporting Countries(OPEC).

The Chairman, Senate Ad- hoc Committee on Crude Oil Theft, Senator Ned Nwoko, made this known in an interview with newsmen in Abuja.

Nwoko noted with dismay the detrimental impact of the issue, which, he said include economic damage, environmental destruction, and its impact on host communities.

According to him, the theft was not only weakening the Naira, but also depriving the nation of vital revenue needed for infrastructure, healthcare, education and social development.

The Senator representing Delta North Senatorial District described the scale of the theft as staggering, with reports indicating losses of over 200,000 barrels per day.

Nwoko disclosed that the ad hoc committee on Crude Oil Theft, which he chairs, recently had a two-day public hearing on the rampant theft of crude oil through illegal bunkering, pipeline vandalism, and the systemic gaps in the regulation and surveillance of the nation’s petroleum resources.

According to him, the public hearing was a pivotal step in addressing one of the most pressing challenges facing the nation.

‘’Nigeria loses billions of dollars annually to crude oil theft. This is severely undermining our economy, weakening the Naira and depriving the nation of vital revenue needed for infrastructure, healthcare, education, and social development.

‘’The scale of this theft is staggering, with reports indicating losses of over 200,000 barrels per day more than some OPEC member nations produce.

‘’This criminal enterprise fuels corruption, funds illegal activities and devastates our environment through spills and pollution.

‘’The public hearing was not just another talk shop; it was a decisive platform to uncover the root causes of crude oil theft, bunkering and pipeline vandalism.

‘’It was a platform to evaluate the effectiveness of existing surveillance, monitoring, and enforcement mechanisms; Identify regulatory and legislative gaps that enable these crimes to thrive.

‘’It was also to engage stakeholders, security agencies, host communities, oil companies, regulators, and experts to proffer actionable solutions; and strengthen legal frameworks to ensure stricter penalties and more efficient prosecution of offenders”, he said.

Nwoko noted that Nigeria’s survival depended

Oil & Energy

Tap Into Offshore Oil, Gas Opportunities, SNEPCO Urges Companies

Shell Nigeria Exploration and Production Company Ltd. (SNEPCo) has called on Nigerian companies to position themselves strategically to take full advantage of the growing opportunities in upcoming offshore and shallow water oil and gas projects.

The Managing Director, SNEPCO, Ronald Adams, made the call at the 5th Nigerian Oil and Gas Opportunity Fair (NOGOF) Conference, held in Yenagoa, Bayelsa State, last Thursday.

Adams highlighted the major projects, including Bonga Southwest Aparo, Bonga North, and the Bonga Main Life Extension, as key areas where Nigerian businesses can grow their capacity and increase their involvement.

“Shell Nigeria Exploration and Production Company Ltd. (SNEPCo) says Nigerian companies have a lot to benefit if they are prepared to take advantage of more opportunities in its offshore and shallow water oil and gas projects.

“Projects such as Bonga Southwest Aparo, Bonga North and Bonga Main Life Extension could grow Nigerian businesses and improve their expertise if they applied themselves seriously to executing higher value contracts”, Adams stated.

Adams noted that SNEPCo pioneered Nigeria’s deepwater oil exploration with the Bonga development and has since played a key role in growing local industry capacity.

He emphasized that Nigerian businesses could expand in key areas like logistics, drilling, and the construction of vital equipment such as subsea systems, mooring units, and gas processing facilities.

The SNEPCO boss explained that since production began at the Bonga field in 2005, SNEPCo has worked closely with Nigerian contractors to build systems and develop a skilled workforce capable of delivering projects safely, on time, and within budget both in Nigeria and across West Africa.

According to him, this long-term support has enabled local firms to take on key roles in managing the Bonga Floating, Production, Storage and Offloading (FPSO) vessel, which reached a major milestone by producing its one-billion barrel of oil on February 3, 2023.

Oil & Energy

Administrator Assures Community Of Improved Power Supply

The Emohua Local Government Area Administrator, Franklin Ajinwo, has pledged to improve electricity distribution in Oduoha Ogbakiri and its environs.

Ajinwo made the pledge recently while playing host in a courtesy visit to the Oduoha Ogbakiri Wezina Council of Chiefs, in his office in Rumuakunde.

He stated that arrangements are underway to enhance available power, reduce frequent outages, and promote steady electricity supply.

The move, he said, was aimed at boosting small and medium-scale businesses in the area.

“The essence of power is not just to have light at night. It’s for those who can use it to enhance their businesses”, he said.

The Administrator, who commended the peaceful nature of Ogbakiri people, urged the Chiefs to continue in promoting peace and stability, saying “meaningful development can only thrive in a peaceful environment”.

He also charged the Chiefs to protect existing infrastructure while promising to address the challenges faced by the community.

Earlier, the Oduoha Ogbakiri Wezina Council of Chiefs, led by HRH Eze Goodluck Mekwa Eleni Ekenta XV, expressed gratitude to the Administrator over his appointment and pledged their support to his administration.

The chiefs highlighted challenges facing the community to include incessant power outage, need for new transformers, and the completion of Community Secondary School, Oduoha.

The visit underscored the community’s expectations from the LGA administration.

With Ajinwo’s assurance of enhancing electricity distribution and promoting development, the people of Oduoha Ogbakiri said they look forward to a brighter future.

By: King Onunwor

-

Opinion9 hours ago

Why Reduce Cut-Off Mark for C.O.E ?

-

News6 hours ago

Rivers Chief Judge Frees 21 Awaiting Trial Inmates

-

Politics8 hours ago

Alleged Money Laundering: Fayose Has No Case To Answer, Court Tells EFCC

-

Rivers7 hours ago

CDS Urges Communities To Protect Pipelines

-

Politics9 hours ago

Atiku’s Exit No Problem To PDP – Makinde

-

News5 hours ago

South-South contributes N34trn to Nigeria’s economy in 2024 – Institute

-

News8 hours ago

News8 hours agoJAMB Uncovers 9,469 Fake Admissions In 20 Tertiary Institutions

-

News7 hours ago

News7 hours agoNAF Disowns Recruitment Adverts, Says It’s Fake