Business

ASUU Strike: FG, Union To Continue Negotiations

The Minister of Education, Malam Adamu Adamu, has said that government would continue its negotiations with ASUU to fulfill their demands except that of exemption from Treasury Single Account (TSA).

Adamu, who disclosed this after the Federal Executive Council meeting last Wednesday, admitted that government had not fulfilled its own part of the agreements with the university lecturers.

He acknowledged that ASUU had late last year issued a one-week strike notice leading to a meeting where agreements were reached but noted that the Association did not follow due process for the current strike.

“The issues we agreed on, there are eight of them.

“Already, let’s say there was the issue of negotiation which is the only one they agreed that government has done what it promised because we set up the negotiation team and the negotiation is already ongoing.

“There is the issue of their earned allowances and I think that because of some miscommunication what was promised could not be done but I am assuring ASUU and the nation that this is going to be done.

“There is the issue of registration for the Nigerian Universities’ Pension Commission.

“I think in that one, there are few issues that they need to sort out with the Nigerian Pension Commission and I believe that there will be no problem there.

“The other is the issue of their staff school which I think the court has given them the verdict to go ahead with it.

“They have requested that they should be allowed off TSA and I think government will not do this.

“But there are some peculiar funds in the universities, like endowments, which are money kept and out of interests they generate prizes and so on are given.

“Government will exempt that one,’’ Adamu said.

Adamu stated that he expected that government and the striking lecturers would reach trusted agreements on the demands.

Explaining further on the TSA, he said that because the Central Bank of Nigeria (CBN) does not give interest on it, that was why endowments was exempted but other payments could be made into it.

He said that ASUU had been paid N30 billion of the allowances requested but because they were unable to render account of its disbursement it was stopped.

“The figures that I know, they have been paid N30 billion and the problem actually arose because they were not able to account for this N30 billion.

“And we said we will only give them the balance if they are able to account and the balance is N23 billion,’’ he said

The minister noted that the total demand was N53 billion, adding that government had the money to pay.

The minister re-affirmed his belief that ASSUU “is composed of patriotic people, very responsible’’, noting that it was one of the fruits of their struggle that led to the creation of the TETFUND.

He noted that without TETFUND today the university system could have collapsed, adding that he was not supporting ASUU but what was good.

Information Minister Lai Mohammed who also briefed on the memoranda submitted by the minister of Transport, Rotimi Amaechi, said that council approved contract for the rehabilitation of Ajaokuta-Itakpe rail line.

He said that it involved track laying, permanent way works and ancillary facilities area and completion of 12 railway stations in favour of Messr CCECC Nig Ltd in the sum of $122.62 million.

He said the amount was inclusive of all taxes at the prevailing CBN exchange rate of one dollar to N305 with a completion period of 15 months.

According to him, Ajaokuta to Warri track is in good condition and when the new contract is completed, access to the seaport is achieved for the evacuation of goods.

Mohammed added that Amaechi also submitted a memo for the interim phase arrangement for the concession of the Nigeria’s narrow gauge railway system which was approved.

He said that the approval was to issue a letter of comfort to General Electric so that by October 2017 there would be full utilisation of Lagos–Kano and Port Harcourt-Calabar–Maiduguri line.

He said it was part of the efforts to rehabilitate the 30,000 km narrow guage line and make it ready for haulage of goods and services.

According to him, from October there will be new 17 wagons to move at least a million tonnes of goods from the roads.

Mohammed added that council also approved the variation cost for the construction of one 150 MVA 330/133 KVA transformer at Birnin Kebbi and the reinforcement of a sub-station in Kumbutso, Kano for the transmission company of Nigeria.

Business

NCDMB, Dangote Refinery Unveil JTC On Deepening Local Content

Business

Industry Leaders Defend Local Content, … Rally Behind NCDMB

Business

Replace Nipa Palms With Mangroove In Ogoni, Group Urges FG, HYPREP

-

Politics20 hours ago

Politics20 hours agoINEC Trains Political Parties Officials On ICNP Use Ahead By-Elections

-

Business22 hours ago

Business22 hours agoReplace Nipa Palms With Mangroove In Ogoni, Group Urges FG, HYPREP

-

Business19 hours ago

Business19 hours agoNCDMB, Dangote Refinery Unveil JTC On Deepening Local Content

-

Niger Delta21 hours ago

C’River Hands Over Rubber Plantation to Private Company

-

Nation20 hours ago

Nation20 hours agoHYPREP Reaffirms Support For Ogoni Youths …Organises Workshop For Undergraduates

-

Business22 hours ago

Business22 hours agoIndustry Leaders Defend Local Content, … Rally Behind NCDMB

-

Politics19 hours ago

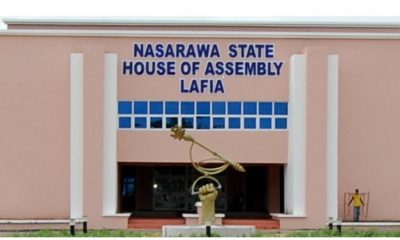

Politics19 hours agoNasarawa Speaker Advocates Conducive Executive/Legislature Relations

-

Niger Delta21 hours ago

Delta Leverages On Extensive River Networks To Drive Blue Economy