Economy

Jobs on Jiji: Great Opportunities and No Scammers

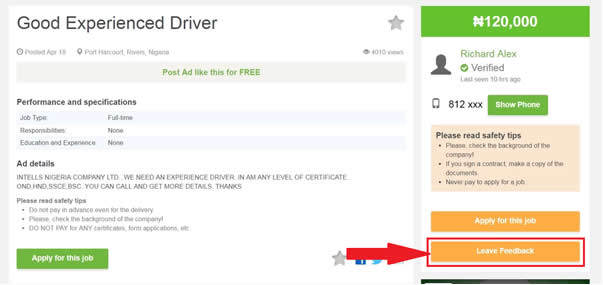

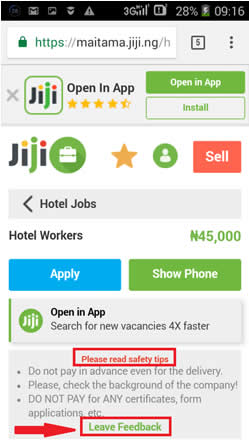

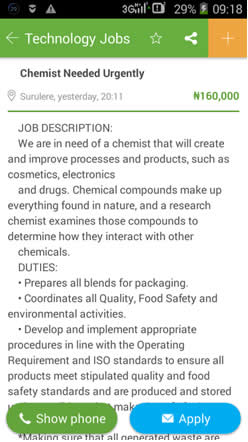

Some people still keep wondering: are Jiji jobs real? On the one hand, it is not surprising, for the wide variety of opportunities and offers often make job seekers question whether an attractive description is true or another ad among scam jobs posted by some frauds. On the other hand, it is not how Jiji works.

Jiji’s customer support is available 24/7. All this time, we are communicating with our users, monitoring website activity, detecting suspicious processes, and controlling automatic mechanisms for employment scams detection.

For your safety and security (find the safety tips here https://jiji.ng/safety-tips.html) , we check user’s personal data, including email, phone etc., so everybody has to pass verification process to use all benefits of the website. Also, we keep track on browsing activity, monitor users’ behavior, typical patterns, proxy, access IP and location in case of need, check history, apply velocity etc.

Altogether, it helps to protect every employer and employee from job scams in Nigeria.

After we detect scammers, we put them in the general list, which is left in the open access on the website and goes to the police department, so criminals will not avoid the punishment.

Every user can join preventive actions for reducing job scams on Jiji and Nigeria in general. In case you notice scam job offers or resume scams, feel free to leave a comment about an employer or illegal actions on the website at support@jiji.ng. All your complaints are forwarded to managers and subject to verifications. In case everything is confirmed, an employer will be blocked. support@jiji.ng

You don’t have to be afraid to look for a job online. You just need to be careful and remember several simple rules.

- Always double check company’s background.

- Look through their website before going for an interview – it will be helpful both for your conversation with an employer and inner peace.

- Never submit any upfront fees for a job application.

- Avoid going to remote, unfamiliar or suspicious places for an interview.

- Do not disclose any personal information, like bank account number, financial data, ID photo copy etc.

Banking/ Finance

Job Searching Tips for Recent College Graduates

Breaking into any field isn’t easy, especially now when so many companies have taken a hit from COVID and are in the process of changing their operations. New graduates are likely going to face intense competition in a job market filled with recently unemployed people, many of whom have serious credentials and work experience that makes them viable candidates. Downsizing on a more practical front includes reducing the number of entry-level employees, which could make a college graduate with no experience feel like they’ll never get hired.

Although you do have a six-month grace period to start paying your student loans, it’s natural to worry what you’ll do if you don’t find a good paying job by then. In the event you are still unable to lock down a stable income, you may consider refinancing your student loans to save money. Refinancing can modify the interest rate and terms of your loan to make them more manageable, especially if you’re not earning enough to even be financially secure. Before you worry about loans, though, here are three things to keep in mind while you’re applying to jobs.

Focus on Skills, Not Job Descriptions

If you don’t have any relevant work experience, focus on what you know how to do, instead. The goal of a resume isn’t to show employers what you’ve done but rather what you can do for them. While prior experience is always great, you shouldn’t let it deter you from really selling yourself as a talented, eager candidate. In the event your experience was not in a related field, try to draw out any details from your responsibilities that carry over. Align your resume to each job’s specific needs, which will drastically improve your chances of getting a callback. Avoid turning in the same resume to different employers; even if you only change the wording on a few lines, it shows you care enough to read what an employer wants.

Don’t Say No to Internships

You may think interning is for undergrads, but it actually might be your ticket to a full-time position. Interning isn’t for everyone, and if the gig is unpaid, it certainly won’t work for a lot of people. But most internships function more like temporary jobs, which means you are paid hourly or given a fixed amount for working a set amount of time.For recent college graduates, internships can provide the experience, skills and connections they need to qualify for positions in the field of choice. You may also find a mentor in one of the company’s employees who can give you insider knowledge and teach you things that you’d never have found out on your own. Many jobs also promote interns into employees if they perform well enough. So, it may not be your first choice, but if you’re looking for work and considering a part-time job anyway, it’s worth considering.

Stay Connected to Your Fellow Alumni

Your university’s alumni community will allow you to network with other graduates who have found work in your desired field. They can offer you tips, provide some sound advice and possibly even recommend you for positions in their own company. Sometimes, job recruiters even check out alumni groups at universities to find candidates that are available for immediate start. Make that point clear whenever you mention you’re looking for a job.

Business

Foreign Capital Imports in Nigeria drop by 78%

The National Bureau of Statistics of Nigeria, or NBS, has reported at the start of September that the value of Nigeria’s capital imports fell to $1.29 billion. This means that there is an active decline of 77.88 percent in the value. This is especially troublesome considering the fact that during the first quarter of 2020 the capital import used to be $5.85 billion.

This means that cumulatively, on a year-to-year basis, the drop amounted to a whopping 78.60 percent from what it used to be in the second financial quarter of 2019 ($6.05 billion).

It is no secret that this large decline is largely attributed to the ongoing novel coronavirus pandemic which is currently plaguing the world. Nigeria is not the only country that has been affected by the global problem. Almost every other country in the world is having financial problems with global economies like the US and UK shrinking by 20%. In Nigeria during the period between April and June the Foreign Direct Investment, or FDI, calculated in equities and other capital, has fallen by 30.65 percent on a quarterly and by 33.41 percent on yearly basis. The current number is sitting at $148.59 million. According to NDS, the FDI accounts for almost 12 percent of the total capital that has been imported in the second quarter of 2020. One of the leading causes is portfolio investment (equities, bonds, foreign exchange market, etc). These investments accumulate to 29.76 percent of the total inflow of foreign money. This unit has fallen by an incredible 91.06 percent just between the first and second quarters of 2020 to $385.32 million.

Major capital investment contributor is classified under “other investment” and comprises trade credits, currency deposits, loans, etc. The statistics show that these types of investments account for as much as 58.77 percent of total imported capital or $761.03 million. The decline here is also quite visible as there is a drop of 42.81 percent on quarter to quarter and 48.60 percent on yearly basis.

According to the report made by the NDS, during these times of crisis, Great Britain has become a major capital investor of Nigeria in the second quarter where the inflow of money shows $428.83 million. This is 33.12 percent of the total capital inflow in the second quarter of 2020.

The largest capital importing state is still considered to be Lagos with $1.13 billion or 87.30 percent of the total capital inflow in Q2 of 2020 closely followed by the states of Abuja and Ogun in second and third positions. However, the difference of capital investment here is quite troubling since Abuja has only $145.30 million and the Ogur state is netting $11 million which are 11.20 percent and 0.85 percent of the capital importing total.

The foreign exchange market (Forex, FX) in Nigeria is starting to boom though. Due to the novel coronavirus which has left a huge number of residents unemployed and others locked up in their own homes the number of people who started researching additional ways to generate income has increased by a significant amount. Forex has proved to be a useful instrument in this battle against unemployment. The educational material is freely available online, so it isn’t far from reality that anyone with a decent computer, smartphone, or even a tablet could go through some materials over the internet.

Choosing a proper, licensed broker is also quite an endeavor. However, it is made easier due to the efforts of regulatory bodies that work hard on licensing these firms which afterward have the ability to offer reliable services. If you’re a trader, you can read online forex reviews here to choose your desired broker, test the waters with a demo account, invest, and start trading currency pairs. It is a unique opportunity for people living in developing countries that do not have enough finances to manage the Coronavirus pandemic. This has been successfully done by countries like South Africa, which has introduced its own regulatory body – Financial Services Conduct Authority (FSCA) – that managed to put the country on the global playfield with the South African rand now becoming the 18th most traded currency on Forex globally.

The reason FX is profitable now is because of the Nigerian naira pushing the limits. The currency has become stronger during the last couple of months (everything is comparable) but this can be largely attributed to the fact that the decrease in imports leaves more focus on exports which directly translates to the strengthening of the local currency. However, the margin at which it strengthened leaves something to desire more. Unfortunately, the Nigerian naira has been devaluing for a very long time now and unless something changes in the inner politics of the nation it is not going to improve. The devaluation happens due to the oil prices jumping around constantly. Nigeria is extremely dependent on the crude price. This has gone to the extent where there are multiple exchange rate policies for naira. Currently, it is sitting around N381 which is a 21 point increase from what it used to be prior to the lockdown.

Business

The inflation rate in Nigeria on an all-time high

Inflation is a rise in the price levels in relation to goods available leading to endless fall in an economy’s purchasing power over a period of time. It measures the proportion of the rate at which the normal price level of goods and services rise over time in an economy. Nigeria has been experiencing increased levels of inflation since the pandemic broke.

The world is currently fighting COVID-19 that has greatly affected many countries and the world at large, that has measures put in place to suppress the virus. Not only did these measures help curb the spread of the novel virus, but it has also reduced the performance of many economies, businesses and health systems of countries. Currently, more than 3,000,000 people got infected worldwide, with almost over 220,414 people dead. 44 people died in Nigeria from the virus with 255 recoveries. This has had a drastic effect on Nigeria’s economy, which saw its peak in March when the first case was recorded. In March, the CPI recorded a 0.84% rise in month-on-month inflation rate in Nigeria, which was a 0.5% increase from the previous month.

The inflation rate in Nigeria has continually been on an increase from month-on-month and year-on-year rates and several financial experts in Nigeria express their concerns about it and are calling for the currency’s stabilization. A majority of forex traders are particularly unaware about the state of the currency at a given period of time, especially beginners who rely on their brokers to update them on events plaguing the markets. The issues with FX broker comparison is that some brokers are more analytical than others when it comes to delivering information to their customers. While some brokers would prefer analyzing news before delivering it to a beginner trader, others just send out the news to their clients, without ensuring that the implications of the news are fully understood.

The average change in the percentage in both rural and urban areas in CPI of one year, ending in March 2020, over the CPI for the previous year till March 2019 was 11.62%. This shows a 0.08 increase rate of over 11.54% recorded in February 2020 for the same average.

In March 2020, the inflation rate in urban regions increased by 12.93% YoY; which was a 0.08 increase rate from 12.85% YoY change recorded in February 2020. With regards to the MoM rate, urban regions list increased by 0.88%, which is a 0.06 increase rate point from 0.82% recorded in earlier months.

This MoM development is generally caused by the prices of food to other consumer goods. Additionally, in March 2020, the inflation rate in the rural areas also increased by 0.03%, highlighting 11.64% from 11.61% in February 2020, which significantly contributed to the index prices of food. Simultaneously, there was a 0.80% increase in indices, at an additional 0.04 rate point from the 0.76% increase recorded earlier that month.

Statistics show that there was a rise in food prices that were brought about by an increase in costs of Potatoes, sweet potato, yams, fish, oils and fats, meat, fruits, bread and oats, and vegetables. There is currently volatility in the prices of all agricultural products, with the inflation rate steady at 9.98%, which is a 0.25% increase compared to the 9.73% recorded in March.

The highest inflation levels in Nigeria were recorded in bicycle prices, passenger transportation by sea and rates increased, medical services, medication, health services in general, and Major family equipment whether electronic or not. The most recent report suggests a quick rise in the prices of all products and services in the country, which was caused by the COVID-19 pandemic lockdown and the continuation of the pandemic. It is worth noting that the most recent inflation rate implies that the buying capacity of customers has decreased.

On Tuesday morning, Nigeria’s Consumer Prices Index, also known as inflation massively increased in August 2020, by 13.22% as per information delivered by the National Bureau of Statistics. This indicates the twelfth continuous rise since September 2019 and the most noteworthy in 28 months reported by a business examination shows that information from the NBS August 2020 expansion.

-

Rivers2 days ago

Group Seeks Prosecution Of Clergy, Others Over Attempted Murder

-

Opinion2 days ago

Restoring Order, Delivering Good Governance

-

Business2 days ago

CRG Partner JR Farms To Plant 30m Coffee Seedlings

-

Sports2 days ago

Eagles B Players Admit Pressure For CHAN Qualification

-

Niger Delta2 days ago

Niger Delta2 days agoNDLEA Intercepts 584.171kg Hard Drugs In Bayelsa … Arrests 559 Suspects

-

Rivers2 days ago

Four Internet Fraudstars Get Different Jail Terms In PH

-

Business2 days ago

Food Security: NDDC Pays Counterpart Fund For LIFE-ND Project

-

Business2 days ago

PH Women Plan Alternative Stew, Shun Tomato High Prices