Featured

Falana To Buhari: Recover $200bn Loot, Forget $29.6bn Loan

President Muhammadu Buhari has been challenged to recover Nigeria’s alleged $200billion looted funds now trapped in foreign banks to fund his programmes instead of pursuing a foreign loan of $29.6billion that may throw the country into many years of debt repayment, and unending poverty.

Lagos-based human rights lawyer and Senior Advocate of Nigeria, Femi Falana, who gave the advise, also charged the Federal Government to deploy the recovered looted funds into concerted efforts to ameliorate the present economic recession, and restore confidence in the country.

Falana said he had written a letter to that effect to the Minister of Finance, Mrs Kemi Adeosun, urging her to focus attention more on strategies to recover the looted funds, and plough back such recovered funds into economic and infrastructure programmes and projects to rejig the nation.

The senior advocate of Nigeria, who spoke while delivering the 4th convocation lecture of Oduduwa University, Ipetumodu, Ile-Ife, titled, “The blessings of natural resource endowments and the curse of corrupt leadership: Critical perspectives on Nigeria’s state of the Federal Government’s move toward underdevelopment”, vehemently opposed the efforts to obtain the loan.

He stressed that at the end of the day, only 50 per cent of the amount will arrive Nigeria while generations yet unborn will suffer the repayment.

Falana also urged Federal Government to recover the looted wealth of the nation and prosecute the culprits notwithstanding their political affiliation, stressing that the payment and servicing of debts should be investigated, as the loans that gave rise to the debt were substantially diverted by public officers.

Speaking on the alleged trapped $200billion, he said: “Curiously, the Buhari administration has failed to address capital flight and round tripping by financial institutions, otherwise why has the government been reluctant to ask the Economic and Financial Crimes Commission (EFCC) to recover and sanction the oil and shipping companies which under-declared crude oil worth billion of dollars shipped from Nigeria, under the previous administration?

“Why has the Federal Government failed to recover the $20.2billion withheld from the Federation Account by the Nigerian National Petroleum Corporation (NNPC) and some oil companies from 1999-2012?

“Why has the Federal Government not inquired into the allegation that the sum of $25.4billion was laundered and illegally taken out of Nigeria by a telecommunications company?

“Why has the government failed to recover the looted wealth of the nation which has been traced to financial institutions in the West and the United Arab Emirates?

“Why has the Central Bank of Nigeria (CBN) failed to recover the $7billion deposited and N600billion bailout given to the commercial banks in 2006 and 2008, respectively?

“Instead of intensifying efforts to recover such huge funds among several others, the government is determined to take a loan of $29.6billion”, Falana queried.

He noted that there was enough money in Nigeria to make the people live happily forever, if not for the poverty of ideas of the leadership which has impoverished the generality of Nigerians.

Featured

Rivers A Strategic Hub for Nigeria’s Blue Economy -Ibas …Calls For Innovation-Driven Solutions

The Administrator of Rivers State, Vice Admiral (Rtd.) Ibok-Ete Ibas, has emphasized the need for innovation-driven strategies, strategic partnerships, and firm policy implementation to fully harness the vast potential of the blue economy.

Speaking during a courtesy visit by participants of Study Group 7 of the Executive Course 47 from the National Institute for Policy and Strategic Studies (NIPSS) at Government House, Port Harcourt, on Monday, Ibas highlighted the importance of diversifying Nigeria’s economy beyond oil by leveraging maritime resources to create jobs, enhance food security, strengthen climate resilience, and generate sustainable revenue.

The Administrator, according to a statement by his Senior Special Adviser on Media, Hector Igbikiowubo, noted that with coordinated efforts and innovative solutions, the blue economy could serve as a catalyst for inclusive growth, economic stability, and long-term environmental sustainability.

“It is estimated that a fully developed blue economy could generate over $296 million annually for Nigeria, spanning fisheries, shipping and logistics, marine tourism, offshore renewable energy, aquaculture, biotechnology, and coastal infrastructure,” he stated.

“We must transition from extractive practices to regenerative, inclusive, and innovation-driven solutions. This requires political cohesion, intergovernmental collaboration, robust infrastructure, and institutional capacity—all of which must be pursued with urgency and intentionality,” he added.

Ibas urged sub-national governments, particularly coastal states, to domesticate the national blue economy framework and develop tailored strategies that reflect their comparative advantages.

He stressed that such efforts must be guided by disciplined planning, regulation, and investment to maximize the sector’s potential.

Highlighting Rivers State’s pivotal role, the Administrator outlined its strategic advantages as follows:

•Nearly 30% of Nigeria’s total coastline (approximately 853km)

•Over 40% of Nigeria’s crude oil and gas output

•More than 33% of the country’s GDP and foreign exchange earnings

•416 of Nigeria’s 1,201 oil wells, many located in marine environments

•Two of Nigeria’s largest seaports, two oil refineries, and the Nigerian Liquefied Natural Gas (NLNG) terminal in Bonny Island—one of Africa’s most advanced gas facilities

Despite these opportunities, Ibas acknowledged challenges such as pollution, coastal erosion, illegal oil refining, unregulated fishing, inadequate infrastructure, and maritime insecurity.

He reaffirmed his administration’s commitment to institutional reforms, coastal zone management, and inter-agency collaboration to build a governance structure that supports a sustainable blue economy.

“Sustainability must be embedded in our development models from the outset, not as an afterthought. We are actively exploring partnerships in maritime education, aquaculture development, port modernization, and renewable ocean energy. We welcome knowledge-sharing engagements like this to refine our strategies and enhance implementation,” he said.

He urged the NIPSS delegation to ensure their findings translate into actionable recommendations that address the sector’s challenges.

Leader of the delegation, Vice Admiral A.A. Mustapha, explained that the visit aligns with their strategic institutional tour mandate on the 2025 theme: “Blue Economy and Sustainable Development in Nigeria: Issues, Challenges, and Opportunities.”

The group is engaging stakeholders to deepen understanding of policy efforts and institutional roles in advancing sustainable development through the blue economy.

Featured

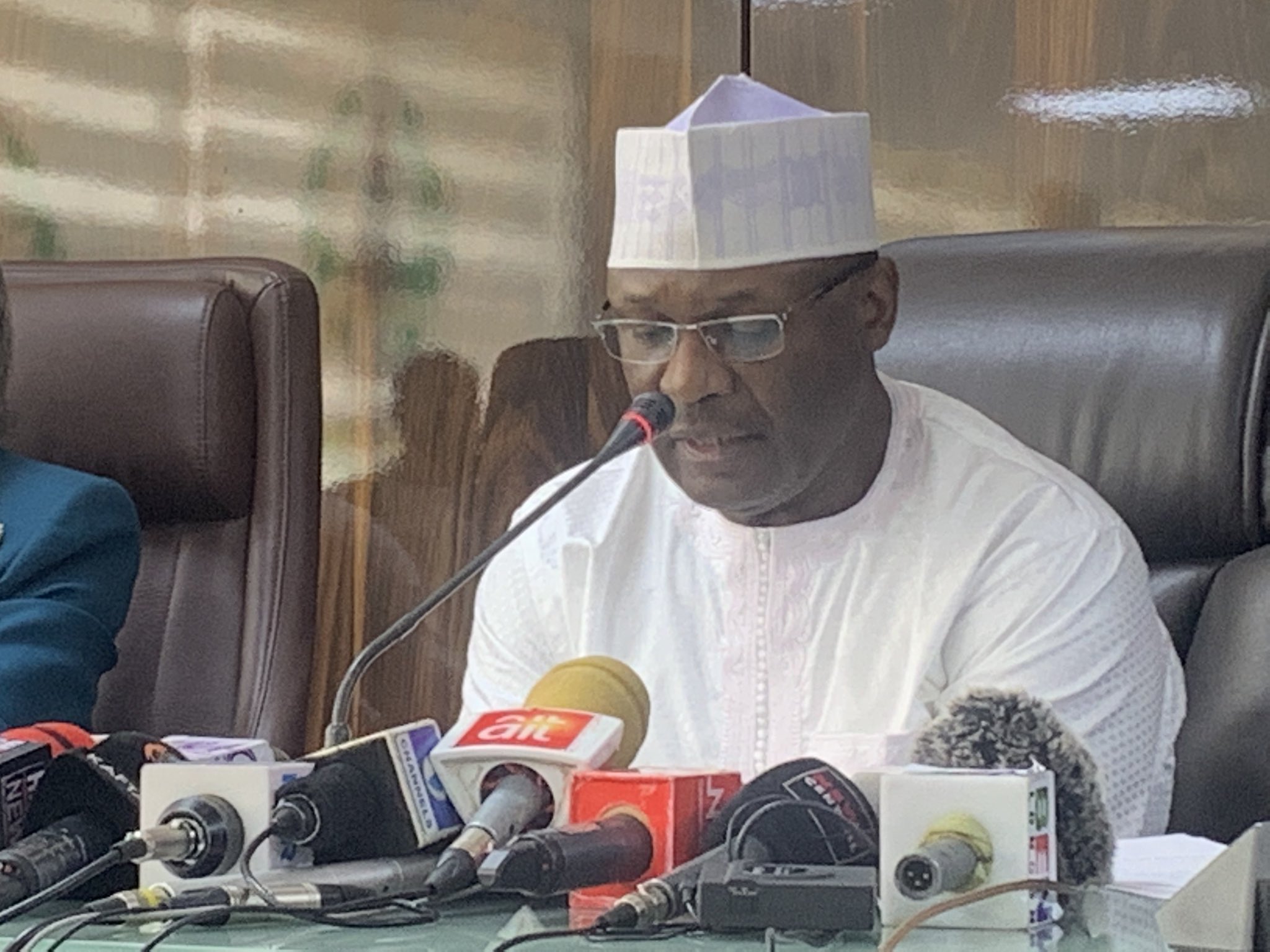

INEC To Unveil New Party Registration Portal As Applications Hit 129

The Independent National Electoral Commission (INEC) has announced that it has now received a total of 129 applications from associations seeking registration as political parties.

The update was provided during the commission’s regular weekly meeting held in Abuja, yesterday.

According to a statement signed by the National Commissioner and Chairman of the Information and Voter Education Committee, Sam Olumekun, seven new applications were submitted within the past week, adding to the previous number.

“At its regular weekly meeting held today, Thursday 10th July 2025, the commission received a further update on additional requests from associations seeking registration as political parties.

“Since last week, seven more applications have been received, bringing the total number so far to 129. All the requests are being processed,” the commission stated.

The commission revealed the introduction of a new digital platform for political party registration. The platform is part of the Party Financial Reporting and Auditing System and aims to streamline the registration process.

Olumekun disclosed that final testing of the portal would be completed within the next week.

“INEC also plans to release comprehensive guidelines to help associations file their applications using the new system.

“Unlike the manual method used in previous registration, the Commission is introducing a political party registration portal, which is a module in our Party Financial Reporting and Auditing System.

“This will make the process faster and seamless. In the next week, the commission will conclude the final testing of the portal before deployment.

“Thereafter, the next step for associations that meet the requirements to proceed to the application stage will be announced. The commission will also issue guidelines to facilitate the filing of applications using the PFRAS,” the statement added.

In the meantime, the list of new associations that have submitted applications has been made available to the public on INEC’s website and other official platforms.

Featured

Tinubu Signs Four Tax Reform Bills Into Law …Says Nigeria Open For Business

President Bola Tinubu yesterday signed into law four tax reform bills aimed at transforming Nigeria’s fiscal and revenue framework.

The four bills include: the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

They were passed by the National Assembly after months of consultations with various interest groups and stakeholders.

The ceremony took place at the Presidential Villa, yesterday.

The ceremony was witnessed by the leadership of the National Assembly and some legislators, governors, ministers, and aides of the President.

The presidency had earlier stated that the laws would transform tax administration in the country, increase revenue generation, improve the business environment, and give a boost to domestic and foreign investments.

“When the new tax laws become operational, they are expected to significantly transform tax administration in the country, leading to increased revenue generation, improved business environment, and a boost in domestic and foreign investments,” Special Adviser to the President on Media, Bayo Onanuga said on Wednesday.

Before the signing of the four bills, President Tinubu had earlier yesterday, said the tax reform bills will reset Nigeria’s economic trajectory and simplify its complex fiscal landscape.

Announcing the development via his official X handle, yesterday, the President declared, “In a few hours, I will sign four landmark tax reform bills into law, ushering in a bold new era of economic governance in our country.”

Tinubu made a call to investors and citizens alike, saying, “Let the world know that Nigeria is open for business, and this time, everyone has a fair shot.”

He described the bills as not just technical adjustments but a direct intervention to ease burdens on struggling Nigerians.

“These reforms go beyond streamlining tax codes. They deliver the first major, pro-people tax cuts in a generation, targeted relief for low-income earners, small businesses, and families working hard to make ends meet,” Tinubu wrote.

According to the President, “They will unify our fragmented tax system, eliminate wasteful duplications, cut red tape, restore investor confidence, and entrench transparency and coordination at every level.”

He added that the long-standing burden of Nigeria’s tax structure had unfairly weighed down the vulnerable while enabling inefficiency.

The tax reforms, first introduced in October 2024, were part of Tinubu’s post-subsidy-removal recovery plan, aimed at expanding revenue without stifling productivity.

However, the bills faced turbulence at the National Assembly and amongst some state governors who rejected its passing in 2024.

At the NASS, the bills sparked heated debate, particularly around the revenue-sharing structure, which governors from the North opposed.

They warned that a shift toward derivation-based allocations, especially with VAT, could tilt fiscal balance in favour of southern states with stronger consumption bases.

After prolonged dialogue, the VAT rate remained at 7.5 per cent, and a new exemption was introduced to shield minimum wage earners from personal income tax.

By May 2025, the National Assembly passed the harmonised versions with broad support, driven in part by pressure from economic stakeholders and international observers who welcomed the clarity and efficiency the reforms promised.

In his tweet, Tinubu stressed that this is just the beginning of Nigeria’s tax evolution.

“We are laying the foundation for a tax regime that is fair, transparent, and fit for a modern, ambitious Nigeria.

“A tax regime that rewards enterprise, protects the vulnerable, and mobilises revenue without punishing productivity,” he stated.

He further acknowledged the contributions of the Presidential Fiscal Policy and Tax Reform Committee, the National Assembly, and Nigeria’s subnational governments.

The President added, “We are not just signing tax bills but rewriting the social contract.

“We are not there yet, but we are firmly on the road.”

-

Business1 day ago

2027: Group Vows To Prevail On Diri To Dump PDP For APC

-

City Crime1 day ago

RSG Tasks Federal Government On Maternal Deaths

-

News1 day ago

South-South Contributes N34trn To Nigeria’s Economy In 2024 – Institute

-

Featured1 day ago

Featured1 day agoRivers A Strategic Hub for Nigeria’s Blue Economy -Ibas …Calls For Innovation-Driven Solutions

-

Rivers1 day ago

Rivers1 day agoNDDC Inaugurates Ultra-Modern Market In Rivers Community

-

Opinion1 day ago

Welcome! Worthy Future For R/S

-

News1 day ago

Nigeria’s Inflation Rate Dropped To 22.22% In June -NBS

-

News1 day ago

NOA Set To Unveil National Values Charter — D-G