Featured

Senate Rejects FIRS N143bn Budget …Halts Works On Sovereign Wealth Act

The Senate, yesterday, rejected the report by the Committee on Finance in which the N143.7billion budget of the Federal Inland Revenue Service was approved.

The lawmakers, while debating the recommendation of the committee during the day’s plenary, criticised the report as lacking details.

While some senators who spoke on the report said it was fraught with ambiguities, others cited duplication of projects in the proposed budget.

The President of the Senate, Bukola Saraki, who presided over the plenary, asked the committee to work on the grey areas in its report and re-present it in one week.

On the proposed 2016 budget of the FIRS, the report said, “The Federal Inland Revenue Service projected to collect tax revenues to the tune of N4.082trillion in 2016.

“This comprises of N484billion oil and N3.597trillion non-oil revenues. The projected four per cent Cost of Collection on non-oil revenue is N143,904,640,000.

“The total projected available fund for the 2016 budget is N146,165,108,293, comprising of four per cent Cost of Collection and N2,260,468,293 or 20 per cent of 2015 operating surplus.”

The Chairman, Senate Committee on Finance, Senator John Enoh, while presenting the report to the chamber, recalled that the Senate on July 21, 2016, considered the request of President Muhammadu Buhari on the 2016 budget of the FIRS and referred same to the committee for further legislative action.

On the performance of the 2015 budget of the FIRS, the report said National Assembly’s joint Committees on Finance approved a revenue projection of N436trillion, comprising of N1.74trillion oil revenue and N262trillion non-oil revenue.

The joint committee also projected the four per cent Cost of Collection of non-oil revenue by the FIRS to be N104,723,880,000.

The committee stated the summary of the proposed 2016 expenditure of the service as follows: personnel, N64,491,130,526; overhead, N46,363,000,000; and capital, N32,868,300,000, bringing the total expenditure to N143,722,430,526.

The committee, according to the report, observed that the projected non-oil revenue collection had increased from the 2015 collection, thereby increasing the four per cent Cost of Collection to the service to N143,904,640,000bn from N104,723,880,000 in 2015.

The committee further observed that, “The total personnel costs are for salaries, wages, allowances, performance bonuses and social contributions. The 8,000 (members of) staff are proposed to be on the payroll during the 2016 financial year, which accounts for the increase of 19 per cent above actual staff strength of 6,748.

The projection presumes a recruitment of new staff in 2016.

It further observed that, “The overhead cost is very vital in driving the achievement of FIRS’ core objectives of tax revenue generation.

“The provisions in 2016 budget give more emphasis on availability of office materials, training, consulting and professional services and publicity.”

The committee added that, “The capital cost estimates proposed includes ongoing projects, which are to be completed during the 2016 financial year, as well as new projects to be carried out.

“These projects include new corporate headquarters and other prototype offices, construction of new offices nationwide and ICT projects.”

The committee, therefore, recommended that a total expenditure of N143,722,430,526 be approved for the FIRS in 2016, which the Senate rejected.

Meanwhile, the shadow of the past that prevented Nigeria from investing in the Sovereign Wealth Fund during the good days of Nigerian crude sale has again resurfaced as the Senate, yesterday, suspended the consideration of the Nigeria Sovereign Investment Authority (Establishment) Act 2011 (Amendment) Bill, following protests by some senators who insisted that further legislative action on the bill would be prejudicial since state governors are already contesting in court, the legality of deducting funds from the federation account by the Federal Government through the agency.

Chairman of the Senate Committee on Finance, Senator John Eno, at plenary presented the report of the bill seeking to amend the Nigerian Sovereign Investment Authority (NSIA), for debate but just before commencement of debate, the Senate Minority Leader, Godswill Akpabio, described any legislation on the bill as illegal, as he pointed out that there is need to await the judgment of the court on the matter.

Akpabio admitted, however, that it is proper for Nigeria to save for the rainy day, but insisted that there is need to strengthen the relevant laws relating to the agency to forestall possible abuse in the management of the agency.

According both him, the major reason why the governors had opposed the policy during the time of former President Goodluck Jonathan was because they wanted the major stakeholders to be involved in the regulation and administration of the agency.

According to him, since the funds will have a commencing seed of one billion dollars, to be deducted from the federation account, which constitutionally belong jointly to the local, states and federal governments, it is proper to have them well represented in the agency and its board.

Deputy Senate President, Senator Ike Ekweremadu, in his contribution noted that there is need to save for the scarce moments but emphasised that it is unconstitutional to consider and pass the report on the bill without first adjusting the Constitution to accommodate the controversial sections of the bill.

He, therefore, advice that the Senate to suspend the consideration of the bill until the Constitution Review Committee amends the Constitution in line with those sections that are unconstitutional in it.

President of the Senate, Senator Saraki, trying to save the bill and to ensure its passage, however advocated that only sections (10) of the bill be stepped down since it is the only section that is not in line with the Constitution.

He said the Senate Committee on Constitution Review, headed by the Deputy Senate President, can address the constitutional issues raised by some lawmakers while reviewing the constitution, before the bill will be passed eventually into law.

According to Saraki, since there is a unanimous agreement among the lawmakers that Nigeria should save for the future, the Senate should go ahead to consider the report.

However, mid into the consideration of the report, the controversial section 10 came up again, seeking to allocate $1billion from the federation account to the NSIA, and became a road block for the debate as it would only be prejudicial to debate on an issue in court already.

At that point, the debate was suspended and the bill withdrawn.

It would be recalled that the Nigeria Sovereign Investment Authority (Establishment) Act 2011 (Amendment) Bill, seeking to save ( Sovereign Wealth Fund) for the rainy day during the hay days of oil price through cuts from the federation account (local , states and federal governments) but was vehemently opposed by state governors, especially governors of the opposition party.

Nneka Amaechi-Nnadi, Abuja

Featured

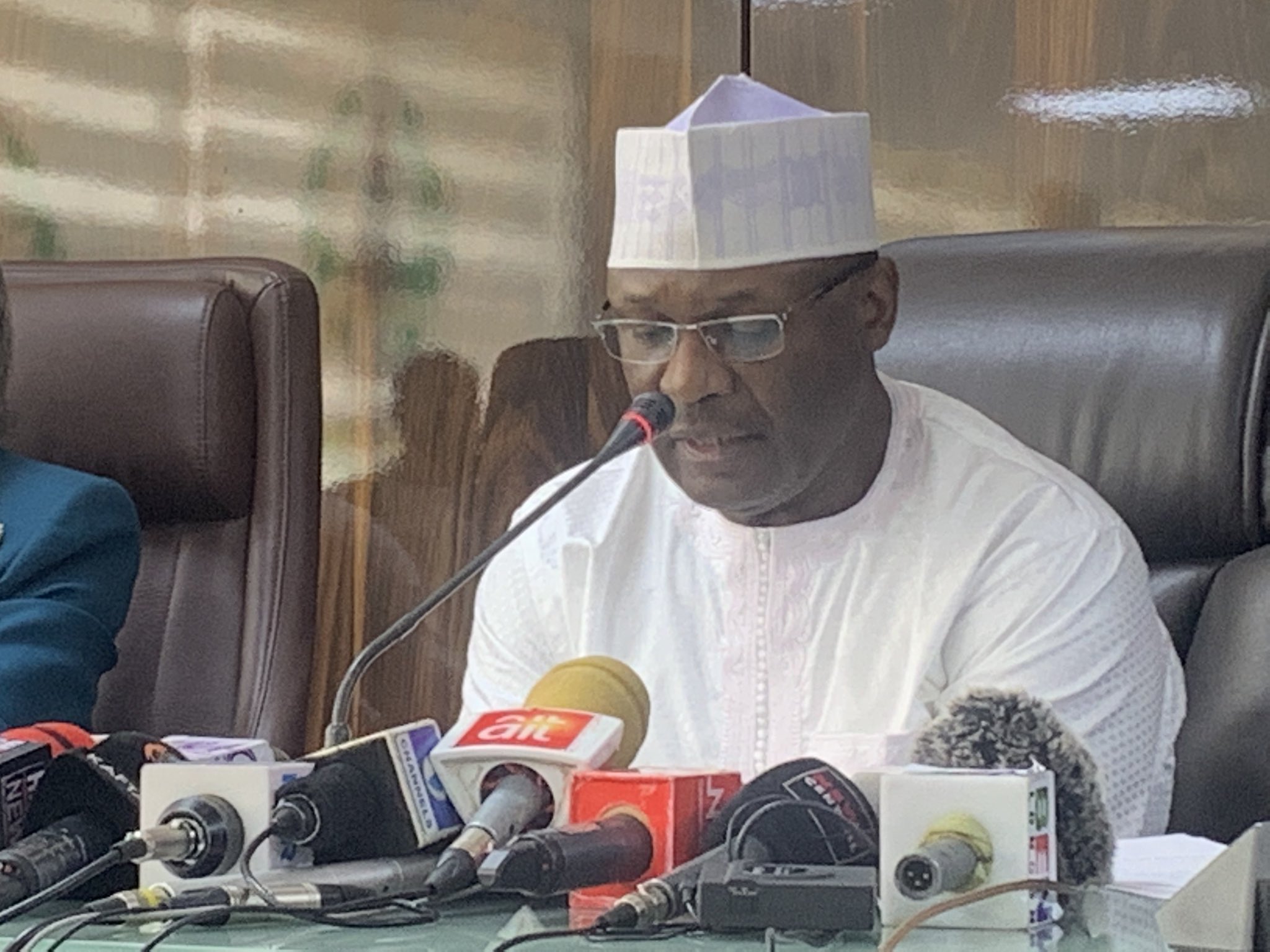

INEC To Unveil New Party Registration Portal As Applications Hit 129

The Independent National Electoral Commission (INEC) has announced that it has now received a total of 129 applications from associations seeking registration as political parties.

The update was provided during the commission’s regular weekly meeting held in Abuja, yesterday.

According to a statement signed by the National Commissioner and Chairman of the Information and Voter Education Committee, Sam Olumekun, seven new applications were submitted within the past week, adding to the previous number.

“At its regular weekly meeting held today, Thursday 10th July 2025, the commission received a further update on additional requests from associations seeking registration as political parties.

“Since last week, seven more applications have been received, bringing the total number so far to 129. All the requests are being processed,” the commission stated.

The commission revealed the introduction of a new digital platform for political party registration. The platform is part of the Party Financial Reporting and Auditing System and aims to streamline the registration process.

Olumekun disclosed that final testing of the portal would be completed within the next week.

“INEC also plans to release comprehensive guidelines to help associations file their applications using the new system.

“Unlike the manual method used in previous registration, the Commission is introducing a political party registration portal, which is a module in our Party Financial Reporting and Auditing System.

“This will make the process faster and seamless. In the next week, the commission will conclude the final testing of the portal before deployment.

“Thereafter, the next step for associations that meet the requirements to proceed to the application stage will be announced. The commission will also issue guidelines to facilitate the filing of applications using the PFRAS,” the statement added.

In the meantime, the list of new associations that have submitted applications has been made available to the public on INEC’s website and other official platforms.

Featured

Tinubu Signs Four Tax Reform Bills Into Law …Says Nigeria Open For Business

President Bola Tinubu yesterday signed into law four tax reform bills aimed at transforming Nigeria’s fiscal and revenue framework.

The four bills include: the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

They were passed by the National Assembly after months of consultations with various interest groups and stakeholders.

The ceremony took place at the Presidential Villa, yesterday.

The ceremony was witnessed by the leadership of the National Assembly and some legislators, governors, ministers, and aides of the President.

The presidency had earlier stated that the laws would transform tax administration in the country, increase revenue generation, improve the business environment, and give a boost to domestic and foreign investments.

“When the new tax laws become operational, they are expected to significantly transform tax administration in the country, leading to increased revenue generation, improved business environment, and a boost in domestic and foreign investments,” Special Adviser to the President on Media, Bayo Onanuga said on Wednesday.

Before the signing of the four bills, President Tinubu had earlier yesterday, said the tax reform bills will reset Nigeria’s economic trajectory and simplify its complex fiscal landscape.

Announcing the development via his official X handle, yesterday, the President declared, “In a few hours, I will sign four landmark tax reform bills into law, ushering in a bold new era of economic governance in our country.”

Tinubu made a call to investors and citizens alike, saying, “Let the world know that Nigeria is open for business, and this time, everyone has a fair shot.”

He described the bills as not just technical adjustments but a direct intervention to ease burdens on struggling Nigerians.

“These reforms go beyond streamlining tax codes. They deliver the first major, pro-people tax cuts in a generation, targeted relief for low-income earners, small businesses, and families working hard to make ends meet,” Tinubu wrote.

According to the President, “They will unify our fragmented tax system, eliminate wasteful duplications, cut red tape, restore investor confidence, and entrench transparency and coordination at every level.”

He added that the long-standing burden of Nigeria’s tax structure had unfairly weighed down the vulnerable while enabling inefficiency.

The tax reforms, first introduced in October 2024, were part of Tinubu’s post-subsidy-removal recovery plan, aimed at expanding revenue without stifling productivity.

However, the bills faced turbulence at the National Assembly and amongst some state governors who rejected its passing in 2024.

At the NASS, the bills sparked heated debate, particularly around the revenue-sharing structure, which governors from the North opposed.

They warned that a shift toward derivation-based allocations, especially with VAT, could tilt fiscal balance in favour of southern states with stronger consumption bases.

After prolonged dialogue, the VAT rate remained at 7.5 per cent, and a new exemption was introduced to shield minimum wage earners from personal income tax.

By May 2025, the National Assembly passed the harmonised versions with broad support, driven in part by pressure from economic stakeholders and international observers who welcomed the clarity and efficiency the reforms promised.

In his tweet, Tinubu stressed that this is just the beginning of Nigeria’s tax evolution.

“We are laying the foundation for a tax regime that is fair, transparent, and fit for a modern, ambitious Nigeria.

“A tax regime that rewards enterprise, protects the vulnerable, and mobilises revenue without punishing productivity,” he stated.

He further acknowledged the contributions of the Presidential Fiscal Policy and Tax Reform Committee, the National Assembly, and Nigeria’s subnational governments.

The President added, “We are not just signing tax bills but rewriting the social contract.

“We are not there yet, but we are firmly on the road.”

Featured

Senate Issues 10-Day Ultimatum As NNPCL Dodges ?210trn Audit Hearing

The Senate has issued a 10-day ultimatum to the Nigerian National Petroleum Company Limited (NNPCL) over its failure to appear before the Senate Committee on Public Accounts probing alleged financial discrepancies amounting to over ?210 trillion in its audited reports from 2017 to 2023.

Despite being summoned, no officials or external auditors from NNPCL showed up yesterday.

However, representatives from the representatives of the Economic and Financial Crimes Commission, Independent Corrupt Practices and Other Related Offences Commission and Department of State Services were present.

Angered by the NNPCL’s absence, the committee, yesterday, issued a 10-day ultimatum, demanding the company’s top executives to appear before the panel by July 10 or face constitutional sanctions.

A letter from NNPCL’s Chief Financial Officer, Dapo Segun, dated June 25, was read at the session.

It cited an ongoing management retreat and requested a two-month extension to prepare necessary documents and responses.

The letter partly read, “Having carefully reviewed your request, we hereby request your kind consideration to reschedule the engagement for a period of two months from now to enable us to collate the requested information and documentation.

“Furthermore, members of the Board and the senior management team of NNPC Limited are currently out of the office for a retreat, which makes it difficult to attend the rescheduled session on Thursday, 26th June, 2025.

“While appreciating the opportunity provided and the importance of this engagement, we reassure you of our commitment to the success of this exercise. Please accept the assurances of our highest regards.”

But lawmakers rejected the request.

The Committee Chairman, Senator Aliyu Wadada, said NNPCL was not expected to submit documents, but rather provide verbal responses to 11 key questions previously sent.

“For an institution like NNPCL to ask for two months to respond to questions from its own audited records is unacceptable,” Wadada stated.

“If they fail to show up by July 10, we will invoke our constitutional powers. The Nigerian people deserve answers,” he warned.

Other lawmakers echoed similar frustrations.

Senator Abdul Ningi (Bauchi Central) insisted that NNPCL’s Group CEO, Bayo Ojulari, must personally lead the delegation at the next hearing.

The Tide reports that Ojulari took over from Mele Kyari on April 2, 2025.

Senator Onyekachi Nwebonyi (Ebonyi North) said the two-month request suggested the company had no answers, but the committee would still grant a fair hearing by reconvening on July 10.

Senator Victor Umeh (Anambra Central) warned the NNPCL against undermining the Senate, saying, “If they fail to appear again, Nigerians will know the Senate is not a toothless bulldog.”

Last week, the Senate panel grilled Segun and other top executives over what they described as “mind-boggling” irregularities in NNPCL’s financial statements.

The Senate flagged ?103 trillion in accrued expenses, including ?600 billion in retention fees, legal, and auditing costs—without supporting documentation.

Also questioned was another ?103 trillion listed under receivables. Just before the hearing, NNPCL submitted a revised report contradicting the previously published figures, raising more concerns.

The committee has demanded detailed answers to 11 specific queries and warned that failure to comply could trigger legislative consequences.

-

Rivers3 days ago

Four Internet Fraudstars Get Different Jail Terms In PH

-

Business3 days ago

Food Security: NDDC Pays Counterpart Fund For LIFE-ND Project

-

Business3 days ago

PH Women Plan Alternative Stew, Shun Tomato High Prices

-

Sports3 days ago

Nigerian Athletes Serving Doping Bans

-

Niger Delta3 days ago

Niger Delta3 days agoEx-IYC President Lampoons Atiku’s Presidential Ambition … Declares It Negative Impact On N’Delta

-

News3 days ago

Tinubu Never Stopped 5-year Visa For U S. Citizens – Presidency ?

-

Featured3 days ago

Featured3 days agoINEC To Unveil New Party Registration Portal As Applications Hit 129

-

Business3 days ago

Industry Leaders Defend Local Content, … Rally Behind NCDMB