Business

NNPC Products’ Sales Hit N38.67bn

The Nigeria National Petroleum Corporation (NNPC), says it recorded N38.67billion from the sale of downstream petroleum products in September.

This is contained in the corporation’s report for September obtained by the News Agency of Nigeria (NAN)in Abuja on Sunday.

It stated that the amount was in respect of revenue from “white products” sold by the Pipelines and Product Marketing Company (PPMC).

The News Agency of Nigeria (NAN) reports that white products include Automotive Gas Oil (AGO), Household Kerosene (HHK), and Premium Motor Spirit (PMS).

The report also indicated that NNPC generated N44.2 billion from the sale of white petroleum products in August.

According to the report, the total revenue for white products sold from January to September 2015 stood at N461.1 billion.

It stated that the Premium Motor Spirit (PMS) contributed about 86 per cent of all the revenues collected from January to September with a value of N395.68 billion.

It stated that the combined value of output by the three refineries in Nigeria amounted to N9.9 billion for crude processed in September.

The report said that the associated crude plus freight cost stood at N6.3 billion, representing a loss of N8.8 billion after an overhead cost of N12.4 billion.

The report also indicated that 75.78 million litres was produced compared to 200.2 million litres in August in respect of products from domestic refineries.

It stated that the total crude processed by the three refineries in September was 261,371.14 bbls (35,648 MT) translating to a combined capacity utilisation of 1.96 per cent

According to the report, only Port Harcourt refinery produced 31,008 million MT of petroleum products, out of 35,648 million MT of crude processed at an average capacity utilisation of 5.77 per cent.

It said the petroleum product supplied and distributed into the country from Off-Shore Processing Agreements (OPA), stood at 763.90 million litres of white products against 701.29 million litres supplied in August.

The report said Dual Purpose Kerosene (DPK), receipt in September was 196.30 million litres compared with zero litres imported in the previous month.

It stated that 507.90 million litres of downstream petroleum products were distributed and sold by PPMC in September 2015 compared to 606.84 million litres sold in the previous month.

The report stated that the sale comprised of 456.81 million litres of PMS, 31.41 million litres of Kerosene and 19.68 million litres of diesel.

It stated that the total sale of white products for the period, January to September stood at 6.41billion litres, with PMS recording 5.08 billion liters or 79 per cent of the sale.

On gas production, it sated that 246 billion standard cubic feet (BCF) of natural gas was produced in September.

The report indicated that an average daily production of 8,187 million standard cubic feet per day was recorded during the period.

It showed that 2,164 BCF of gas was produced between January and September 2015 representing an average daily production of 7,925 mmscfd during the period.

It stated that the production from Joint Ventures (JVs), Production Sharing Contracts (PSC) and the Nigerian Petroleum Development Company (NPDC) contributed about 69.8, 22.0 and 8.2 per cents respectively to the total national gas production.

The report stated that an average of 773 mmscfd of domestic gas supply to the power sector was delivered to the gas fired power plants in September 2015.

It stated that the supply was designed to generate an average power of about 3,141 Mega Watts(MWs) of electricity compared to the 2015 YTD average gas supply of 656 mmscfd and power generation of 2,843 MWs.

Business

NCDMB Tasks Media Practitioners On Effective Reportage

Business

FCTA, Others Chart Path To Organic Agriculture Practices

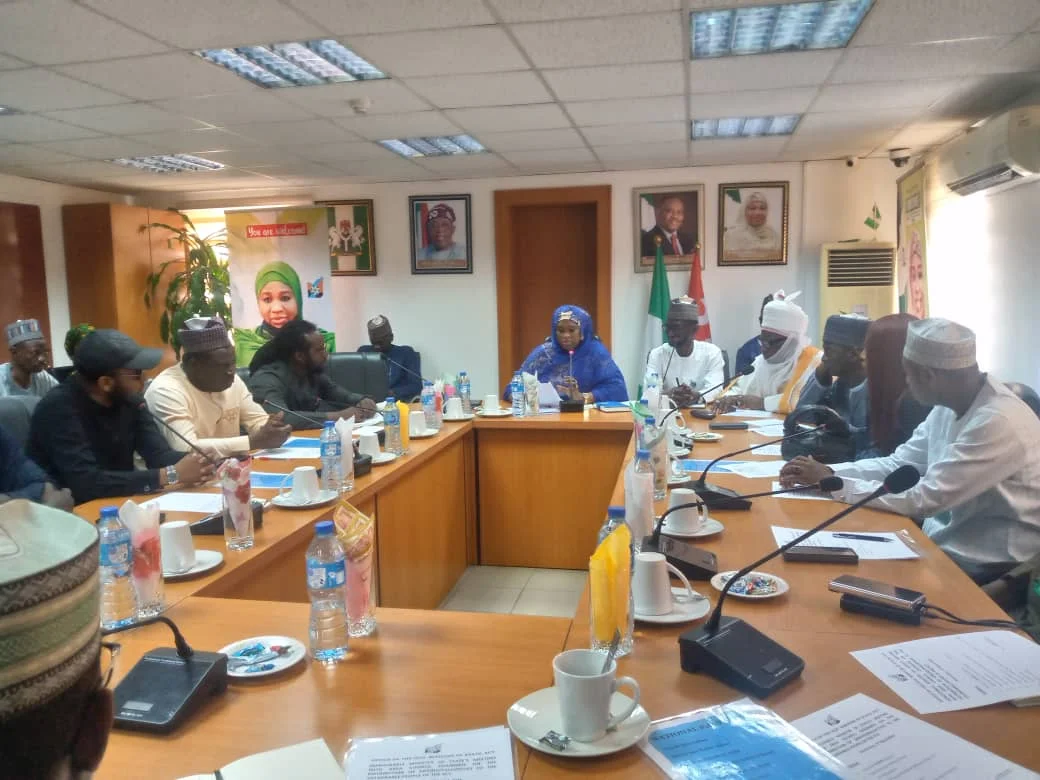

The Federal Capital Territory Administration (FCTA) and other stakeholders have charted path to improved organic agriculture practices nationwide.

At a 2024 national organic and agroecology business summit held recently in Abuja, stakeholders took turn to speak on the additional areas of promoting the practices.

The Mandate Secretary, FCT Agriculture and Rural Development Secretariat (ARDS), Lawan Geidam, advocated for sustainable practice to develop resilient food systems that will benefit people.

The event, with the theme,”Towards Policies for Upscaling Organic Agroecological Businesses in Nigeria”, is aimed at fostering growth in the organic agriculture sector.

Geidam, who was represented by the Acting Director, Agric Services, in the Secretariat, Mr. Ofili Bennett, emphasised the success of organic and agroecological farming, reling on the active involvement of farmers, businesses and consumers.

He reassured attendees that the FCT Administration, led by the Minister, Nyesom Wike, and Minister of State, Dr. Mariya Mahmoud, remains dedicated to supporting initiatives that enhance the livelihood of residents.

Geidam described the partnership between the Secretariat and the organic and Agroecology initiative for a monthly exhibition and sale of organic products in the FCTA premises as a testament to this commitment.

“The ARDS remains committed to driving policies and initiatives that align with national goals and global standards”, Geidam said.

On her part, the Chairperson of Organic and Agroecology Initiative, Mrs. Janet Igho, urged residents to embrace healthy eating habits to sustain a good lifestyle. She stressed the importance of adopting organic practices, highlighting the benefits of going organic, growing organic and consuming organic products.

Igho expressed her optimism regarding the Agricultural Revival Programmes as articulated in President Bola Ahmed Tinubu’s “Renewed Hope Agenda”, which aims at fostering food and nutrition security.

She also extended her gratitude to ARDS for graciously allocating a space in the FCTA premises for the exhibition and sale of organic products, noting that the platform has been effectively used to advance the promotion of organic agriculture in FCT.

Igho outlined several benefits of organic agriculture which includes improved soil health, increased biodiversity, availability nutritious and healthy food and a reduced carbon footprint.

Stakeholders at the summit, underscored the critical need for enhanced private sector involvement and robust capacity building initiatives for farmers.

They highlighted the importance of implementing supportive policies to foster the growth of the organic agriculture sector.

In the light of the significant challenges facing Nigeria’s agricultural landscape, stakeholders decided that organic agricultural practices present sustainable solutions and a pathway for a more resilient and productive farming systems.

The three-day summit featured exhibitions showcasing organic foods, fruits, vegetables and fertilizers, providing an opportunity for residents to better appreciate the benefits of production and consumption of organic agricultural products.

Business

Dangote Refinery Exports PMS to Cameroon

-

News2 days ago

RSHA Moves To Investigate Oil Spill In Bonny …As Two Bills Pass First Reading

-

Politics2 days ago

NGO Passes Confidence Vote On Fubara Over Dev Strides

-

Sports2 days ago

Nigeria To Host 2026 Golf AACT

-

Niger Delta2 days ago

NSCDC Holds Walk Against National Assets Vandalism In Edo

-

News2 days ago

News2 days agoSenate Issues Arrest Warrant Against Julius Berger MD Over Road Project

-

News2 days ago

Engage Violence-Free Approach In Quest For Equity, Justice, Fubara Tells IYC

-

Nation2 days ago

Bill To Enforce Local Processing Of Raw Materials Scales 2nd Reading …Set to Boost Local Industries

-

Women2 days ago

The Transformative Power Of The Girl Child