Business

FIRS Partners Experts To Improve Operations

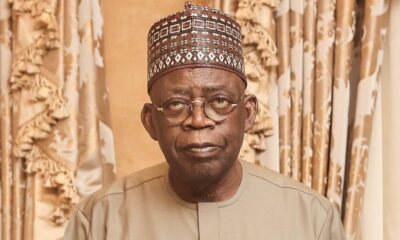

The Acting Executive

Chairman of the Federal Inland Revenue Service (FIRS), Mr Kabir Mashi, said last Thursday that the organisation had engaged experts for technical assistance and operational efficiency.

Mashi made the announcement at the “FIRS Stakeholders’ Engagement Forum’’ in Lagos.

He said that the organisation had employed the service of Mckinsey and Company to implement Capacity Enhancement Programme (CEP) and helped to improve non-oil tax collection.

Mashi said the CEP had been useful in improving other indices of measurement.

He said that such other indices include Tax to Gross Domestic Ratio and Ratio of Oil to Non-Oil Tax collection.

The FIRS chief said that the organisation embarked on CEP as a specific intervention to uplift the organisation in its quest to become efficient.

He also said that it would assist FIRS to proactively support government’s aspirations, particularly in making Nigeria’s economy one of the largest in the world.

“With the intervention of CEP, we have some key initiatives as a platform for achieving our goal.

“These initiatives are in the areas of audits, arrears and debt enforcement as well as tax exemptions,” Mashi said.

He said that others included evasion of tax in terms of high net worth transactions and rentals; registration and improved communication to enhance compliance.

The FIRS chief said that the forum was organised to reassure tax payers that the organisation appreciated their efforts in contributing to national development by paying taxes.

Mashi urged Nigerians to continue to cooperate and support the organisation.

“We are constantly seeking to improve upon our performance and we ask that you buy into our initiatives as we roll them out.

“As we implement these initiatives, we shall interact with you more closely and hope you see yourselves as partners in national development,’’ he said.

Also speaking at the event, the Chairman of Dangote Group, Alhaji Aliko Dangote, urged the FIRS to employ the ‘naming and shaming approach’ in enforcing tax compliance among stakeholders.

Dangote said that faithful tax payers should be openly celebrated, while defaulters should also be openly warned if a roundtable discussion would not make them comply.

The Tide source reports that other stakeholders at the forum urged the Federal Government to find a way of harmonising tax collections in different states.

The stakeholders said that if the government harmonised tax collections, it would help to boost the level of tax compliance among Nigerians.

Business

NPA Assures On Staff Welfare

Business

ANLCA Chieftain Emerges FELCBA’s VP

Business

NSC, Police Boost Partnership On Port Enforcement

-

Rivers4 days ago

FIDA, PCRC Train Police On Paralegal Cases

-

News4 days ago

News4 days agoTinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

-

News4 days ago

News4 days agoSenate Confirms Odey As RISEIC Chairman

-

Sports4 days ago

‘Ofili Still Representing Nigeria’

-

News4 days ago

Immigration Plays Strategic Role In Nation Building -Worika

-

Niger Delta4 days ago

NDLEA Apprehends 312 Suspects … Seizes 803.672 kg Of Drugs In A’Ibom

-

Women4 days ago

How Women Can Manage Issues In Marriage

-

Business4 days ago

Coy Expands Pipeline Network In Rivers