Oil & Energy

Why Gas Flaring Deadline Is Hardly Met -Don

When at last, the

Federal Government set the current deadline for the stoppage of gas flaring by oil exploration and development companies in the country, most Nigerians heaved a sigh of relief that the disturbing issue of gas flaring would soon be a thing of the past, but surprisingly, many years after the Federal Government’s deadline, gas flames still dot oil-producing areas of the Niger Delta.

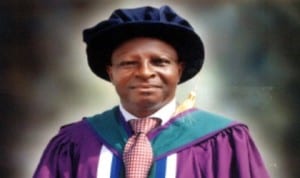

The Acting Director of Pollution Studies (IPS) of the Rivers State University of Science and Technology, Port Harcourt, Dr. Tubonimi Joseph Ideriah, identified some factors as being responsible for the deadlines not being adhered to.

He said, “There are many factors that contribute to why it is so. One, the operators find it difficult because when you stop the flaring, where do you channel the gas to? That arrangement or provision has not been made or put in place for them to divert the gas to such areas.”

“Again, like every other area in our system where laws are made and people flout the laws as good enforcement is lacking to follow up defaulters of these laws,” he said, noting that the laws are made but that people go behind to receive gratifications, they mellow down and allow unacceptable practices to continue unabated.

Dr. Ideriah expressed the belief that if properly followed up, the operators could definitely look for alternative ways of channeling the gas being flared such that it could be utilized.

The IPS director, who is an expert in Environmental Analytical Chemistry said that though he could not give the value of the nation’s wealth being wasted through gas flare figure-wise but that the nation is losing so much.

He advised that the new power companies that bought over Power Holding Companies of Nigeria (PHCN) could benefit if the gas being flared is channeled to them to solve the problem of gas shortage which they often complain about.

The expert regretted that apart from the huge wealth being wasted in flaring the gas, the environment is being polluted by the activities of unpatriotic Nigerians who sabotage the nation by vandalizing gas pipelines because of survival or agitations.

He advised that sabotaging the effort of government through vandalism of gas pipes should stop and Nigerians should be patriotic while to the agitators, the environmentalist advised them to channel their request to the appropriate quarters and give sometime for the government to attend to such requests. “But when you go the other way round to sabotage, you create problems for the community on behalf of whom may be you think you are fighting for because the environmental effects for such activities could be disastrous as the pollutants emitted into the air may linger for decades and children yet unborn could come to meet them.

The Niger Delta region, he said, is comparatively polluted basically because of the oil exploration and exploitation activities heavily going on in the area as there is no way such activities could be carried on in the area without the pollution associated with such economic activities.

“Since the advent of these oil companies in the Niger Delta, we began to see serious changes in the environment. For instance, houses that are in communities where you have oil exploration activities taking place, farmers and fishermen who managed to buy a bundle of zinc to build house, hoping that the house could be for life, but we have started experiencing fast decay of roofing sheets in most communities especially the riverine area”.

“The gases are mixed with the air that we breathe, so you can see that the air we breathe is polluted, the water we use from the River that we fish as Niger Deltans whose major occupation is fishing as we depend on it and once the river is polluted, whatever we get from the River is contaminated and once you take a contaminated seafood, definitely it gets to the food chain,” he explained.

Ideriah urged the Federal Government through the National Assembly to not only put in place necessary laws but to effectively implement such laws to the latter.

“It is a thing of development and therefore no well-meaning person will contest that these oil activities should stop,” he said but emphasised the need for adoption of international best practices.

These international best practices should be put in practice here also. What is obtained to make other developed places who are also oil exploiting and exploration countries live environmentally clean life should also be applied here,” he advised and wondered why a particular law could effectively work in such countries and not work here where they are operating similar activity.

“If a law is put in place, that law should also be implemented to the latter. There should be no question of short cuts because there are certain things you can’t caught corners without it telling on the system”, he continued.

Noting that we have some good laws because some of them were adopted from some countries that have similar operations going on there and remarked that inefficiency in their implementations make them look as if they were different laws.

The IPS director accepted that quick passage of the Petroleum Industry Bill (PIB) is desirable for the nation and urged the National Assembly to pass the bill without further delay.

“There could be definitely a lot of proposals that were being made that would sanitise the sector, but we don’t know how effective these proposals that have been made could be implemented. The first stage is for the bill to be passed because without passing it you cannot get to the stage of how effective the implementation would be”, he stated, stressing that whether they were playing politics with it would be know later.

The National Assembly, he said has committees to monitor its implementations but expressed hope that it would contain proposals geared towards sanitizing the industry.

Commenting on the institute, the Acting Director said, “IPS as the pioneer Institute for Environmental Studies in Nigeria, has done so much towards raising the standard and quality of environmental research in the region since its inception in 1982.

“The institute since its inception in 1982 has been living up to expectations especially in the Niger Delta. For example, the document that is being used in the whole of Nigeria by the Federal Ministry of Environment. In 1991, the institute was part of the team that worked to put those standards that guide operations”, he said.

Some of the major goals of IPS, he said, are to raise the standard and quality of environmental research in the region and to ensure utilization of such research findings in sustainable environmental management and development.

According to him, IPS has achieved those goals through the delivery of world class environmental research studies and reports and cited instances with Environmental Baseline Studies for Establishments of Control Criteria and Standards against Petroleum related Pollution in Nigeria (RPI) report of 1985 and the Niger Delta Environmental Survey (NDES) report of 2000.

He said while RPI covers all spectrum of the environment, Air, Aquatic and Terrestrial, NDES is a regional survey covering the nine states of the Niger Delta and noted that both reports were world class by every standard and were widely referenced document.

He, however, regretted that inspite of the fact that it was the foremost in Nigeria some of the companies and establishments that were beneficiaries of our studies have changed their policies to what you could describe as lowest bidder kind of thing so that the lowest bidder is given the study job,” he said, remarking that before it was not like that as it was based on recognition and capability.

Christ Oluoh

Oil & Energy

Nigeria Loses More Crude Oil Than Some OPEC Members – Nwoko

Nigeria’s losses due to crude oil theft has been said to be more significant than those of some other members of the Organisation of Petroleum Exporting Countries(OPEC).

The Chairman, Senate Ad- hoc Committee on Crude Oil Theft, Senator Ned Nwoko, made this known in an interview with newsmen in Abuja.

Nwoko noted with dismay the detrimental impact of the issue, which, he said include economic damage, environmental destruction, and its impact on host communities.

According to him, the theft was not only weakening the Naira, but also depriving the nation of vital revenue needed for infrastructure, healthcare, education and social development.

The Senator representing Delta North Senatorial District described the scale of the theft as staggering, with reports indicating losses of over 200,000 barrels per day.

Nwoko disclosed that the ad hoc committee on Crude Oil Theft, which he chairs, recently had a two-day public hearing on the rampant theft of crude oil through illegal bunkering, pipeline vandalism, and the systemic gaps in the regulation and surveillance of the nation’s petroleum resources.

According to him, the public hearing was a pivotal step in addressing one of the most pressing challenges facing the nation.

‘’Nigeria loses billions of dollars annually to crude oil theft. This is severely undermining our economy, weakening the Naira and depriving the nation of vital revenue needed for infrastructure, healthcare, education, and social development.

‘’The scale of this theft is staggering, with reports indicating losses of over 200,000 barrels per day more than some OPEC member nations produce.

‘’This criminal enterprise fuels corruption, funds illegal activities and devastates our environment through spills and pollution.

‘’The public hearing was not just another talk shop; it was a decisive platform to uncover the root causes of crude oil theft, bunkering and pipeline vandalism.

‘’It was a platform to evaluate the effectiveness of existing surveillance, monitoring, and enforcement mechanisms; Identify regulatory and legislative gaps that enable these crimes to thrive.

‘’It was also to engage stakeholders, security agencies, host communities, oil companies, regulators, and experts to proffer actionable solutions; and strengthen legal frameworks to ensure stricter penalties and more efficient prosecution of offenders”, he said.

Nwoko noted that Nigeria’s survival depended

Oil & Energy

Tap Into Offshore Oil, Gas Opportunities, SNEPCO Urges Companies

Shell Nigeria Exploration and Production Company Ltd. (SNEPCo) has called on Nigerian companies to position themselves strategically to take full advantage of the growing opportunities in upcoming offshore and shallow water oil and gas projects.

The Managing Director, SNEPCO, Ronald Adams, made the call at the 5th Nigerian Oil and Gas Opportunity Fair (NOGOF) Conference, held in Yenagoa, Bayelsa State, last Thursday.

Adams highlighted the major projects, including Bonga Southwest Aparo, Bonga North, and the Bonga Main Life Extension, as key areas where Nigerian businesses can grow their capacity and increase their involvement.

“Shell Nigeria Exploration and Production Company Ltd. (SNEPCo) says Nigerian companies have a lot to benefit if they are prepared to take advantage of more opportunities in its offshore and shallow water oil and gas projects.

“Projects such as Bonga Southwest Aparo, Bonga North and Bonga Main Life Extension could grow Nigerian businesses and improve their expertise if they applied themselves seriously to executing higher value contracts”, Adams stated.

Adams noted that SNEPCo pioneered Nigeria’s deepwater oil exploration with the Bonga development and has since played a key role in growing local industry capacity.

He emphasized that Nigerian businesses could expand in key areas like logistics, drilling, and the construction of vital equipment such as subsea systems, mooring units, and gas processing facilities.

The SNEPCO boss explained that since production began at the Bonga field in 2005, SNEPCo has worked closely with Nigerian contractors to build systems and develop a skilled workforce capable of delivering projects safely, on time, and within budget both in Nigeria and across West Africa.

According to him, this long-term support has enabled local firms to take on key roles in managing the Bonga Floating, Production, Storage and Offloading (FPSO) vessel, which reached a major milestone by producing its one-billion barrel of oil on February 3, 2023.

Oil & Energy

Administrator Assures Community Of Improved Power Supply

The Emohua Local Government Area Administrator, Franklin Ajinwo, has pledged to improve electricity distribution in Oduoha Ogbakiri and its environs.

Ajinwo made the pledge recently while playing host in a courtesy visit to the Oduoha Ogbakiri Wezina Council of Chiefs, in his office in Rumuakunde.

He stated that arrangements are underway to enhance available power, reduce frequent outages, and promote steady electricity supply.

The move, he said, was aimed at boosting small and medium-scale businesses in the area.

“The essence of power is not just to have light at night. It’s for those who can use it to enhance their businesses”, he said.

The Administrator, who commended the peaceful nature of Ogbakiri people, urged the Chiefs to continue in promoting peace and stability, saying “meaningful development can only thrive in a peaceful environment”.

He also charged the Chiefs to protect existing infrastructure while promising to address the challenges faced by the community.

Earlier, the Oduoha Ogbakiri Wezina Council of Chiefs, led by HRH Eze Goodluck Mekwa Eleni Ekenta XV, expressed gratitude to the Administrator over his appointment and pledged their support to his administration.

The chiefs highlighted challenges facing the community to include incessant power outage, need for new transformers, and the completion of Community Secondary School, Oduoha.

The visit underscored the community’s expectations from the LGA administration.

With Ajinwo’s assurance of enhancing electricity distribution and promoting development, the people of Oduoha Ogbakiri said they look forward to a brighter future.

By: King Onunwor