News

‘Global Growth’ll Increase Oil Demand, Market Stability In 2021’

The Organisation of Petroleum Exporting Countries (OPEC), has stressed that the estimated 4.8 per cent global growth will culminate in oil market stability this year.

This is even as the price of Bonny Light, Nigeria’s premium oil grade, dropped from $65.70 to $63.11, while OPEC Basket, and other crudes also dropped marginally over uncertainty about the outcome on the ongoing 49th Meeting of the Joint Technical Committee (JTC) (Videoconference).

However, speaking at the meeting, Secretary General, OPEC, Mohammad Sanusi Barkindo, stated, “The economic recovery is gaining momentum. This is reflected in our latest global growth estimate of 4.8% for 2021, up from the 4.4% projection we shared at our last meeting. This is a major turnaround from the grim conditions of 2020, with our most recent estimates showing the global economy plummeting by 3.9%.

“2021 is the Year of the Ox in China, a fitting symbol for this sturdy economy. China, which emerged from last year as the only major economy to remain in positive growth territory, continues to exceed expectations and is forecast to grow by 7.4% this year.

“India’s economy, which fell 8.2% in 2020, is now expected to expand by 7.5% in 2021. We had earlier expected these key economies to expand by just under 7% this year. Globally, historic levels of fiscal and momentary support continue to lubricate the economic engines and keep us in forwarding gear.

“Last week, Federal Reserve Chairman, Jay Powell, put to rest any idea of an immediate course reversal when it comes to supporting the US economy. This welcome news was followed by the G20 finance ministers and central bankers announcing on Friday (February 26) that they will continue to support a strong global recovery, and they lent support to the idea of boosting the International Monetary Fund’s firepower so it can further assist developing countries.”

Barkindo,, who noted that the actions of the United States will also impact positively on the market, stated, “The Joseph Biden administration’s massive fiscal stimulus package, which passed its first legislative hurdle by winning US House approval last Saturday, continues to kindle hope for a sustained rebound. Against the backdrop of encouraging developments, oil demand remains on course to grow by 5.8 mb/d to just around 96 mb/d.

“The encouraging global economic developments and resilient demand in Asia are upside factors, especially beyond this quarter. Initial data from January this year show that crude oil processing in India rose to its highest level since November, 2019, fuelled by rising economic and industrial activity.

“This positive regional outlook is underscored by the comments of India’s Minister of Petroleum, Natural Gas and Steel, Dharmendra Pradhan, at the recent IEA-IEF-OPEC Symposium on Energy Outlooks. Pradham stated that his country’s energy demand is expected to rise by 3% per annum through to 2040, around three times the anticipated global demand increase.

“Our capable OPEC analysts will go into more detail about inventory levels in a moment. For now, let me say that the outlook continues to move in the right direction, and the data we have before us reflects improvements over last month’s report to this Committee. Preliminary data for January shows that OECD commercial stocks declined by around 11mb. At 3 billion barrels, they were around 140mb higher than the same time one year ago and about 126mb above the average for 2015 to 2019.

“Turning to the latest figures on days of forwarding cover, OECD commercial stocks fell by 1.4 days from December to January, to 69.2 days, which is slightly lower than a year earlier, but 7.4 days above the pre-pandemic five-year average.

“The oil storage situation also appears to be aided by a refocus in the US tight oil sector from production to generating cash flow and rewarding investors. US crude production fell by more than 10% in mid-February following extreme winter in key producing states like Texas, helping to offset the rise in US crude stocks due to the significant drop in refinery utilization rates. Also regarding inventories, global short-term floating storage has fallen every month since October and stood at 142mb in January this year, significantly less than the 250mb reached in mid2020.”

He, however, added, “In a further sign of light on the horizon, the key benchmarks have risen steadily so far this year along with other commodities, in particular metals, and traders continue to take a strong positive position in oil. Since January, the futures price structure of all three key markets has been in sustained backwardation, an indication that the market is tightening and the rebalancing process is gaining speed. We have come a long way from a year ago. The days of GDP and oil demand figures being in the red because of the pandemic-induced shock appear to be behind us.”

News

Shettima In Ethiopia For State Visit

Vice President Kashim Shettima has arrived in Addis Ababa, Ethiopia, for an official State visit at the invitation of the Prime Minister, Dr. Abiy Ahmed.

Upon arrival yesterday, Shettima was received at the airport by the Minister of Foreign Affairs of Ethiopia, Dr. Gedion Timothewos, and other members of the Ethiopian and Nigerian diplomatic corps.

Senior Special Assistant to the Vice President on Media and Communication, Stanley Nkwocha, revealed this in a statement he signed yesterday, titled: “VP Shettima arrives in Ethiopia for official state visit.”

During the visit, Vice President Shettima will participate in the official launch of Ethiopia’s Green Legacy Programme, a flagship environmental initiative.

The programme designed to combat deforestation, enhance biodiversity, and mitigate the adverse effects of climate change targets the planting of 20 billion tree seedlings over a four-year period.

In line with strengthening bilateral ties in agriculture and industrial development, the Vice President will also embark on a strategic tour of key industrial zones and integrated agricultural facilities across selected regions of Ethiopia.

News

RSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

The Rivers State Government has called on the people of the state especially farmers to access the ?4billion agricultural loans made available by the State and domiciled in the Bank of Industry.

This is as the State Project Implementation Unit (SPIU) of Rural Access and Agricultural Marketing Project (RAAMP), a World Bank project, took its sensitization campaign to Opobo/Nkoro, Andoni, Port Harcourt City and Obio/Akpor local government areas.

The campaign was aimed at enlightening community dwellers and other stakeholders in the various local government areas on the RAAMP project implementation and programme activities.

The Permanent Secretary, Rivers State Ministry of Agriculture, Mr Maurice Ogolo, said this at Opobo town, Ngo, Port Harcourt City and Rumuodumanya, headquarters of the four local government areas respectively, during the sensitization campaign.

Ogolo said apart from the ?4billion, the government has also made available fertilizers and other farm inputs to farmers in the various local government areas.

The Permanent Secretary who is the Chairman, State Steering Committee for the project, said RAAMP will construct roads that will connect farms to markets to enable farmers and fishermen sell their farms produce and fishes.

He also said rural roads would be constructed to farms and fishing settlements, and warned against any act that will lead to the cancellation of the projects in the four local government areas.

According to him, the World Bank and Federal Government which are the financiers of the programme will not condone such acts like kidnapping, marching ground and other acts inimical to the successful implementation of the projects in their respective areas.

At PHALGA, Ogolo asserted that the city will benefit in the areas of roads and bridge construction.

He noted that RAAMP was thriving in both the Federal Capital Territory, Abuja; Lagos and other states in the country, stressing that the project should also be given the seriousness it deserves in Rivers State.

Speaking at Opobo town, the headquarters of Opobo/Nkoro Local Government Area, the project coordinator, RAAMP, Mr.Joshua Kpakol, said the programme would reduce poverty in the state.

According to him, both fishermen and farmers will maximally benefit from the programme.

At Ngo which is the headquarters of Andoni Local Government Area, Kpakol said roads will be constructed to all remote fishing settlements.

He said Rivers State is lucky to be among the states implementing the project, and stressed the need for the people to embrace it.

Meanwhile, Kpakol said at PHALGA that RAAMP is a project that will transform the lives of farmers, traders and other stakeholders in the area.

He urged the stakeholders to spread the information to their various communities.

However, some of the stakeholders at Opobo town complained about the destruction of their farms by bulls allegedly owed by traditional rulers in the area, as well as incessant stealing of their canoes at waterfronts.

At Ngo, Archbishop Elkanah Hanson, founder of El-Shaddai Church, commended the World Bank and the Federal Government for bringing the projects to Andoni.

He stressed the need for the construction of roads to fishing settlements in the area.

Also, a former Commissioner for Agriculture in the state and Okan Ama of Ekede, HRH King Gad Harry, noted that storage facilities have become necessary for a successful agricultural programme.

Harry also stressed the need for the programme to be made sustainable.

In their separate speeches, the administrators of Andoni and Opobo/Nkoro Local Government Areas, pledged their readiness to support the programme.

At Port Harcourt City, the Administrator, Dr Arthur Kalagbor, represented by the Head of Local Government Administration, Port Harcourt City, Mr Clifford Paul, said the city would support the implementation of the programme in the area.

Also, the administrator of Obio/Akpor Local Government Area, Dr Clifford Ndu Walter, represented by Mr Michael Elenwo, pledged to support the programme in his local government area.

Among dignitaries at the Obio/Akpor stakeholders engagement is the chairman, Rivers State Traditional Rulers Council and paramount ruler of Apara Kingdom, HRM Eze Chike Wodo, amongst others.

John Bibor

News

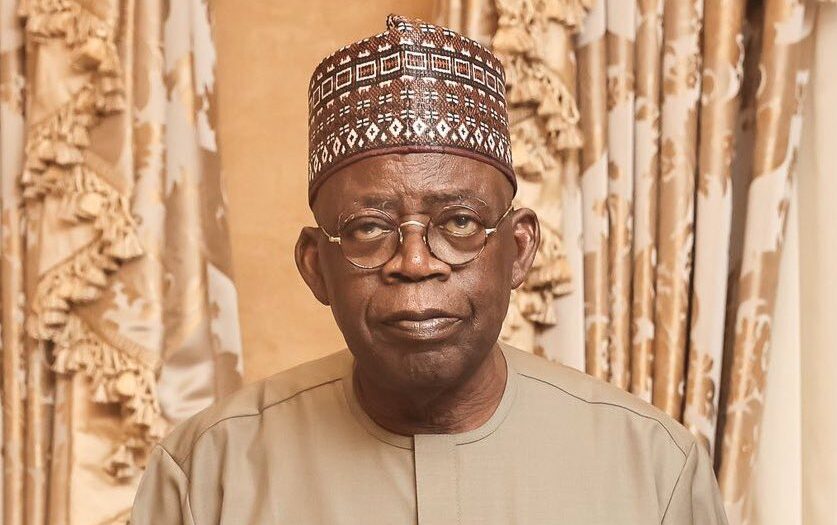

Tinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

President Bola Tinubu has ordered the commencement of personnel audit and skill gap analysis across all cadres of federal civil servants.

The president gave this directive in Abuja, yesterday, while speaking at the International Civil Service Conference, reaffirming his resolve to achieve efficiency and professional service delivery in the civil service.

“I have authorized the comprehensive personnel audit and skill gap analysis across the federal civil service to deepen capacity. I urge all responsible stakeholders to prioritize timely completion of this critical exercise, to begin implementing targeted reforms, to realize the full benefit of a more agile, competent and responsive civil service,” the president announced.

Tinubu further directed all Ministries, Departments and Agencies (MDAs), to prioritise data integrity and sovereignty in national interest.

He called for the capture, protection and strategic publication of public sector data in line with the Nigeria Data Protection Act of 2023.

“We must let our data speak for us. We must publish verified data assets within Nigeria and share them internationally recognized as fruitful. This will allow global benchmarking organisation to track our progress in real time and help us strengthen our position on the world stage. This will preserve privacy and uphold data sovereignty,” Tinubu added.

President Tinubu hailed the federal civil service as the “engine” driving his Renewed Hope Agenda, and the vehicle for delivering sustainable national development.

He submitted that the roles of civil servants remain indispensable in modern governance, declaring that in the face of a fast-evolving digital and economic landscape, the civil service must remain agile, future-ready, and results-driven.

“This maiden conference is a bold step toward redefining governance in an era of rapid transformation. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“It captures our collective ambition to reimagine and reposition the civil service. In today’s rapid, evolving world of technology, innovation remains critical in ensuring that the civil service is dynamic, digital” the President said.

Head of the Civil Service of the Federation, Didi Walson-Jack in her welcome address told the President that his presence and strong words of commendation at the conference has renewed the morale and mandate of public servants across the country.

Walson-Jack described Tinubu as the backbone of driving transformation in the Nigerian civil service, and noted that the takeaways from past study tours undertaken to understudy the civil service in Singapore, the UK and US under her leadership, is already yielding multiplier effects.

Walson-Jack assured Tinubu that her office, in collaboration with reform-minded stakeholders, will not relent in accelerating the implementation of the Federal Civil Service Strategy and Implementation Plan, FCSSIP 25.

She affirmed that digitalisation, performance management, and continuous learning remain key pillars in strengthening accountability, transparency, and service delivery across MDAs.

Walson-Jack reaffirmed that the civil service is determined to exceed expectations by embedding a culture of innovation, ethical leadership, and citizen-centred governance in the heart of public administration.