News

FG ’s Budget Faces Crisis As OPEC Paints Gloomy Outlook For 2021

Despite the stability of oil prices at $50 per barrel in recent times, the Organisation of Petroleum Exporting Countries (OPEC) has painted a mixed oil market outlook for 2021.

In his opening remarks at the 47th Meeting of the Joint Technical Committee (JTC), yesterday, via videoconference, OPEC Secretary General, Mohammad Barkindo, said, “Amid the hopeful signs, the outlook for the first half of 2021 is very mixed and there are still many downside risks to juggle. We are only beginning to emerge from a year of deep investment cuts, huge job losses and the worst crude oil demand destruction on record.

“Curbs on social and economic activity remain in place in a number of countries, and there is concern about the emergence of a pernicious new strain of the virus. Last night I saw on the news there are now about 30 countries that have reported this new strain.”

According to him, “Though the ongoing restrictions are necessary to combat the pandemic, they have chipped away at business sentiment and consumer confidence in some of the world’s biggest economies. It is too early to tell how quickly key sectors will bounce back to their pre-pandemic growth trajectories even if the vaccines defeat this terrible virus.

“Mr Chairman, sectorally, travel, tourism, leisure and hospitality continue to be affected. Our projections show that there will be rebound in the second half of 2021 with upside potential.

“However, it could be another a couple of years before these sectors bounce back to pre-Covid-19 levels, with corresponding lagging impact on oil demand.

“The Christmas Eve trade agreement between the United Kingdom (UK) and European Union (EU) is a promising development for the recovery process after months of very difficult and rancorous negotiations. Stimulus packages have clearly helped prevent deeper economic contractions and continue to lend crucial recovery support.

“The EU and US have now approved measures which, taken together, provide nearly $2trillion in additional support for those economies. It is worth noting that fiscal and monetary stimulus packages in the G20, including bank guarantees, have reached $25trillion, corresponding to more than 20 per cent of the global economy.”

Barkindo said, “Tomorrow, we begin a new chapter in the Declaration of Cooperation (DoC) with the start of monthly OPEC and non-OPEC Ministerial Meetings to evaluate the market. It was only one year ago that the DoC participating countries began to introduce adjustments of a then-astonishing 1.7million b/d, with additional voluntary contributions pushing that number to 2.1 million b/d.

“These adjustments, as agreed at the 7th OPEC and non-OPEC Ministerial Meeting in December 2019, were a pre-emptory response to support continued stability in 2020, actions that were welcomed widely as the market rang in a new and promising year. Looking back at the projections provided by the JTC, I don’t think anyone could have done a better job.

“In retrospect, those efforts taken at the end of 2019 pale in comparison to the scope and scale of the actions we have carried out since a series of ground-breaking Ministerial Meetings in April, June, and culminating in the visionary decisions taken at the last meeting one month ago today. The outcome of the December 3, Ministerial Meeting paved the way for a gradual return of 2million b/d to the market over the coming months, while the participating countries stand ready to adjust these levels depending on market conditions and developments.”

Barkindo said, “Collectively over the last nine months, we have delivered an unprecedented response to an unparalleled market shock and continue to lead the industry on the road to recovery. We are witnessing the very early stages of Covid-19 vaccinations and the progress so far has injected optimism into the economy. These promising developments, in parallel with the Declaration of Cooperation’s market leadership during the crisis, have contributed to a healthier oil market outlook for 2021.

“Following the last Ministerial Meetings, the price of Brent crude inched above $50 per barrel for the first time since early March, while Brent crude and US West Texas Intermediate experienced their longest stretch of advances since June. After the unprecedented shock experienced last year, the economic forecast calls for brighter days ahead.

“Our analysts expect the global economy to grow by 4.4 per cent in 2021 compared to a sharp contraction of around 4.2 per cent last year. The Covid-19 vaccinations provide upside potential for the economic outlook and may help usher in a strong rebound in the second half of 2021.

“Furthermore, we continue to see upward momentum in Asia, especially China, which remains on course for positive growth in 2020 – a singular achievement among the world’s biggest economies. China’s broad-based recovery forecast stands at about 6.9 per cent for 2021 and provides a beacon of hope for other economies, in the region and beyond. Our analysts in the Secretariat anticipate that crude oil demand will shift from reverse to forward gear and rise to 95.9million b/d this year, a gain of 5.9million b/d from 2020. The non-OECD will be in the driver’s seat with growth of around 3.3million b/d”, Barkindo added.

News

Shettima In Ethiopia For State Visit

Vice President Kashim Shettima has arrived in Addis Ababa, Ethiopia, for an official State visit at the invitation of the Prime Minister, Dr. Abiy Ahmed.

Upon arrival yesterday, Shettima was received at the airport by the Minister of Foreign Affairs of Ethiopia, Dr. Gedion Timothewos, and other members of the Ethiopian and Nigerian diplomatic corps.

Senior Special Assistant to the Vice President on Media and Communication, Stanley Nkwocha, revealed this in a statement he signed yesterday, titled: “VP Shettima arrives in Ethiopia for official state visit.”

During the visit, Vice President Shettima will participate in the official launch of Ethiopia’s Green Legacy Programme, a flagship environmental initiative.

The programme designed to combat deforestation, enhance biodiversity, and mitigate the adverse effects of climate change targets the planting of 20 billion tree seedlings over a four-year period.

In line with strengthening bilateral ties in agriculture and industrial development, the Vice President will also embark on a strategic tour of key industrial zones and integrated agricultural facilities across selected regions of Ethiopia.

News

RSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

The Rivers State Government has called on the people of the state especially farmers to access the ?4billion agricultural loans made available by the State and domiciled in the Bank of Industry.

This is as the State Project Implementation Unit (SPIU) of Rural Access and Agricultural Marketing Project (RAAMP), a World Bank project, took its sensitization campaign to Opobo/Nkoro, Andoni, Port Harcourt City and Obio/Akpor local government areas.

The campaign was aimed at enlightening community dwellers and other stakeholders in the various local government areas on the RAAMP project implementation and programme activities.

The Permanent Secretary, Rivers State Ministry of Agriculture, Mr Maurice Ogolo, said this at Opobo town, Ngo, Port Harcourt City and Rumuodumanya, headquarters of the four local government areas respectively, during the sensitization campaign.

Ogolo said apart from the ?4billion, the government has also made available fertilizers and other farm inputs to farmers in the various local government areas.

The Permanent Secretary who is the Chairman, State Steering Committee for the project, said RAAMP will construct roads that will connect farms to markets to enable farmers and fishermen sell their farms produce and fishes.

He also said rural roads would be constructed to farms and fishing settlements, and warned against any act that will lead to the cancellation of the projects in the four local government areas.

According to him, the World Bank and Federal Government which are the financiers of the programme will not condone such acts like kidnapping, marching ground and other acts inimical to the successful implementation of the projects in their respective areas.

At PHALGA, Ogolo asserted that the city will benefit in the areas of roads and bridge construction.

He noted that RAAMP was thriving in both the Federal Capital Territory, Abuja; Lagos and other states in the country, stressing that the project should also be given the seriousness it deserves in Rivers State.

Speaking at Opobo town, the headquarters of Opobo/Nkoro Local Government Area, the project coordinator, RAAMP, Mr.Joshua Kpakol, said the programme would reduce poverty in the state.

According to him, both fishermen and farmers will maximally benefit from the programme.

At Ngo which is the headquarters of Andoni Local Government Area, Kpakol said roads will be constructed to all remote fishing settlements.

He said Rivers State is lucky to be among the states implementing the project, and stressed the need for the people to embrace it.

Meanwhile, Kpakol said at PHALGA that RAAMP is a project that will transform the lives of farmers, traders and other stakeholders in the area.

He urged the stakeholders to spread the information to their various communities.

However, some of the stakeholders at Opobo town complained about the destruction of their farms by bulls allegedly owed by traditional rulers in the area, as well as incessant stealing of their canoes at waterfronts.

At Ngo, Archbishop Elkanah Hanson, founder of El-Shaddai Church, commended the World Bank and the Federal Government for bringing the projects to Andoni.

He stressed the need for the construction of roads to fishing settlements in the area.

Also, a former Commissioner for Agriculture in the state and Okan Ama of Ekede, HRH King Gad Harry, noted that storage facilities have become necessary for a successful agricultural programme.

Harry also stressed the need for the programme to be made sustainable.

In their separate speeches, the administrators of Andoni and Opobo/Nkoro Local Government Areas, pledged their readiness to support the programme.

At Port Harcourt City, the Administrator, Dr Arthur Kalagbor, represented by the Head of Local Government Administration, Port Harcourt City, Mr Clifford Paul, said the city would support the implementation of the programme in the area.

Also, the administrator of Obio/Akpor Local Government Area, Dr Clifford Ndu Walter, represented by Mr Michael Elenwo, pledged to support the programme in his local government area.

Among dignitaries at the Obio/Akpor stakeholders engagement is the chairman, Rivers State Traditional Rulers Council and paramount ruler of Apara Kingdom, HRM Eze Chike Wodo, amongst others.

John Bibor

News

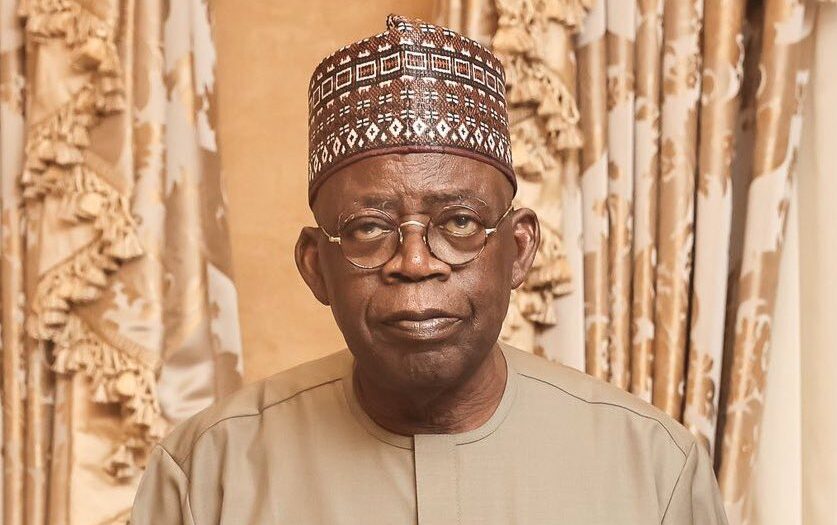

Tinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

President Bola Tinubu has ordered the commencement of personnel audit and skill gap analysis across all cadres of federal civil servants.

The president gave this directive in Abuja, yesterday, while speaking at the International Civil Service Conference, reaffirming his resolve to achieve efficiency and professional service delivery in the civil service.

“I have authorized the comprehensive personnel audit and skill gap analysis across the federal civil service to deepen capacity. I urge all responsible stakeholders to prioritize timely completion of this critical exercise, to begin implementing targeted reforms, to realize the full benefit of a more agile, competent and responsive civil service,” the president announced.

Tinubu further directed all Ministries, Departments and Agencies (MDAs), to prioritise data integrity and sovereignty in national interest.

He called for the capture, protection and strategic publication of public sector data in line with the Nigeria Data Protection Act of 2023.

“We must let our data speak for us. We must publish verified data assets within Nigeria and share them internationally recognized as fruitful. This will allow global benchmarking organisation to track our progress in real time and help us strengthen our position on the world stage. This will preserve privacy and uphold data sovereignty,” Tinubu added.

President Tinubu hailed the federal civil service as the “engine” driving his Renewed Hope Agenda, and the vehicle for delivering sustainable national development.

He submitted that the roles of civil servants remain indispensable in modern governance, declaring that in the face of a fast-evolving digital and economic landscape, the civil service must remain agile, future-ready, and results-driven.

“This maiden conference is a bold step toward redefining governance in an era of rapid transformation. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“It captures our collective ambition to reimagine and reposition the civil service. In today’s rapid, evolving world of technology, innovation remains critical in ensuring that the civil service is dynamic, digital” the President said.

Head of the Civil Service of the Federation, Didi Walson-Jack in her welcome address told the President that his presence and strong words of commendation at the conference has renewed the morale and mandate of public servants across the country.

Walson-Jack described Tinubu as the backbone of driving transformation in the Nigerian civil service, and noted that the takeaways from past study tours undertaken to understudy the civil service in Singapore, the UK and US under her leadership, is already yielding multiplier effects.

Walson-Jack assured Tinubu that her office, in collaboration with reform-minded stakeholders, will not relent in accelerating the implementation of the Federal Civil Service Strategy and Implementation Plan, FCSSIP 25.

She affirmed that digitalisation, performance management, and continuous learning remain key pillars in strengthening accountability, transparency, and service delivery across MDAs.

Walson-Jack reaffirmed that the civil service is determined to exceed expectations by embedding a culture of innovation, ethical leadership, and citizen-centred governance in the heart of public administration.