News

$1.1bn Malabu Scam: FG Files Fresh Charges Against Adoke, Shell, Others

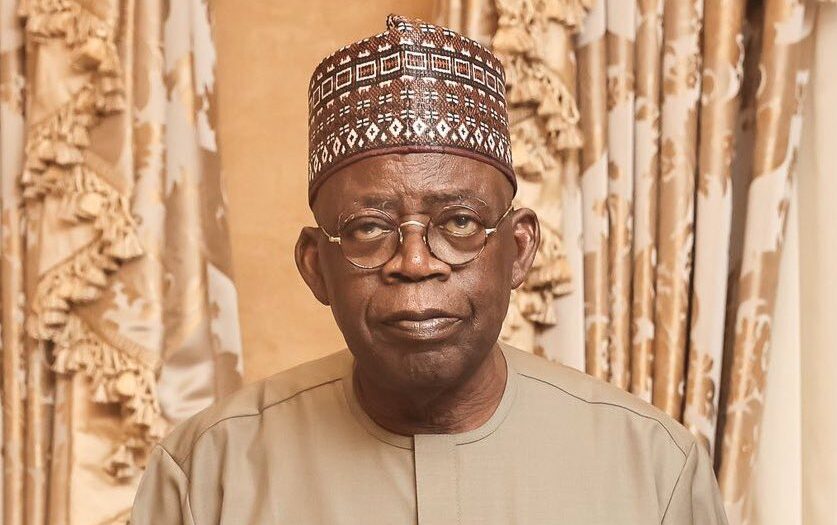

The Federal Government has filed a fresh 42-count charge against former Attorney-General of the Federation (AGF) and Minister of Justice, Mr. Mohammed Bello Adoke and six others over alleged fraud in the $1.1billion Malabu oil deal.

Adoke is being charged alongside Rasky Gbinigie, A. Abubakar, Malabu Oil and Gas Limited, Nigeria Agip Exploration Limited, Shell Ultra Deep Limited and Shell Nigeria Exploration Production Limited.

The Federal Government, in a document with charge number CR/151/2020 dated January 14 and filed on January 15, at the High Court of the Federal Capital Territory, accused Adoke and others of receiving gratification to allegedly carry out a fraudulent oil deal.

According to the Federal Government, as Attorney-General, Adoke mediated controversial agreements that ceded OPL 245 to Shell and Eni who in turn paid about $1.1billion to accounts controlled by former Petroleum Minister, Dan Etete.

Etete, now at large, was a former Petroleum Minister under the regime of Gen Sani Abacha.

Investigations show that Adoke, since he left the country after the administration of former President Goodluck Jonathan, returned into the country on December 19, 2019 from Dubai, United Arab Emirates, and was arrested by the operatives of the EFCC at the Nnamdi Azikiwe International Airport, Abuja.

He is being charged by the anti-graft agency on alleged abuse of office and money laundering in respect of the granting of the Oil Prospecting License (OPL) 245 to Shell and ENI.

According to the charge, the former AGF in August 2013 in Abuja while serving as a minister knowingly received United State Dollars equivalent of N300million which is reasonably suspected of having been unlawfully obtained and thereby committed offence punishable under Section 319A of the Penal Code, Cap. 532 Laws of the Federation of Nigeria 1990.

The suit, signed by Bala Sanga on behalf of the EFCC, Mr Ibrahim Magu, further said that one of the accused persons, Rasky Gbinigie conspired with Munamuna Seidougha (at large), Amaran Joseph (at large) and Dauzia Loya Etete (at large), sometime in 2013, in Abuja, dishonestly used as genuine the forged form CAC 7 and Board Resolution of Malabu Oil and Gas Limited and the letter of resignation of one Mohammed Sani to open a Bank Account No. 2018288005 with First Bank of Nigeria Plc to receive the sum of $401. 5million.

According to the charge, the accused persons committed an offence contrary to section 366 of the Penal Code and punishable under the same section of the Penal Code.

In one of the counts, Adoke was said to have in September, 2013 knowingly and unlawfully obtained the sum of US dollars equivalent to N367,318,800 and thereby committed an offence punishable under Section 319A of the Penal Code, Cap.532 Laws of the Federation of Nigeria, 1990.

In the charge, Gbinigie, the company secretary of Malabu oil was said to have made false resignation letter signed by one Alhaji Hassan Hindu as having resigned from the Board of Malabu Oil and Gas Limited with intent to commit fraud.

Some of the charges, among others, read: “That you, Mohammed Bello Adoke, being a public servant at the material time, the Attorney-General and Minister for Justice of the Government of Nigeria, sometime in August, 2013, in Abuja, within the jurisdiction of this Honourable Court was in possession and custody of the sum of N300million reasonably suspected to have been unlawfully obtained and thereby committed an offence an offence under section 319A of the Penal Code and punishable under the same section of the Penal Code.

“That you, Mohammed Bello Adoke, being a public servant at the material time, the Attorney-General and Minister for Justice of the Government of Nigeria, sometime in 2013, in Abuja, within the jurisdiction of this Honourable Court, accepted for yourself without consideration, the sum of N300million to broker the negotiation and signing of the Block 245 Resolution Agreement with Shell Nigeria Ultra Deep Limited, Nigeria Agip Exploration Limited, Shell Nigeria Exploration and Production Company Limited and thereby committed an offence under section 119 of the Penal Code and Punishable under the same section of the Penal Code.”

News

Shettima In Ethiopia For State Visit

Vice President Kashim Shettima has arrived in Addis Ababa, Ethiopia, for an official State visit at the invitation of the Prime Minister, Dr. Abiy Ahmed.

Upon arrival yesterday, Shettima was received at the airport by the Minister of Foreign Affairs of Ethiopia, Dr. Gedion Timothewos, and other members of the Ethiopian and Nigerian diplomatic corps.

Senior Special Assistant to the Vice President on Media and Communication, Stanley Nkwocha, revealed this in a statement he signed yesterday, titled: “VP Shettima arrives in Ethiopia for official state visit.”

During the visit, Vice President Shettima will participate in the official launch of Ethiopia’s Green Legacy Programme, a flagship environmental initiative.

The programme designed to combat deforestation, enhance biodiversity, and mitigate the adverse effects of climate change targets the planting of 20 billion tree seedlings over a four-year period.

In line with strengthening bilateral ties in agriculture and industrial development, the Vice President will also embark on a strategic tour of key industrial zones and integrated agricultural facilities across selected regions of Ethiopia.

News

RSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

The Rivers State Government has called on the people of the state especially farmers to access the ?4billion agricultural loans made available by the State and domiciled in the Bank of Industry.

This is as the State Project Implementation Unit (SPIU) of Rural Access and Agricultural Marketing Project (RAAMP), a World Bank project, took its sensitization campaign to Opobo/Nkoro, Andoni, Port Harcourt City and Obio/Akpor local government areas.

The campaign was aimed at enlightening community dwellers and other stakeholders in the various local government areas on the RAAMP project implementation and programme activities.

The Permanent Secretary, Rivers State Ministry of Agriculture, Mr Maurice Ogolo, said this at Opobo town, Ngo, Port Harcourt City and Rumuodumanya, headquarters of the four local government areas respectively, during the sensitization campaign.

Ogolo said apart from the ?4billion, the government has also made available fertilizers and other farm inputs to farmers in the various local government areas.

The Permanent Secretary who is the Chairman, State Steering Committee for the project, said RAAMP will construct roads that will connect farms to markets to enable farmers and fishermen sell their farms produce and fishes.

He also said rural roads would be constructed to farms and fishing settlements, and warned against any act that will lead to the cancellation of the projects in the four local government areas.

According to him, the World Bank and Federal Government which are the financiers of the programme will not condone such acts like kidnapping, marching ground and other acts inimical to the successful implementation of the projects in their respective areas.

At PHALGA, Ogolo asserted that the city will benefit in the areas of roads and bridge construction.

He noted that RAAMP was thriving in both the Federal Capital Territory, Abuja; Lagos and other states in the country, stressing that the project should also be given the seriousness it deserves in Rivers State.

Speaking at Opobo town, the headquarters of Opobo/Nkoro Local Government Area, the project coordinator, RAAMP, Mr.Joshua Kpakol, said the programme would reduce poverty in the state.

According to him, both fishermen and farmers will maximally benefit from the programme.

At Ngo which is the headquarters of Andoni Local Government Area, Kpakol said roads will be constructed to all remote fishing settlements.

He said Rivers State is lucky to be among the states implementing the project, and stressed the need for the people to embrace it.

Meanwhile, Kpakol said at PHALGA that RAAMP is a project that will transform the lives of farmers, traders and other stakeholders in the area.

He urged the stakeholders to spread the information to their various communities.

However, some of the stakeholders at Opobo town complained about the destruction of their farms by bulls allegedly owed by traditional rulers in the area, as well as incessant stealing of their canoes at waterfronts.

At Ngo, Archbishop Elkanah Hanson, founder of El-Shaddai Church, commended the World Bank and the Federal Government for bringing the projects to Andoni.

He stressed the need for the construction of roads to fishing settlements in the area.

Also, a former Commissioner for Agriculture in the state and Okan Ama of Ekede, HRH King Gad Harry, noted that storage facilities have become necessary for a successful agricultural programme.

Harry also stressed the need for the programme to be made sustainable.

In their separate speeches, the administrators of Andoni and Opobo/Nkoro Local Government Areas, pledged their readiness to support the programme.

At Port Harcourt City, the Administrator, Dr Arthur Kalagbor, represented by the Head of Local Government Administration, Port Harcourt City, Mr Clifford Paul, said the city would support the implementation of the programme in the area.

Also, the administrator of Obio/Akpor Local Government Area, Dr Clifford Ndu Walter, represented by Mr Michael Elenwo, pledged to support the programme in his local government area.

Among dignitaries at the Obio/Akpor stakeholders engagement is the chairman, Rivers State Traditional Rulers Council and paramount ruler of Apara Kingdom, HRM Eze Chike Wodo, amongst others.

John Bibor

News

Tinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

President Bola Tinubu has ordered the commencement of personnel audit and skill gap analysis across all cadres of federal civil servants.

The president gave this directive in Abuja, yesterday, while speaking at the International Civil Service Conference, reaffirming his resolve to achieve efficiency and professional service delivery in the civil service.

“I have authorized the comprehensive personnel audit and skill gap analysis across the federal civil service to deepen capacity. I urge all responsible stakeholders to prioritize timely completion of this critical exercise, to begin implementing targeted reforms, to realize the full benefit of a more agile, competent and responsive civil service,” the president announced.

Tinubu further directed all Ministries, Departments and Agencies (MDAs), to prioritise data integrity and sovereignty in national interest.

He called for the capture, protection and strategic publication of public sector data in line with the Nigeria Data Protection Act of 2023.

“We must let our data speak for us. We must publish verified data assets within Nigeria and share them internationally recognized as fruitful. This will allow global benchmarking organisation to track our progress in real time and help us strengthen our position on the world stage. This will preserve privacy and uphold data sovereignty,” Tinubu added.

President Tinubu hailed the federal civil service as the “engine” driving his Renewed Hope Agenda, and the vehicle for delivering sustainable national development.

He submitted that the roles of civil servants remain indispensable in modern governance, declaring that in the face of a fast-evolving digital and economic landscape, the civil service must remain agile, future-ready, and results-driven.

“This maiden conference is a bold step toward redefining governance in an era of rapid transformation. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“It captures our collective ambition to reimagine and reposition the civil service. In today’s rapid, evolving world of technology, innovation remains critical in ensuring that the civil service is dynamic, digital” the President said.

Head of the Civil Service of the Federation, Didi Walson-Jack in her welcome address told the President that his presence and strong words of commendation at the conference has renewed the morale and mandate of public servants across the country.

Walson-Jack described Tinubu as the backbone of driving transformation in the Nigerian civil service, and noted that the takeaways from past study tours undertaken to understudy the civil service in Singapore, the UK and US under her leadership, is already yielding multiplier effects.

Walson-Jack assured Tinubu that her office, in collaboration with reform-minded stakeholders, will not relent in accelerating the implementation of the Federal Civil Service Strategy and Implementation Plan, FCSSIP 25.

She affirmed that digitalisation, performance management, and continuous learning remain key pillars in strengthening accountability, transparency, and service delivery across MDAs.

Walson-Jack reaffirmed that the civil service is determined to exceed expectations by embedding a culture of innovation, ethical leadership, and citizen-centred governance in the heart of public administration.