News

Buhari’s Re-Election Dangerous To Economic Dev -HSBC …APC FG, Stinking Can Of Corruption -Timi Frank

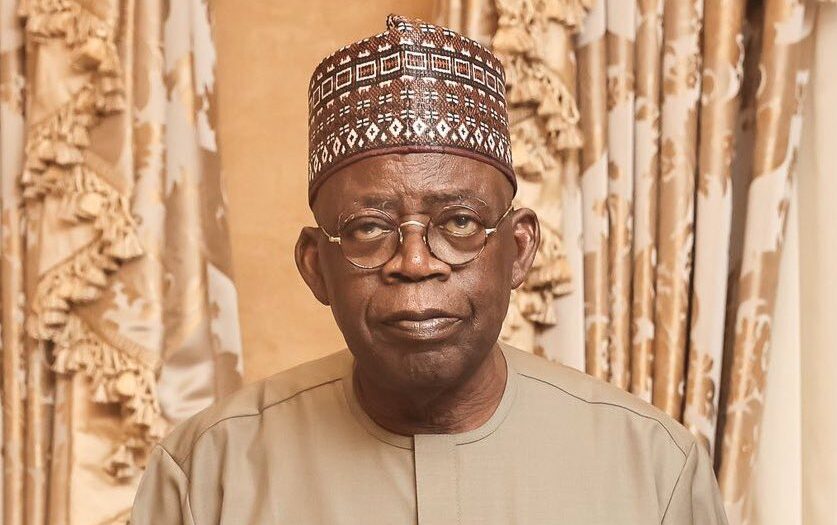

Nigeria’s current economic struggles look set to continue if President Muhammadu Buhari wins a second term in office, the multinational banking and financial services company, HSBC, has said.

The company stated this in a report by its Global Research unit, entitled, “Nigeria, Papering Over the Cracks”, obtained by London-based Telegraph, yesterday.

According to the financial institution, although President Buhari’s “approval ratings sit near all-time low a development, it said, “largely reflects the impact of Nigeria’s painful recession in 2016-17 and the sustained economic hardship that has accompanied his presidency, including rapidly rising joblessness, and poverty,” the President will once again lead the APC into the 2019 elections.

It, however, stated: “A second term for Buhari raises the risk of limited economic progress and further fiscal deterioration, prolonging the stagnation of his first term, particularly if there is no move towards completing reform of the exchange rate system or fiscal adjustments that diversify government revenues away from oil.”

The multinational banking group, which is Europe’s largest by total assets, noted that while higher oil prices have brightened Nigeria’s macro outlook, boosting export earnings, improving the supply of foreign exchange, and supporting naira stability, the Buhari administration was yet to address the economy’s structural shortcomings.

Specifically, it said: “Economic growth remains sluggish and reliant on the rebound in oil output while the non-oil economy, which accounts for about 90 per cent of GDP, continues to languish with many service sectors still mired in contraction. Joblessness continues to rise, up almost three-fold in three years to 19 per cent in Q3 2017, pushing the number in poverty to 87million.

“Meanwhile, current account improvements may have pivoted on higher oil prices, but they also derive from on-going import restrictions and limited FX access for many sectors of the economy. All told, we see growth capped at about 2.5 per cent over the next two years – a welcome recovery from the 2016 contraction, but less than half the rate of the previous cycle.”

It further stated that in addition to failing to address the country’s ongoing reliance on oil revenues and the issue of inadequate nonoil tax collection, the administration was also grappling with the challenge of having a large share of its budget directed to debt service.

The company noted that while the Federal Government’s debt management strategy of issuing external debt to redeem more expensive short-term government securities is helping reduce debt service costs in the near term, it “exposes the fiscal position to exchange rate risk in the event of a future decline in oil prices and naira devaluation.”

In addition, it stated that high oil prices has not translated into nonoil growth, adding that: “Nigeria’s reliance on fuel imports means rising international oil prices are pushing up the cost of fuel subsidies, estimated by the Petroleum Products Pricing Regulatory Agency (PPPRA) at USD250m in May alone.”

Besides, HSBC projected: “Oil prices at current levels therefore suggest a fuel subsidy that could total $1.5billion in H2 2018, and about $2.5billion for the year as a whole, which would equate to almost 20 per cent of last year’s gross oil revenue.”

It, however, stated that while the, “polls look set to be a closely contested affair” and the, “political environment favours a return to power for the PDP, yet the opposition remains weak and fragmented, and has yet to declare its presidential candidate.”

The Senior Special Assistant on Media and Publicity to the President, Mallam Garba Shehu, declined comments on the report but referred our correspondent to the Chief Economic Adviser to the President.

However, the referral could not be reached as at the time of filing this report.

Meanwhile, former Deputy National Publicity Secretary of the All Progressives Congress (APC), Comrade Timi Frank, has described the President Muhammadu Buhari’s-led administration of a stinking can of corruption.

Frank was reacting to claims by the Chairman, Presidential Advisory Committee Against Corruption (PACAC), Prof. Itse Sagay, in an interview with a national daily, that President Muhammadu Buhari was being soft on corrupt politicians in his cabinet and within the All Progressives Congress (APC) in order to “win the 2019 elections” and to “strengthen democracy.”

In a statement signed, yesterday, Frank insisted that it is fraudulent to cover-up graft and protect accused persons – who occupy enviable positions in this regime – under the guise of ensuring the re-election of Buhari or strengthening democracy.

Frank noted that the recent defection of a former Governor of Akwa Ibom State, Senator Godswill Akpabio, from the Peoples Democratic Party (PDP) into the APC was one out of the multitude of allegedly corrupt politicians who have taken permanent refuge in the Buhari’s administration in order to escape the lawful prosecution for their nefarious deeds.

The Bayelsa-born politician said: “We know that that the allegations of false NYSC exemption certificate against the Minister of Finance, Kemi Adeosun, has since been swept under the carpet. The grass cutting scandal involving the immediate past SGF, Babacheer Lawal, remains a no go area. The bribery allegations against the Chief of Staff to the President, Abba Kyari does not warrant investigation and prosecution by a government claiming to fight corruption!

“Need I talk about the large-scale corruption being perpetuated by officials of the Central Bank of Nigeria (CBN) who have elected to operate varied exchange rates regime to defraud the country with the active connivance of their collaborators in the presidency.

“The corruption in the NNPC rightly exposed by the Minister of State (Petroleum), Dr. Ibe Kachikwu, does not warrant investigation because the presidency is involved in it.

“Only recently, N100billion tax evasion scam by Alpha Beta – a tax consulting firm owned by A chieftain of the APC, Asiwaju Bola Ahmed Tinubu, was exposed. Yet, the Economic and Financial Crimes Commission (EFCC) does not deem it fit to commence investigation into the activities of the company simply because an APC chieftain would be put in the eye of the storm!

“The Governor of Rivers State, Chief Nyesom Wike, has severally petitioned the EFCC with a call on the anti-graft body to investigate corruption allegations against the immediate past governor of the state, Chibuike Rotimi Amaechi – the Minister of Transportation under the Buhari’s administration -yet apart from acknowledging that it indeed received the said petitions, the EFCC has since turned a blind eye to the allegations,” he lamented.

He said while the government has been on asset-freezing-and-loot-recovery-spree, especially from the members of the opposition political parties or those considered to be anti-Buhari accused of corruption, the real looters in government and politicians with corruption allegations against them within the ranks of the APC are sitting pretty at ease enjoying underserved amnesty.

He said: “We know several top officials of this government and members of their families who have continued to acquire choice assets and those building mansions in their states of origin and abroad since they joined this government in 2015.

“Those perpetuating corruption under this government whose names have never been mentioned are legion compared to the few names mentioned above and very soon we shall expose them with concrete evidence to prove their corrupt activities.”

He called on the EFCC to immediately recommence the investigation and prosecution of all those with corruption baggage in President Buhari’s administration and the APC or lose its credibility both at home and abroad for ever.

He added that the EFCC and other security agencies will henceforth lack the moral right to prosecute members of the opposition political parties or any Nigerian accused of corruption should they fail to immediately prosecute the identified corrupt elements in this administration and the APC.

He also called on the international community to note clearly that Buhari is not fighting corruption but rather persecuting and repressing members of the opposition to remain in power, should he fail to order the prosecution of his cronies and party faithful with clear corruption allegations against them.

“These corrupt personalities hiding inside the government of Buhari and the APC will remain a test case for the EFCC as their investigation, arrest and prosecution or not will determine whether or not the anti-corruption policy of the Federal Government is genuine or a cheap political tool to retain power and remain relevant beyond 2019,” he declared.

News

Shettima In Ethiopia For State Visit

Vice President Kashim Shettima has arrived in Addis Ababa, Ethiopia, for an official State visit at the invitation of the Prime Minister, Dr. Abiy Ahmed.

Upon arrival yesterday, Shettima was received at the airport by the Minister of Foreign Affairs of Ethiopia, Dr. Gedion Timothewos, and other members of the Ethiopian and Nigerian diplomatic corps.

Senior Special Assistant to the Vice President on Media and Communication, Stanley Nkwocha, revealed this in a statement he signed yesterday, titled: “VP Shettima arrives in Ethiopia for official state visit.”

During the visit, Vice President Shettima will participate in the official launch of Ethiopia’s Green Legacy Programme, a flagship environmental initiative.

The programme designed to combat deforestation, enhance biodiversity, and mitigate the adverse effects of climate change targets the planting of 20 billion tree seedlings over a four-year period.

In line with strengthening bilateral ties in agriculture and industrial development, the Vice President will also embark on a strategic tour of key industrial zones and integrated agricultural facilities across selected regions of Ethiopia.

News

RSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

The Rivers State Government has called on the people of the state especially farmers to access the ?4billion agricultural loans made available by the State and domiciled in the Bank of Industry.

This is as the State Project Implementation Unit (SPIU) of Rural Access and Agricultural Marketing Project (RAAMP), a World Bank project, took its sensitization campaign to Opobo/Nkoro, Andoni, Port Harcourt City and Obio/Akpor local government areas.

The campaign was aimed at enlightening community dwellers and other stakeholders in the various local government areas on the RAAMP project implementation and programme activities.

The Permanent Secretary, Rivers State Ministry of Agriculture, Mr Maurice Ogolo, said this at Opobo town, Ngo, Port Harcourt City and Rumuodumanya, headquarters of the four local government areas respectively, during the sensitization campaign.

Ogolo said apart from the ?4billion, the government has also made available fertilizers and other farm inputs to farmers in the various local government areas.

The Permanent Secretary who is the Chairman, State Steering Committee for the project, said RAAMP will construct roads that will connect farms to markets to enable farmers and fishermen sell their farms produce and fishes.

He also said rural roads would be constructed to farms and fishing settlements, and warned against any act that will lead to the cancellation of the projects in the four local government areas.

According to him, the World Bank and Federal Government which are the financiers of the programme will not condone such acts like kidnapping, marching ground and other acts inimical to the successful implementation of the projects in their respective areas.

At PHALGA, Ogolo asserted that the city will benefit in the areas of roads and bridge construction.

He noted that RAAMP was thriving in both the Federal Capital Territory, Abuja; Lagos and other states in the country, stressing that the project should also be given the seriousness it deserves in Rivers State.

Speaking at Opobo town, the headquarters of Opobo/Nkoro Local Government Area, the project coordinator, RAAMP, Mr.Joshua Kpakol, said the programme would reduce poverty in the state.

According to him, both fishermen and farmers will maximally benefit from the programme.

At Ngo which is the headquarters of Andoni Local Government Area, Kpakol said roads will be constructed to all remote fishing settlements.

He said Rivers State is lucky to be among the states implementing the project, and stressed the need for the people to embrace it.

Meanwhile, Kpakol said at PHALGA that RAAMP is a project that will transform the lives of farmers, traders and other stakeholders in the area.

He urged the stakeholders to spread the information to their various communities.

However, some of the stakeholders at Opobo town complained about the destruction of their farms by bulls allegedly owed by traditional rulers in the area, as well as incessant stealing of their canoes at waterfronts.

At Ngo, Archbishop Elkanah Hanson, founder of El-Shaddai Church, commended the World Bank and the Federal Government for bringing the projects to Andoni.

He stressed the need for the construction of roads to fishing settlements in the area.

Also, a former Commissioner for Agriculture in the state and Okan Ama of Ekede, HRH King Gad Harry, noted that storage facilities have become necessary for a successful agricultural programme.

Harry also stressed the need for the programme to be made sustainable.

In their separate speeches, the administrators of Andoni and Opobo/Nkoro Local Government Areas, pledged their readiness to support the programme.

At Port Harcourt City, the Administrator, Dr Arthur Kalagbor, represented by the Head of Local Government Administration, Port Harcourt City, Mr Clifford Paul, said the city would support the implementation of the programme in the area.

Also, the administrator of Obio/Akpor Local Government Area, Dr Clifford Ndu Walter, represented by Mr Michael Elenwo, pledged to support the programme in his local government area.

Among dignitaries at the Obio/Akpor stakeholders engagement is the chairman, Rivers State Traditional Rulers Council and paramount ruler of Apara Kingdom, HRM Eze Chike Wodo, amongst others.

John Bibor

News

Tinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

President Bola Tinubu has ordered the commencement of personnel audit and skill gap analysis across all cadres of federal civil servants.

The president gave this directive in Abuja, yesterday, while speaking at the International Civil Service Conference, reaffirming his resolve to achieve efficiency and professional service delivery in the civil service.

“I have authorized the comprehensive personnel audit and skill gap analysis across the federal civil service to deepen capacity. I urge all responsible stakeholders to prioritize timely completion of this critical exercise, to begin implementing targeted reforms, to realize the full benefit of a more agile, competent and responsive civil service,” the president announced.

Tinubu further directed all Ministries, Departments and Agencies (MDAs), to prioritise data integrity and sovereignty in national interest.

He called for the capture, protection and strategic publication of public sector data in line with the Nigeria Data Protection Act of 2023.

“We must let our data speak for us. We must publish verified data assets within Nigeria and share them internationally recognized as fruitful. This will allow global benchmarking organisation to track our progress in real time and help us strengthen our position on the world stage. This will preserve privacy and uphold data sovereignty,” Tinubu added.

President Tinubu hailed the federal civil service as the “engine” driving his Renewed Hope Agenda, and the vehicle for delivering sustainable national development.

He submitted that the roles of civil servants remain indispensable in modern governance, declaring that in the face of a fast-evolving digital and economic landscape, the civil service must remain agile, future-ready, and results-driven.

“This maiden conference is a bold step toward redefining governance in an era of rapid transformation. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“It captures our collective ambition to reimagine and reposition the civil service. In today’s rapid, evolving world of technology, innovation remains critical in ensuring that the civil service is dynamic, digital” the President said.

Head of the Civil Service of the Federation, Didi Walson-Jack in her welcome address told the President that his presence and strong words of commendation at the conference has renewed the morale and mandate of public servants across the country.

Walson-Jack described Tinubu as the backbone of driving transformation in the Nigerian civil service, and noted that the takeaways from past study tours undertaken to understudy the civil service in Singapore, the UK and US under her leadership, is already yielding multiplier effects.

Walson-Jack assured Tinubu that her office, in collaboration with reform-minded stakeholders, will not relent in accelerating the implementation of the Federal Civil Service Strategy and Implementation Plan, FCSSIP 25.

She affirmed that digitalisation, performance management, and continuous learning remain key pillars in strengthening accountability, transparency, and service delivery across MDAs.

Walson-Jack reaffirmed that the civil service is determined to exceed expectations by embedding a culture of innovation, ethical leadership, and citizen-centred governance in the heart of public administration.