News

FG To Review NNPC’s $6bn Oil Swaps

Apparently scandalised by the acute petrol scarcity, which marred the Yuletide celebrations, the Federal Government is set to review the $6 billion Direct Sale-Direct Purchase (DSDP) contracts of the Nigerian National Petroleum Corporation (NNPC).

The objective is to blacklist some oil traders whose failure to meet their petrol supply obligations plunged the country into the fuel crisis.

Speaking to newsmen on the fuel crisis in an interview, the Minister of State for Petroleum Resources, Dr. Ibe Kachikwu stated that some of the oil traders failed to deliver petrol to NNPC due to either lack of capacity to deliver or for profiteering reasons.

According to him, the failure of the companies to meet their contractual obligations caused the fuel crisis, which was aggravated by the high cost of crude oil in the international market.

The minister stated that in order to avert future fuel crises, the federal government would explore support mechanisms, by way of tax relief to boost the capacity of marketers to import petrol on their own.

Kachikwu said the federal government would review the list of the beneficiaries of the DSDP contracts to ensure that those companies that breached their contractual agreements would not benefit from the contracts.

Kachikwu said: “I think the immediate cause of this (fuel crisis) is the increase in the price of crude, and then a lot of deliveries at obviously a loss that NNPC is doing just to keep the nation going – also not the fault of NNPC.”

“That is what caused it. So we need to do better planning obviously in terms of foreseeing this and trying to provide for this. And there were a lot of people who took the DSDP programme to deliver products that failed in their deadlines – some for profiteering reasons, some for just sheer lack of capacity.

“So, we need to look at that list again and see who performed this year and who breached the contracts and make sure that those who did not perform are not back on that list again as we go forward,” Kachikwu explained.

Kachikwu said the long-term solution to the perennial crisis would be to encourage private marketers to import petrol on their own without relying on NNPC.

“I would like to see marketers being able to bring in their own products on their own and not NNPC bringing products for them. I would like to see NNPC bring its own products.”

“If there is a support mechanism, we have to find a way – either through tax relief or whatever it is to try and address that issue so that everybody has the capacity to do business.

“That is one of the things I will be developing and try to see my principal (President Buhari) obviously in the coming days to address the long-term problems.

“Final one is that the refineries should work. All these will fall into insignificance if the refineries are up and running. And we are working hard to begin the refinery repairs.

“We are almost at the end of the recommendations that will go to Mr. President,” Kachikwu added.

He stated that the federal government would develop a model that would allow NNPC and the marketers to import their own products.

“At the end of the day, that is the solution. And I will have to sit down with the Group Managing Director of NNPC and obviously get approval of Mr. President and put together structures that will enable us to address this, so that people take responsibility and answer to liabilities.

“If you say you are going to bring a cargo and we depend on you, we are going to add a penalty on it if you fail to perform. We are going to be doing that, going forward,” Kachikwu noted.

Speaking to journalists while monitoring the fuel situation in Lagos on Christmas Day, Vice-President Yemi Osinbajo also attributed the scarcity to the failure of some companies to deliver petrol to NNPC.

“I think that going by what we have seen, there is what is called winter deliveries. Towards the end of the year, the premium goes up – the cost of fuel goes up in many parts of the world for those who are importing.

“Obviously, that gave rise to problems for those who were bringing in products. We had one or two short deliveries by the importers and that accounted for some of the problems,” he said.

“I think that over time – in fact, if you look at the past few months, NNPC has been importing and they have been doing a very good job because we didn’t have a shortage in October and we did not have a shortage in November; it is only in December that we had a disruption,” Osinbajo added.

Last April, NNPC signed about $6 billion in deals with local and international traders to exchange about 330,000 barrels per day (bpd) of crude oil for imported petrol.

Our correspondent gathered that the oil traders engaged by NNPC were meant to import petrol into the country after shipping crude oil to international refiners.

It was, however, learnt that in the months of November and December, some of the companies converted their DSDP contracts into diesel, as they could not bring back petrol owing to the high cost of the product in the international market.

The implication was a flooded domestic market with diesel, which is also imported by other private marketers as a deregulated product, while petrol, which other marketers lacked the capacity to import and had been relying on NNPC for supply, became scarce.

News

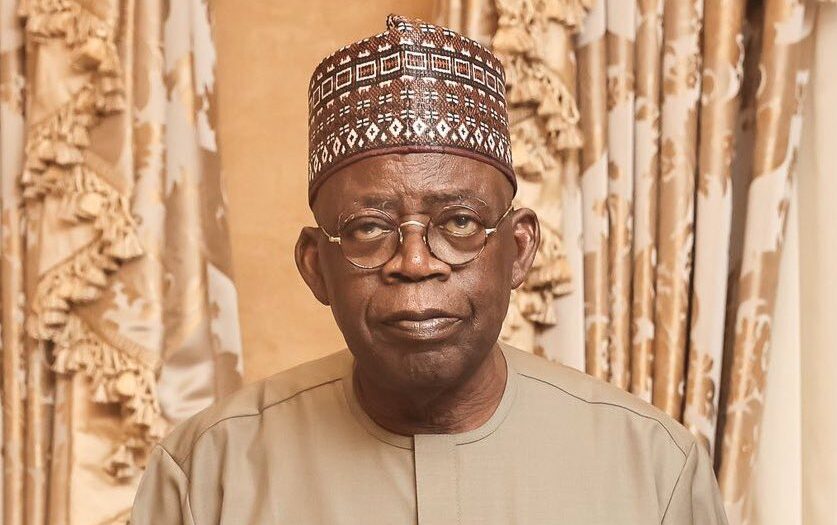

Shettima In Ethiopia For State Visit

Vice President Kashim Shettima has arrived in Addis Ababa, Ethiopia, for an official State visit at the invitation of the Prime Minister, Dr. Abiy Ahmed.

Upon arrival yesterday, Shettima was received at the airport by the Minister of Foreign Affairs of Ethiopia, Dr. Gedion Timothewos, and other members of the Ethiopian and Nigerian diplomatic corps.

Senior Special Assistant to the Vice President on Media and Communication, Stanley Nkwocha, revealed this in a statement he signed yesterday, titled: “VP Shettima arrives in Ethiopia for official state visit.”

During the visit, Vice President Shettima will participate in the official launch of Ethiopia’s Green Legacy Programme, a flagship environmental initiative.

The programme designed to combat deforestation, enhance biodiversity, and mitigate the adverse effects of climate change targets the planting of 20 billion tree seedlings over a four-year period.

In line with strengthening bilateral ties in agriculture and industrial development, the Vice President will also embark on a strategic tour of key industrial zones and integrated agricultural facilities across selected regions of Ethiopia.

News

RSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

The Rivers State Government has called on the people of the state especially farmers to access the ?4billion agricultural loans made available by the State and domiciled in the Bank of Industry.

This is as the State Project Implementation Unit (SPIU) of Rural Access and Agricultural Marketing Project (RAAMP), a World Bank project, took its sensitization campaign to Opobo/Nkoro, Andoni, Port Harcourt City and Obio/Akpor local government areas.

The campaign was aimed at enlightening community dwellers and other stakeholders in the various local government areas on the RAAMP project implementation and programme activities.

The Permanent Secretary, Rivers State Ministry of Agriculture, Mr Maurice Ogolo, said this at Opobo town, Ngo, Port Harcourt City and Rumuodumanya, headquarters of the four local government areas respectively, during the sensitization campaign.

Ogolo said apart from the ?4billion, the government has also made available fertilizers and other farm inputs to farmers in the various local government areas.

The Permanent Secretary who is the Chairman, State Steering Committee for the project, said RAAMP will construct roads that will connect farms to markets to enable farmers and fishermen sell their farms produce and fishes.

He also said rural roads would be constructed to farms and fishing settlements, and warned against any act that will lead to the cancellation of the projects in the four local government areas.

According to him, the World Bank and Federal Government which are the financiers of the programme will not condone such acts like kidnapping, marching ground and other acts inimical to the successful implementation of the projects in their respective areas.

At PHALGA, Ogolo asserted that the city will benefit in the areas of roads and bridge construction.

He noted that RAAMP was thriving in both the Federal Capital Territory, Abuja; Lagos and other states in the country, stressing that the project should also be given the seriousness it deserves in Rivers State.

Speaking at Opobo town, the headquarters of Opobo/Nkoro Local Government Area, the project coordinator, RAAMP, Mr.Joshua Kpakol, said the programme would reduce poverty in the state.

According to him, both fishermen and farmers will maximally benefit from the programme.

At Ngo which is the headquarters of Andoni Local Government Area, Kpakol said roads will be constructed to all remote fishing settlements.

He said Rivers State is lucky to be among the states implementing the project, and stressed the need for the people to embrace it.

Meanwhile, Kpakol said at PHALGA that RAAMP is a project that will transform the lives of farmers, traders and other stakeholders in the area.

He urged the stakeholders to spread the information to their various communities.

However, some of the stakeholders at Opobo town complained about the destruction of their farms by bulls allegedly owed by traditional rulers in the area, as well as incessant stealing of their canoes at waterfronts.

At Ngo, Archbishop Elkanah Hanson, founder of El-Shaddai Church, commended the World Bank and the Federal Government for bringing the projects to Andoni.

He stressed the need for the construction of roads to fishing settlements in the area.

Also, a former Commissioner for Agriculture in the state and Okan Ama of Ekede, HRH King Gad Harry, noted that storage facilities have become necessary for a successful agricultural programme.

Harry also stressed the need for the programme to be made sustainable.

In their separate speeches, the administrators of Andoni and Opobo/Nkoro Local Government Areas, pledged their readiness to support the programme.

At Port Harcourt City, the Administrator, Dr Arthur Kalagbor, represented by the Head of Local Government Administration, Port Harcourt City, Mr Clifford Paul, said the city would support the implementation of the programme in the area.

Also, the administrator of Obio/Akpor Local Government Area, Dr Clifford Ndu Walter, represented by Mr Michael Elenwo, pledged to support the programme in his local government area.

Among dignitaries at the Obio/Akpor stakeholders engagement is the chairman, Rivers State Traditional Rulers Council and paramount ruler of Apara Kingdom, HRM Eze Chike Wodo, amongst others.

John Bibor

News

Tinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

President Bola Tinubu has ordered the commencement of personnel audit and skill gap analysis across all cadres of federal civil servants.

The president gave this directive in Abuja, yesterday, while speaking at the International Civil Service Conference, reaffirming his resolve to achieve efficiency and professional service delivery in the civil service.

“I have authorized the comprehensive personnel audit and skill gap analysis across the federal civil service to deepen capacity. I urge all responsible stakeholders to prioritize timely completion of this critical exercise, to begin implementing targeted reforms, to realize the full benefit of a more agile, competent and responsive civil service,” the president announced.

Tinubu further directed all Ministries, Departments and Agencies (MDAs), to prioritise data integrity and sovereignty in national interest.

He called for the capture, protection and strategic publication of public sector data in line with the Nigeria Data Protection Act of 2023.

“We must let our data speak for us. We must publish verified data assets within Nigeria and share them internationally recognized as fruitful. This will allow global benchmarking organisation to track our progress in real time and help us strengthen our position on the world stage. This will preserve privacy and uphold data sovereignty,” Tinubu added.

President Tinubu hailed the federal civil service as the “engine” driving his Renewed Hope Agenda, and the vehicle for delivering sustainable national development.

He submitted that the roles of civil servants remain indispensable in modern governance, declaring that in the face of a fast-evolving digital and economic landscape, the civil service must remain agile, future-ready, and results-driven.

“This maiden conference is a bold step toward redefining governance in an era of rapid transformation. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“It captures our collective ambition to reimagine and reposition the civil service. In today’s rapid, evolving world of technology, innovation remains critical in ensuring that the civil service is dynamic, digital” the President said.

Head of the Civil Service of the Federation, Didi Walson-Jack in her welcome address told the President that his presence and strong words of commendation at the conference has renewed the morale and mandate of public servants across the country.

Walson-Jack described Tinubu as the backbone of driving transformation in the Nigerian civil service, and noted that the takeaways from past study tours undertaken to understudy the civil service in Singapore, the UK and US under her leadership, is already yielding multiplier effects.

Walson-Jack assured Tinubu that her office, in collaboration with reform-minded stakeholders, will not relent in accelerating the implementation of the Federal Civil Service Strategy and Implementation Plan, FCSSIP 25.

She affirmed that digitalisation, performance management, and continuous learning remain key pillars in strengthening accountability, transparency, and service delivery across MDAs.

Walson-Jack reaffirmed that the civil service is determined to exceed expectations by embedding a culture of innovation, ethical leadership, and citizen-centred governance in the heart of public administration.