Business

FMB, Estate Developers Sign $2bn Housing Deal

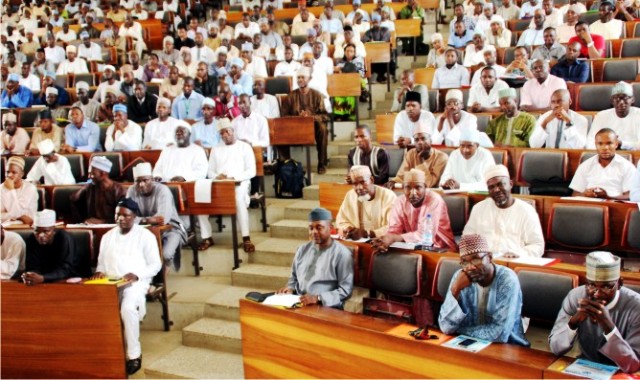

The Federal Mortgage Bank of Nigeria (FMBN), SHELTER AFRIQUE and Real Estate Developers Association of Nigeria (REDAN), have signed a two billion dollar Memorandum of Understanding to provide affordable housing for Nigerians.

Signing the MoU on Thursday in Abuja, Mr Richard Esin , the Acting Managing Director of FMBN, said the MoU was the first critical journey aimed at providing affordable housing for citizens.

The managing director added that the move was in line with the Federal Government’s agenda to encourage home ownership in the sector.

He said the bank had been able to create about 734 mortgages using about N5.4 billion.

Esin said that the FMBN, SHELTER AFRIQUE and REDAN met to explore the opportunity that would come with the launch of the National Housing Model.

“In the meeting we agreed that we needed to bring in SHELTER AFRIQUE to work in partnership with the Real Estate Developers Association of Nigeria to make available some funds over the next 10 years to give impetus to the national housing model.

” By providing other members with the necessary construction finance that will be required to drive the national housing model,’’ he said.

The acting director said that the FCMB has agreed on the housing design and pricing, adding that it would be their responsibility to give confidence, by committing to providing the mortgage financing required.

He said that they have the understanding that the Nigerian market would not require anything less than $200 million annually over the next 10 years for this purpose.

“With $200 million annually into construction finance, I am sure we can generate up to eight to 10, 000 housing units annually,’’ he said.

Esin said that this scheme would create job opportunities, adding that at least 150 jobs would be generated in the activity.

The President, REDAN, Mr Ugochukwu Chime said that one of the covenant of the MoU being signed was an opportunity to get the stock market and regular format that would enable the use of naira instead of dollar

”One of the covenant of the MoU being signed was an opportunity to get the stock market and regular format that will enable us to have a naira denominated facility SHELTER AFRIQUE rather than the dollar facility’’.

He said that the MoU would promote team work, adding that it was impossible for them in REDAN to move forward without considering the skills of all those involved in housing sector.

Chime said that they have met with many artisans to see how they could contribute their quota in the delivery of affordable housing, adding that many artisans were currently undergoing training.

He called for the total recapitalisation of the FMBN, adding that over the years FMBN has being limited in their ability to deliver in their mandate because of poor capitalisation.

Also speaking, the Managing Director, Company for Habitat and Housing in Africa(SHELTER AFRIQUE), Mr James Mugerwa, said that the MoU would herald a new chapter in Nigeria’s housing sector.

He said that the MoU, also heralds provision of end- to-end solutions to the housing demand and supply challenges currently facing the country.

He said that the MoU paves the way for to SHELTER AFRIQUE to renew its support to members of REDAN on the supply side of the housing chain.

According to him, with a supply backlog estimated at over 17 million housing units, Nigeria, like other African countries requires significant investments in the housing sector.

”With more than three decades of involvement in the housing sector across Africa, SHELTER AFRIQUE is uniquely positioned to partner with REDAN and FMBN.

”In designing and providing housing and construction finance solutions to support provision of decent and affordable housing to a wider cross-section of the Nigerian population,’’ he said.

He said that it was the aspiration of SHELTER AFRIQUE that all the parties involved would commit and dedicate all their expertise and resources to ensure that good quality housing and affordability remains two key considerations in all collaboration opportunity.

Business

NCDMB, Dangote Refinery Unveil JTC On Deepening Local Content

Business

Food Security: NDDC Pays Counterpart Fund For LIFE-ND Project

Business

Replace Nipa Palms With Mangroove In Ogoni, Group Urges FG, HYPREP

-

Business2 days ago

Industry Leaders Defend Local Content, … Rally Behind NCDMB

-

News3 days ago

KENPOLY Appoints Abalubu As Ag. Registrar

-

Niger Delta2 days ago

Niger Delta2 days agoC’River Focused On Youth Empowerment – Commissioner

-

News3 days ago

UN Warns Floods May Unleash Toxic Chemicals, Pose Risk To Elderly, Ecosystems

-

Rivers2 days ago

NSE Members Tasked On National Dev

-

Business2 days ago

NCDMB Promises Oil Industry Synergy With Safety Boots Firm

-

News3 days ago

Police Rescue Kidnapped Victim As Suspects Escape With Gunshots in Rivers

-

Politics2 days ago

Your Lies Chasing Investors From Nigeria, Omokri Slams Obi