Featured

Engaging The Cultists …The Rivers Example

On New Year eve, amidst the familiar fire works in disobedience of regular Police warning, gunmen, suspected to be cultists invaded Marine Base. By the time residents realized that the bangs were gun-shots and made distress call to the Police, two bodies were found lifeless in a pool of their own blood.

One was later identified as an enemy ‘combatant’, while the second was a driver with the Rivers State Newspaper Corporation, on official duty that had nothing to do with cultists and their activities. He was caught up in the cross-fire, an innocent death.

That incident is only one of several examples of collateral damages to cult-related violence, senseless bloodletting and incessant warfare for either supremacy or reprisal. Infact, many innocent citizens have paid the supreme price, without necessarily being partakers of the orgy of violence known to cult gangs.

On the last count, some local government areas in Rivers State were invaded by competing cult groups, leaving behind every such attack, dead bodies, among them innocent defenceless men, women and children.

Most of these cult gangs are so heavily armed that they can take-over and run a community to the utter helplessness of local authorities. In some communities, they are governments unto themselves and impose all manner of sanctions for disobedience. Where there are sources of ready funds from either state, federal and or oil production activities, the rivalry among such cult groups is often fiercest.

The history of the armed gangs is traceable to many sponsors, key among them are politicians who most often were said to have armed them as alternative security men and thugs, during elections, with promises of heaven on earth.

These young men were very often abandoned by such benefactors afterwards without any effort to retrieve their weaponry. And so, like the monster that outgrows his master, the cult groups become danger not only to their masters but also to society from which they must feed.

The warfare is also very deadly where two or more such groups are domiciled in the same locality and one seen to be favoured by public institutions against others. In such rivalries, the ambition of each group is usually to instill fear and force obedience from ordinary people. At other times, efforts are made to enlarge membership through forced initiations.

By such brute force, they enforce their own laws and order and eventually earn phoney legitimacy from among the populace who out of fear become subservient. At such times, rival groups also stockpile arms to dislodge the status quo, and the cycle continues.

Such is the near-frequent recourse to violence. Some of them are also accused of complicity in the incessant cases of kidnap in the state and elsewhere, with inexplicable ransom-demands that eventually make the trade a lucrative pastime. But kidnapping is not the only indiscretion often ascribed to such groups. Some of their members it is said are also believed to be into robberies of different kinds.

What is astonishing is that it is believed that the Police indeed know the leaders and even members of such groups. They also know their hide-outs and could indeed engage them to a stand-still.

But to the Police, such confrontation would be futile without the required political will of the government in power. This is because, without such needed assurances, such Police officers would merely endanger their jobs and or lives, because it is often difficult to know the support base of such cultists.

One could be arrested one day, only to get an ‘order from above’ to release such ‘innocent citizen’ only for such suspect to mock the Police men and loudly celebrate his freedom.

For such reasons, even some policemen, it was once alleged, also ‘blend’ a term commonly used to mean ‘initiation’ to enjoy the protection of a powerful cult.

Curiously, many citizens believe that the strength of the Police can only be noticed, when there is a police casualty in cross-fire. Police search, in such instances, is often very thorough, decisive and committed. At such times, the consideration of possible assailant’s powerful backers and a political will to back-up their reaction to their own dead ones, do not count. It is indeed in such an instance when it is best to find the best in policemen.

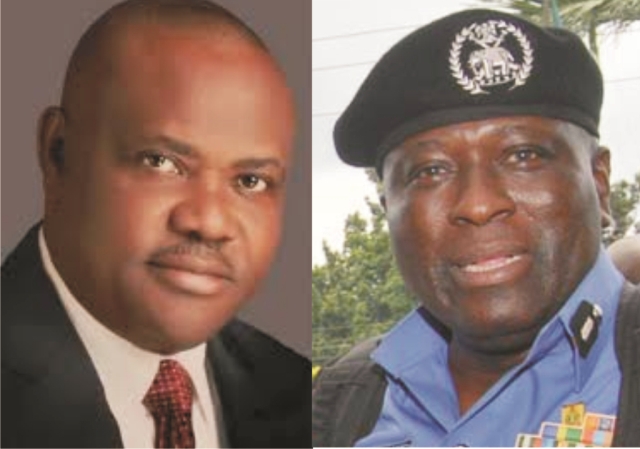

Aside from that, even the Police is often helpless. That is why the resolve of Rivers State Governor, Chief Nyesom Ezenwo Wike to partner the State Police Command in taking the anti-crime war to the cult groups is most noteworthy.

After the initial raid of cult havens in Obio/Akpor Local government Area, Governor Wike’s own LGA, where buildings of cult-gangs and kidnappers were demolished and land, recovered for public use, the Governor’s battle continued at the weekend, with a raid of similar cult havens at Eagle Island, in Port Harcourt City.

Joined by the new State Commissioner of Police, Mr. Foluso Adebanjo, Governor Wike personally supervised the demolition of two alleged deadly cultists’ camps, one of them located behind the Redeemed Christian Church of God and the other one simply called Andoni Camp.

Like that in Obio/Akpor, Governor Wike announced that a Police Station will be built at the camp behind the Church while a community hospital will replace the Andoni Camp. Addressing the security afterwards, Wike assured that the demolition of cultists’ hide-outs will continue until innocent citizens know peace and sleep with both eyes closed.

The security action is coming after Governor Wike had appealed to the youth involved in crime, to denounce their trade, embrace peace and be granted amnesty. Governor Wike assured that such repentant cultists and criminals would be re-integrated into the civil society through programmes that would reform and make them better and dependable citizens.

It is not known, how many such persons heeded the governor’s call and hand of friendship. What is known is that the level of cult activities could no longer be treated with levity.

At these times of economic downturn; when, states are doing everything humanly possible to attract direct foreign investments, the fortunes of the state cannot be left at the mercy of cultists, whose orgy of violence naturally creates insecurity that could scare away such foreigners and local investors alike.

Rivers is second only to Lagos in internally generated revenue. That underscores the relative peace enjoyed by companies who live and do business in the state. That success cannot be sacrificed for cult-induced violence that daily put Rivers on the front pages of newspapers as insecure.

The joint Government/Police action is also to make a point to trouble-makers that they are not welcome at the forthcoming rerun elections planned for the state. They are only welcome as civil citizens and voters, not as hired thugs and or weapon wielding alternate security to politicians.

So far, the public seems convinced that the war against crime and criminals enjoys the required political will, with the direct involvement and participation of the State Governor in all the raids on cultists’ hide-outs and subsequent demolition. Also welcome, are the choices of public projects already earmarked to replace the demolished property. Institutions like community hospitals and police stations would without doubt help meet the health needs of the people and also guarantee law and order in the affected communities.

My agony is that it is still unclear if there would not be ‘order-from-above’ to immediately release suspected cultists in Police custody, in a clime where, bail of a murder accused is made an issue before a higher court, obviously for political reasons. Methinks more issues than necessary are being politicised these days and that should be checked, if we are not to record more innocent deaths in cross-fire, like the fate that befell, The Tide’s driver, on New Year eve.

Soye Wilson Jamabo

Featured

Tinubu Signs Four Tax Reform Bills Into Law …Says Nigeria Open For Business

President Bola Tinubu yesterday signed into law four tax reform bills aimed at transforming Nigeria’s fiscal and revenue framework.

The four bills include: the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

They were passed by the National Assembly after months of consultations with various interest groups and stakeholders.

The ceremony took place at the Presidential Villa, yesterday.

The ceremony was witnessed by the leadership of the National Assembly and some legislators, governors, ministers, and aides of the President.

The presidency had earlier stated that the laws would transform tax administration in the country, increase revenue generation, improve the business environment, and give a boost to domestic and foreign investments.

“When the new tax laws become operational, they are expected to significantly transform tax administration in the country, leading to increased revenue generation, improved business environment, and a boost in domestic and foreign investments,” Special Adviser to the President on Media, Bayo Onanuga said on Wednesday.

Before the signing of the four bills, President Tinubu had earlier yesterday, said the tax reform bills will reset Nigeria’s economic trajectory and simplify its complex fiscal landscape.

Announcing the development via his official X handle, yesterday, the President declared, “In a few hours, I will sign four landmark tax reform bills into law, ushering in a bold new era of economic governance in our country.”

Tinubu made a call to investors and citizens alike, saying, “Let the world know that Nigeria is open for business, and this time, everyone has a fair shot.”

He described the bills as not just technical adjustments but a direct intervention to ease burdens on struggling Nigerians.

“These reforms go beyond streamlining tax codes. They deliver the first major, pro-people tax cuts in a generation, targeted relief for low-income earners, small businesses, and families working hard to make ends meet,” Tinubu wrote.

According to the President, “They will unify our fragmented tax system, eliminate wasteful duplications, cut red tape, restore investor confidence, and entrench transparency and coordination at every level.”

He added that the long-standing burden of Nigeria’s tax structure had unfairly weighed down the vulnerable while enabling inefficiency.

The tax reforms, first introduced in October 2024, were part of Tinubu’s post-subsidy-removal recovery plan, aimed at expanding revenue without stifling productivity.

However, the bills faced turbulence at the National Assembly and amongst some state governors who rejected its passing in 2024.

At the NASS, the bills sparked heated debate, particularly around the revenue-sharing structure, which governors from the North opposed.

They warned that a shift toward derivation-based allocations, especially with VAT, could tilt fiscal balance in favour of southern states with stronger consumption bases.

After prolonged dialogue, the VAT rate remained at 7.5 per cent, and a new exemption was introduced to shield minimum wage earners from personal income tax.

By May 2025, the National Assembly passed the harmonised versions with broad support, driven in part by pressure from economic stakeholders and international observers who welcomed the clarity and efficiency the reforms promised.

In his tweet, Tinubu stressed that this is just the beginning of Nigeria’s tax evolution.

“We are laying the foundation for a tax regime that is fair, transparent, and fit for a modern, ambitious Nigeria.

“A tax regime that rewards enterprise, protects the vulnerable, and mobilises revenue without punishing productivity,” he stated.

He further acknowledged the contributions of the Presidential Fiscal Policy and Tax Reform Committee, the National Assembly, and Nigeria’s subnational governments.

The President added, “We are not just signing tax bills but rewriting the social contract.

“We are not there yet, but we are firmly on the road.”

Featured

Senate Issues 10-Day Ultimatum As NNPCL Dodges ?210trn Audit Hearing

The Senate has issued a 10-day ultimatum to the Nigerian National Petroleum Company Limited (NNPCL) over its failure to appear before the Senate Committee on Public Accounts probing alleged financial discrepancies amounting to over ?210 trillion in its audited reports from 2017 to 2023.

Despite being summoned, no officials or external auditors from NNPCL showed up yesterday.

However, representatives from the representatives of the Economic and Financial Crimes Commission, Independent Corrupt Practices and Other Related Offences Commission and Department of State Services were present.

Angered by the NNPCL’s absence, the committee, yesterday, issued a 10-day ultimatum, demanding the company’s top executives to appear before the panel by July 10 or face constitutional sanctions.

A letter from NNPCL’s Chief Financial Officer, Dapo Segun, dated June 25, was read at the session.

It cited an ongoing management retreat and requested a two-month extension to prepare necessary documents and responses.

The letter partly read, “Having carefully reviewed your request, we hereby request your kind consideration to reschedule the engagement for a period of two months from now to enable us to collate the requested information and documentation.

“Furthermore, members of the Board and the senior management team of NNPC Limited are currently out of the office for a retreat, which makes it difficult to attend the rescheduled session on Thursday, 26th June, 2025.

“While appreciating the opportunity provided and the importance of this engagement, we reassure you of our commitment to the success of this exercise. Please accept the assurances of our highest regards.”

But lawmakers rejected the request.

The Committee Chairman, Senator Aliyu Wadada, said NNPCL was not expected to submit documents, but rather provide verbal responses to 11 key questions previously sent.

“For an institution like NNPCL to ask for two months to respond to questions from its own audited records is unacceptable,” Wadada stated.

“If they fail to show up by July 10, we will invoke our constitutional powers. The Nigerian people deserve answers,” he warned.

Other lawmakers echoed similar frustrations.

Senator Abdul Ningi (Bauchi Central) insisted that NNPCL’s Group CEO, Bayo Ojulari, must personally lead the delegation at the next hearing.

The Tide reports that Ojulari took over from Mele Kyari on April 2, 2025.

Senator Onyekachi Nwebonyi (Ebonyi North) said the two-month request suggested the company had no answers, but the committee would still grant a fair hearing by reconvening on July 10.

Senator Victor Umeh (Anambra Central) warned the NNPCL against undermining the Senate, saying, “If they fail to appear again, Nigerians will know the Senate is not a toothless bulldog.”

Last week, the Senate panel grilled Segun and other top executives over what they described as “mind-boggling” irregularities in NNPCL’s financial statements.

The Senate flagged ?103 trillion in accrued expenses, including ?600 billion in retention fees, legal, and auditing costs—without supporting documentation.

Also questioned was another ?103 trillion listed under receivables. Just before the hearing, NNPCL submitted a revised report contradicting the previously published figures, raising more concerns.

The committee has demanded detailed answers to 11 specific queries and warned that failure to comply could trigger legislative consequences.

Featured

17 Million Nigerians Travelled Abroad In One Year -NANTA

The National Association of Nigerian Travel Agencies (NANTA) said over 17 million Nigerians travelled out between 2023 and 2024.

This is as the association announced that it would be organising a maiden edition of Eastern Travel Market 2025 in Uyo, Akwa Ibom State capital from 27th to 30th August, 2025.

Vice Chairman of NANTA, Eastern Zone, Hope Ehiogie, disclosed this during a news briefing in Port Harcourt.

Ehiogie explained that the event aims to bring together over 1,000 travel professionals to discuss the future of the industry in the nation and give visibility to airlines, hospitality firms, hospitals and institutions in the South-South and South-East, tagged Eastern Zone.

He stated that the 17 million number marks a significant increase in overseas travel and tours.

According to him, “Nigerian travel industry has seen significant growth, with 17 million people traveling out of the country in 2023”.

Ehiogie further said the potential of tourism and travel would bring in over $12 million into the nation’s economy by 2026, saying it would be a major spike in the sector, as 2024 recorded about $4 million.

“The potential of tourism and travel is that it can generate about $12 million for the nation’s economy by 2026. Last year it was $4 million.

“In the area of travels, over 17 million Nigerians traveled out of the country two years ago for different purposes. This included, health, religious purposes, visit, education and others,” Ehiogie said.

While highlighting the potential of Nigeria’s tourism, he said the hospitality industry in Nigeria has come of age, saying it is now second to none.

The Vice Chairman of NANTA, Eastern Zone further said, “We are not creating an enabling environment for business to thrive. We need to support the industry and provide the necessary infrastructure for growth.”

He said the country has a lot of tourism potential, especially as the government is now showing interest in and supporting the sector.

Ehiogie emphasized that NANTA has been working to support the industry with initiatives such as training schools and platforms for airlines and hotels to sell their products.

He added, “We now have about four to five training schools in the region, and within two years, the first set of students will graduate. We are helping airlines sell tickets and hotels sell their rooms.”

Also speaking, former Chairman of the Board of Trustees of NANTA, Stephen Isokariari of Dial Travels, called for more support from the industry.

Isokariari stated, “We need to work together to grow the industry and contribute to the nation’s Gross Domestic Product.

“With the right support and infrastructure, the Nigerian travel industry has the potential to make a significant contribution to the nation’s economy.”