Front Pix

‘We Didn’t Meet N10bn In RSG Account’

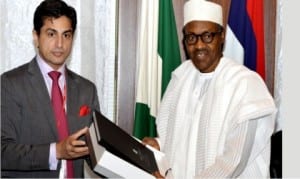

President Muhammadu Buhari (right), receiving Centenary City documents from Executive Director for Africa, Eagle Hills, Mr Jaimal Shergill, during a meeting of the Centenary City Board members with the President at the Presidential Villa in Abuja, last Friday

The Rivers State Government has described as frivolous and baseless allegations by the immediate past Governor of the state, Rt. Hon. Chibuike Rotimi Amaechi that he left N10 billion in the state coffers.

Governor Wike, who said this while, declaring, opened this year’s civil service day in Port Harcourt asked why the ex-governor did not use the money to settle some outstanding claims owed by the state.

The governor, who also decried the non-payment of overheads to ministries, departments and agencies since last October, said that the Commissioner for Finance has been directed to ensure that ministries, departments and agencies get their overheads as at when due.

Meanwhile, the Rivers State government has promised to give more opportunities to women to serve in the soon-to-be constituted State Executive Council.

The state governor, who said this during this year’s Civil Service Day in Port Harcourt, also described the theme of the celebration: “The Role of Public Service in Women Empowerment, Innovation and Accessible Service Delivery”, as apt and timely.

He said that it was in that light that more women were recently appointed as Permanent Secretaries.

Wike also said that, the present administration is out to reposition the service for efficient service delivery, and warned Civil Servants against partisanship, but strive for excellence and improved productivity.

The governor also urged the State Head of Service, Mr. Rufus Godwins to ensure that the State Secretariat is given a facelift as civil servants must not be made to work in an unconclusive environment.

The Head of Service, Mr. Rufus Godwins commended the governor for paying outstanding arrears of salaries accumulated by the previous administration to civil servants.

Godwins also commended the governor for giving 42 per cent to women in the recent appointment of Permanent Secretaries, adding that Permanent Secretaries and other cadres of civil servants due retirement were being retired to create room for the employment of younger ones into the service.

Earlier, the former Rivers State Governor, Chibuike Rotimi Amaechi had challenged his successor in office, Governor Nyesom Wike to publish the statements of government accounts with Skye Bank, FAAC, Zenith Bank and Access Bank.

Amaechi added that he left about N7.5 billion cash as balance in the state Internally Generated Revenue (IGR) as at May 29, 2015, alongside money in other accounts.

Amaechi, in a statement, Monday, by his media office said: “Our attention has been drawn to comments by Governor Wike, where he attempted to justify his sham probe of the immediate past governor of the state and distort our statement on the amount of money Amaechi left in the state treasury.

“However, what the public may not know is that Wike’s deceptive probe of Amaechi is a distraction to entertain and keep the public focus on his circus show, while he siphons and salt away billions of naira from the state treasury. From the moment he stepped into Government House, Port Harcourt, Wike has run a government of lies, deception and fraud.

“Wike claimed he met a completely empty treasury. That again is another big lie and grand deception to steal state funds. We have said that Amaechi left billions of naira and we even went ahead to mention the banks and give the names of the accounts the money were, as at May 29, 2015.

“We repeat that N7.5 billion cash was left behind as balance in the state Internally Generated Revenue account with Skye Bank, FAAC account with Zenith Bank, balance with Access Bank and funds in the State reserve fund account in First Bank.

“This is besides other balance in the state Government House account with Zenith Bank and other government ministries, departments and agencies, MDAs accounts, like the Bureau for Public Procurement (BPP). Amaechi left N939million in the Commercial Agric Credit Scheme Account in Zenith Bank.

“By the time you pull all these together, we are looking at readily available cash in the region of N8 billion to N10 billion left for the Wike administration. We have mentioned banks, account names and funds left in the accounts. These are facts that cannot be distorted by Wike.

“If Wike says he’s not lying that he met an empty treasury, we challenge him to publish the statements of these government accounts that we have mentioned and other Rivers State Government ministries, departments and agencies, MDAs accounts as at May 29 to prove his claim and show the public that Amaechi left an empty treasury for him.”

Front Pix

DEPLOY YOUR CAPACITY, TECHNICAL KNOWHOW TO REVITALISE SONGHAI FARMS, FUBARA TELLS TASK FORCE

Rivers State Governor, Sir Siminalayi Fubara, has said that diversifying the economy of the State has become inevitable because of the need to solve the problem of food shortages while also providing jobs for the teeming unemployed youths.

These, he said, are the reasons why great care has been taken to critically look at the prospects of revitalising the Songhai Integrated Farms, which is located in Bunu Tai, in Tai Local Government Area of the State.

Governor Fubara insisted that if the problem associated with food shortages is tackled with good intent and purpose, about 40 to 50 percent of current problems of economic hardship plaguing the country and its people would have been solved.

Governor Fubara made the assertion while inaugurating the Chairman, Mr Biedima Oliver, and members of the task force saddled with the responsibility of supervising the revitalization of Songhai Integrated Farms by its partners: Vitalcrop Ventures Limited and Imagine Adama Limited, at Government House in Port Harcourt, yesterday.

Other members of the task force included, the Rivers State Commissioner for Agriculture, Engr Victor Kii; Commissioner for Finance, Barrister Emmanuel Frank-Fubara; Dr Ayebaesin Beredugo; and Mr Maurice Ogolo.

The Governor explained that it took him time to approve the constitution of the task force being inaugurated because of the ugly experience with the previous group that shown such interest.

Governor Fubara stated that a process was initiated and driven halfway into the handing over of Songhai Farms on concession to an interested partner who latter showed a total lack of the needed capacity to undertake such task.

He said, “As a matter of fact, if few of you could remember, we even conceded the place to an investor who came in after he had made his presentation, and we, believing that he has the capacity, we said okay to him, and we had already signed up.

“But something happened. He came back to tell us that he wanted us to give him a N5billion bank guarantee. We then asked him, why? If we have the N5billion, why do we need you to come and even revitalize Songhai Farms? We would have put that N5billion there ourselves. For that reason, we cancelled that arrangement.”

Governor Fubara said now that two separate companies have come together to indicate interest and given the assurance of having the needed capacity to drive the process, he is delighted to see them meeting that expectation.

Governor Fubara pointed to the expectation of the people who want to see the Songhai Farms back on stream on a sustainable basis.

That expectation, he insisted, is also what his administration wants to see actualised within its lifespan.

He noted, “We want to see food sufficiency, because we know when Songhai Farms comes on board, there will be food, which is one of the problems we are having in this country. If we are able to tackle the issue of food, 40 to 50 percent of our problem will be solved.”

Governor Fubara also stated that although he believes in the presentation made by the group and has taken their assurance to heart, but warned that he would not tolerate a repeat of what happened before.

The Governor said, “I hope your story will not be (end) halfway too. I hope you have the capacity and all the technical knowhow to handle it. It is not when we start now, after we had finished inaugurating the task force, you will come back to tell us that you need $2million. If we have $2million, we won’t need you. We will invest it by ourselves.”

Governor Fubara, however, praised the capacity of the Chairman of the task force, Biedima Oliver, saying that incidentally, he was one of the personnel that convinced the then administration to develop the Songhai Farms, and had worked with the Rivers State Sustainable Development Agency (RSSDA) to manage the project.

He said, “He knows and understands the workings of Songhai, and now that we are making you the chairman of the task force, we want to believe that you will make that place come back to life.

“I don’t have any doubt in your capacity. A few things you’ve touched, you turned them to gold. Please, bring it back to what we used to see in Songhai. Bring it back with the help of your committee.”

Governor Fubara assured that his administration will remain committed to providing all the necessary support that they may require to make their assignment a success.

He added, “So, I hereby inaugurate you. Your task is very simple: Do everything within your powers and with our support to make sure that Songhai becomes operational to the benefit, not just the people of Tai, but to the entire Rivers State and Nigeria as a whole”.

In his acceptance speech, the Chairman of the Task Force to Supervise the Revitalization of Songhai Farms with Vitalcrop Ventures Limited and Imagine Adama Limited, Mr. Biedima Oliver, expressed appreciation to Governor Fubara for the opportunity and confidence reposed in them to revive Songhai Farms.

Mr. Oliver assured that they will deliver the expected goal on Songhai Farms, and doing so on time and on target so that the good people of Rivers State can eventually be happy and also benefit from the huge investment.

Front Pix

Our Policies Are Geared Towards Protecting Rivers Interest -Fubara

Rivers State Governor, Sir Siminalayi Fubara, has declared that all the policies and programmes of his administration are tailored towards the protection of interest of Rivers people, especially the youths.

This, he said, is borne out of the importance his administration attaches to youths’ development and empowerment as leaders of tomorrow.

Fubara, according to a statement by his Chief Press Secretary, Nelson Chukwudi, disclosed this when he received the youths of Emohua Local Government Area under the auspices of “Emohua Youths For SIM” on solidarity visit to Government House, Port Harcourt, last Friday.

He said that his administration has put in place modalities that will boost the livelihoods and well-being of Rivers citizens, which youths of Emohua will also benefit when they materialise.

The governor, who spoke through the Rivers State Head of Service, Dr. George Nwaeke, pointed out that the recently awarded Elele-Omudiaga-Egbeda-Ubimini-Ikiri-Omoku Road, the ongoing Emohua-Kalabari Road, reinstatement of illegally sacked workers of Emohua Local Government Area and the approval for electrification of the area, are part of deliberate measures to open up the area to make life conducive and more meaningful for the people.

According to him, “Everything about the governor is putting the interest of Rivers State first. He is looking at and taking action on those things that we need to do to restart the wheels of progress in Rivers State.

“There are many things the governor has planned and is already doing that will boost the life and welfare of every citizen of Rivers State, but most importantly the youths.

“Growing up, I learnt that Egbeda is one of the biggest communities in the whole of Ikwerre, and it’s predominantly an agrarian community. They have food in Egbeda, they have food in Ubimini, they have food in Omudiaga and other natural resources. The whole world is tilting to agriculture, and this is the way to go.

“The Elele-Umudioga-Egbeda-Ubimini-Omoku road, when completed, will open up the area for real development. Your food and everything you produce there will now have value, they will no longer be thrown away. In all these, you the youths are going to be the utmost beneficiaries.”

He added, “Same will be applicable to the Emohua-Kalabari Road which will also, trigger development in the area, and you will be the greatest beneficiaries. When the LGA is also electrified, you will be having 24 or 20 hours of electricity, and those things the youths can do with electricity, you can stay at home and create wealth for yourself and children.

“All the totality of what the governor is doing, when they are completed, or even as some are completed now, the youths are going to be utmost beneficiaries.”

While acknowledging that youths are the true leaders of tomorrow and any government that fails to carry them along in the scheme of things is doomed to fail, the governor assured them of his administration’s commitment to always address issues concerning youths and ensure that they are part of his government.

He commended the youths for toeing the path of truth by identifying with his administration, urging them to sustain the tempo and shun evil, as his government will ensure that the trend whereby politicians turn youths to beggars are over.

He said, “Youths are, indeed, the leaders of tomorrow. The time of youth is a very important time. It a time that your parents or whoever is your leader at that time have to make the greatest investment in you. And any Government that decides to only carry the elderly, chiefs aling and abandon the youths is bound to fail,” he asserted.

“But I am happy that Governor Fubara has concentrated his energy on everything that will benefit the society, especially the youths.

“And based on these, I want to thank you for recognising what is good and calling it good, for shunning what is evil, for saying the Governor is standing for you.

“Let me tell you, you are on the right direction. Let me tell you again, Rivers State is the bride of Nigeria. The whole Nigeria is looking at what will happen here. As they look here and see you standing on the path of truth, this is a very important step that you have taken to right all the wrongs of the past, to make Rivers State stand on the tripod of justice, peace and security. That is what we are going to gain through the governor, taking all the wise actions that he has already initiated.

“The projects the governor is embarking on are meant to prepare nets for the youths to fish and put food on their table, hence you should continue to follow him.

“The SIMplified Movement brought upon by the governor will ensure that Rivers youths stop the habit of going to bow down before politicians, pledging loyalty before they can eat.”

Earlier, spokesman for the Emohua Youths for SIM, Comrade Ovamale O. Ovamale, had said that the visit by youths from the 14 political wards in Emohua Local Government Area was to thank the governor for the award of the Elele-Omudiaga-Egbeda-Ubimini-Ikiri-Omoku road, the approval for electrification of the area and reinstatement of sacked workers of Emohua Local Government Council, of which the youths were mostly affected.

According to him, “Siminalayi Fubara of recent has given Emohua Local Government road that links Elele to Omoku, which comprises over four communities in the local government.”

“Emohua Local Government has also been in darkness for eight years. No community in the local government that has light. But, of recent, because of the passion and love the governor has for the people of Emohua, he has approved the electrification of the local government.

“Also, the illegal sack of Emohua Local Government workers, for which the youths were mostly affected and without the approval of the Local Government Service Commission, the governor, in his compassionate nature, has reinstated them, and that is why we said we must come and thank His Excellency”, he said.

Front Pix

Our Legacy’ll Leave Lasting Impression On Rivers People -Fubara

Rivers State Governor, Sir Siminalayi Fubara, has assured that his administration will collaborate and continue to consult widely in delivering a liberated State experiencing enduring peace.

Fubara said, in doing so, he would not operate as a dictator but as a member of a team that has the best interest of the State at heart and determined to leave a lasting legacy that can be celebrated.

The governor spoke during the formal presentation of Certificate of Recognition and Staff of Office to the Amanyanabo of Okochiri Kingdom, King Ateke Michael Tom, as first class tradition ruler, at Government House in Port Harcourt, yesterday.

Fubara stated that, during the Sixth State Executive Council meeting, N80.8billion was approved with 50 percent contract value paid already as the Government awarded the construction of the Elele-Egbeda-Omoku Road.

He said the project will be funded from the savings from Internally Generated Revenue (IGR) to underscore his administration’s prudence without also borrowing to complete the project.

“We are at a crossroad in our State where we all need to stand for what is right. It happens once in a life time. So, for now, be one of those people that will be in the course to liberate and free our dear State.

“And I know strongly that having the support of a peace-loving Amanyanabo of Okochiri Kingdom, having the support of the wonderful Council of Chiefs, having the support of the great people of Rivers State, we will bring peace in our State. We will do those things that are right to develop our State.

“We will continue to consult. We will not act as dictators. We will act as people who know that one day, we will leave, and when we leave, the way we have acted will speak for us. We will not force people to talk good about us. Our legacy will be a signature for how we led”, the governor said.

Fubara explained that he acted within the ambit of the law to upgrade the traditional stool upon which King Ateke Tom sits in recognition of his efforts in promoting peace in Okrika, and indeed, the State, and urged him to continue to do justice to everyone.

In his speech, Commissioner for Chieftaincy and Community Affairs, Hon Charles Amadi, congratulated King Ateke Tom for being formally presented with the Certificate of Recognition and Staff of Office as first class traditional ruler.

Also speaking, former Transport Minister, Chief Abiye Sekibo, thanked the governor for fulfilling his promise of upgrading the traditional stool of Okochiri Kingdom, and pledged the support of Kirike Se people to his administration.