News

Fuel Scarcity Persists In Rivers, FCT Groans

Pensioners at the Pension Transitional Arrangement Directorate Stakeholders Forum in Abuja last Thursday.

The scarcity of Petrol in Port Harcourt, the Rivers State Capital, has remained high since last week with some filling stations selling at between N110.00 and N120 per litre as against the official pump price of N87.00 while most do not have product.

The situation is even worse at the outskirts of Port Harcourt city as marketers sell at between N120.00 and N130.00 per litre.

It would be recalled that scarcity of the product resurfaced in the state since last week Saturday thereby engendering panic buying by helpless buyers who have the fear that full scale scarcity night hit the state.

A motorist, Mike Odeh said he bought petrol yesterday at Eliozu in Obio/Akpor Local Government Area at the cost of N120.00per litre.

Another commercial bus driver, Zubi Iyke, who plies Port Harcourt/Yenagoa route, said he bought a litre of Petrol at N120.00 in Ahoada.

“The problem is that there is no product in most filling stations on the way. So, you have no option than to buy it at any price”, lyke said.

Investigation by The Tide shows that marketers have started to hoard the product in anticipation of more serious scarcity and pump adjustment has become a bizarre thing.

A reliable source close to some of the marketers disclosed to our correspondents that there might be imminent shortage of product across the nation as marketers are not comfortable with the official reduction from N97.00 to N87.00 and the consistent depreciation of Naira, Nigeria’s official currency.

He blamed the Department of Petroleum Resources (DPR) for not effectively monitoring the activities of marketers in the state.

“DPR in Rivers State feels less concerned while marketers embark on all sorts of fraud as selling above official pump price and adjustment of meters”, he said.

The source, who expressed worry at the attitude of DPR, said it takes serious monitoring to check the excesses of the marketers.

The Rivers State Commissioner for Energy, Hon. Okey Amadi blamed the Federal Government over the situation, saying the circumstances surrounding the price adjustment is responsible for the situation.

Meanwhile, the NNPC, yesterday, promised that it is working to ensure that the situation is addressed quickly and assured Nigerians that the fuel supply situation will improve in the coming days. The fuel crisis in Abuja worsened weekend, as many of the petrol stations across the Federal Capital Territory, FCT, were shut down, leaving motorists stranded.

This was in spite of claims by the Nigerian National Petroleum Corporation, NNPC, on Friday, that it is injecting about 688 million of Premium Motor Spirit, PMS, into the market. Motorists had to resort to the black marketý, where roadside petrol sellers now sell the commodity for as high as N250 per litre.

Spokesperson for the NNPC, Mr. Ohi Alegbe, said, “On Friday, we had stated that in 48 hours we will wet the market with 688 million litres of petrol. Distribution of products is by trucking. You will agree that it is some distance from the depots and tank farms in the south to the depots and retail outlets in the hinterland. Expectedly, the ýqueues should disappear before long.”

Alegbe blamed the scarcity oný panic buying by motorists and sharp practices by some retail outlets who are hoarding the commodity, thereby frustrating efforts to stem the scarcity.

He said the NNPC has informed the Department of Petroleum Resources, DPR, of the ýthese sharp practices by some petrol stations’ owners for adequate sanctions against them.

He said, “Panic buying has persisted in spite of our appeal to motorists. Secondly, some retail outlets are hoarding product by dispensing from only one pump head. We have reported some of them to the DPR and we believe appropriate sanctions will be meted out to them.

A source in the Department of Petroleum Resources, DPR, disclosed that the scarcity currently being experienced in Abuja is as a result of panic buying and not because of non-availability of petrol.

According to the source who spoke on the condition of anonymity, DPR officers ýin depots across the country and even in the FCT have been sending in reports of availability of the commodity at the various depots and liftings by trucks to various petrol stations.

“The DPR had also had discussions with a number of petrol stations’ owners who told us that the long queues is as a result of panic buying. A particular owner of one of the petrol stations told us that he received a tanker load of fuel on Friday morning and is expecting to receive another consignment of the product before the end of the day. So, it is evident that the product is not scarce, just people buying the commodity out of fear of the unknown,” the source said.

In addition, the source urged motorists to avoid panic buying as there are large quantity of the products in depots across the country.

ýAlmost all the petrol stations in Wuse, Maitama, Nyanya, Abuja – Keffi expressway, Asokoro, Jabi, Gwarinpa, Kubwa Expressway, Airport Road among others were closed while the few that were selling had long queues of motorists to contend with.

Some residents said they had to abandon their vehicles at home throughout the weekend, hoping to conserve the little fuel they had for their journey to their various offices during the week.

Some of the respondents called on the Federal Government to intervene urgently and bring the situation under control, before it escalates.

ýThe crisis had started on Thursday when long queues resurfaced in petrol filling stations in Abuja, over rumour of an impending scarcity of the product earlier in the week.

The rumour of the impending scarcity was hinged on the debt owed marketers by the Federal Government, a development which was claimed has made it impossible for the marketers to import the commodity.

However, to forestall the crisis in the sector, the Federal Government quickly stepped in and promised to pay off about N264 billion between now and end of March, as subsidy reimbursement applications submitted to marketers as at end of January 2015.

The sum comprises 2014 outstanding debts of N164 billion in addition to N100 billion derived from foreign exchange and bank interest charges.

The decision to pay the debts was arrived at a crucial meeting with the Ministries of Finance, Petroleum Resources, the Central Bank of Nigeria, CBN, and oil marketers in Abuja on Monday at the instance of the Minister of Finance, Dr. Ngozi Okonjo-Iweala.

News

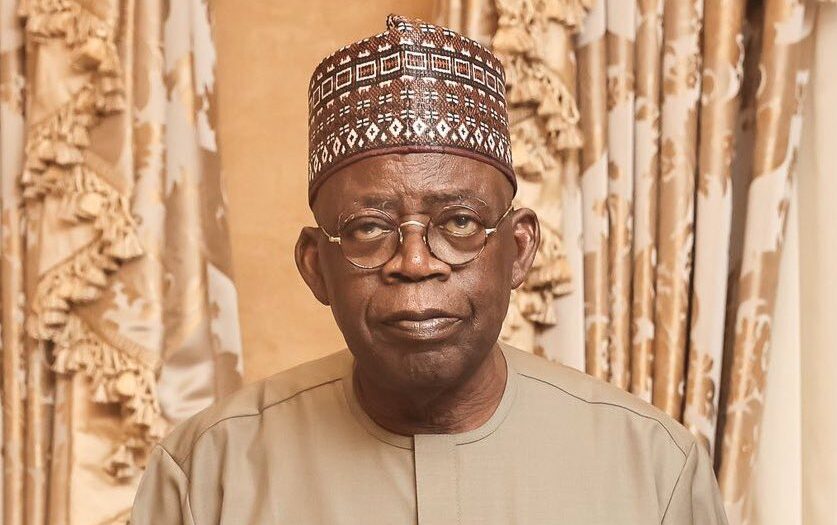

Shettima In Ethiopia For State Visit

Vice President Kashim Shettima has arrived in Addis Ababa, Ethiopia, for an official State visit at the invitation of the Prime Minister, Dr. Abiy Ahmed.

Upon arrival yesterday, Shettima was received at the airport by the Minister of Foreign Affairs of Ethiopia, Dr. Gedion Timothewos, and other members of the Ethiopian and Nigerian diplomatic corps.

Senior Special Assistant to the Vice President on Media and Communication, Stanley Nkwocha, revealed this in a statement he signed yesterday, titled: “VP Shettima arrives in Ethiopia for official state visit.”

During the visit, Vice President Shettima will participate in the official launch of Ethiopia’s Green Legacy Programme, a flagship environmental initiative.

The programme designed to combat deforestation, enhance biodiversity, and mitigate the adverse effects of climate change targets the planting of 20 billion tree seedlings over a four-year period.

In line with strengthening bilateral ties in agriculture and industrial development, the Vice President will also embark on a strategic tour of key industrial zones and integrated agricultural facilities across selected regions of Ethiopia.

News

RSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

The Rivers State Government has called on the people of the state especially farmers to access the ?4billion agricultural loans made available by the State and domiciled in the Bank of Industry.

This is as the State Project Implementation Unit (SPIU) of Rural Access and Agricultural Marketing Project (RAAMP), a World Bank project, took its sensitization campaign to Opobo/Nkoro, Andoni, Port Harcourt City and Obio/Akpor local government areas.

The campaign was aimed at enlightening community dwellers and other stakeholders in the various local government areas on the RAAMP project implementation and programme activities.

The Permanent Secretary, Rivers State Ministry of Agriculture, Mr Maurice Ogolo, said this at Opobo town, Ngo, Port Harcourt City and Rumuodumanya, headquarters of the four local government areas respectively, during the sensitization campaign.

Ogolo said apart from the ?4billion, the government has also made available fertilizers and other farm inputs to farmers in the various local government areas.

The Permanent Secretary who is the Chairman, State Steering Committee for the project, said RAAMP will construct roads that will connect farms to markets to enable farmers and fishermen sell their farms produce and fishes.

He also said rural roads would be constructed to farms and fishing settlements, and warned against any act that will lead to the cancellation of the projects in the four local government areas.

According to him, the World Bank and Federal Government which are the financiers of the programme will not condone such acts like kidnapping, marching ground and other acts inimical to the successful implementation of the projects in their respective areas.

At PHALGA, Ogolo asserted that the city will benefit in the areas of roads and bridge construction.

He noted that RAAMP was thriving in both the Federal Capital Territory, Abuja; Lagos and other states in the country, stressing that the project should also be given the seriousness it deserves in Rivers State.

Speaking at Opobo town, the headquarters of Opobo/Nkoro Local Government Area, the project coordinator, RAAMP, Mr.Joshua Kpakol, said the programme would reduce poverty in the state.

According to him, both fishermen and farmers will maximally benefit from the programme.

At Ngo which is the headquarters of Andoni Local Government Area, Kpakol said roads will be constructed to all remote fishing settlements.

He said Rivers State is lucky to be among the states implementing the project, and stressed the need for the people to embrace it.

Meanwhile, Kpakol said at PHALGA that RAAMP is a project that will transform the lives of farmers, traders and other stakeholders in the area.

He urged the stakeholders to spread the information to their various communities.

However, some of the stakeholders at Opobo town complained about the destruction of their farms by bulls allegedly owed by traditional rulers in the area, as well as incessant stealing of their canoes at waterfronts.

At Ngo, Archbishop Elkanah Hanson, founder of El-Shaddai Church, commended the World Bank and the Federal Government for bringing the projects to Andoni.

He stressed the need for the construction of roads to fishing settlements in the area.

Also, a former Commissioner for Agriculture in the state and Okan Ama of Ekede, HRH King Gad Harry, noted that storage facilities have become necessary for a successful agricultural programme.

Harry also stressed the need for the programme to be made sustainable.

In their separate speeches, the administrators of Andoni and Opobo/Nkoro Local Government Areas, pledged their readiness to support the programme.

At Port Harcourt City, the Administrator, Dr Arthur Kalagbor, represented by the Head of Local Government Administration, Port Harcourt City, Mr Clifford Paul, said the city would support the implementation of the programme in the area.

Also, the administrator of Obio/Akpor Local Government Area, Dr Clifford Ndu Walter, represented by Mr Michael Elenwo, pledged to support the programme in his local government area.

Among dignitaries at the Obio/Akpor stakeholders engagement is the chairman, Rivers State Traditional Rulers Council and paramount ruler of Apara Kingdom, HRM Eze Chike Wodo, amongst others.

John Bibor

News

Tinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

President Bola Tinubu has ordered the commencement of personnel audit and skill gap analysis across all cadres of federal civil servants.

The president gave this directive in Abuja, yesterday, while speaking at the International Civil Service Conference, reaffirming his resolve to achieve efficiency and professional service delivery in the civil service.

“I have authorized the comprehensive personnel audit and skill gap analysis across the federal civil service to deepen capacity. I urge all responsible stakeholders to prioritize timely completion of this critical exercise, to begin implementing targeted reforms, to realize the full benefit of a more agile, competent and responsive civil service,” the president announced.

Tinubu further directed all Ministries, Departments and Agencies (MDAs), to prioritise data integrity and sovereignty in national interest.

He called for the capture, protection and strategic publication of public sector data in line with the Nigeria Data Protection Act of 2023.

“We must let our data speak for us. We must publish verified data assets within Nigeria and share them internationally recognized as fruitful. This will allow global benchmarking organisation to track our progress in real time and help us strengthen our position on the world stage. This will preserve privacy and uphold data sovereignty,” Tinubu added.

President Tinubu hailed the federal civil service as the “engine” driving his Renewed Hope Agenda, and the vehicle for delivering sustainable national development.

He submitted that the roles of civil servants remain indispensable in modern governance, declaring that in the face of a fast-evolving digital and economic landscape, the civil service must remain agile, future-ready, and results-driven.

“This maiden conference is a bold step toward redefining governance in an era of rapid transformation. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“It captures our collective ambition to reimagine and reposition the civil service. In today’s rapid, evolving world of technology, innovation remains critical in ensuring that the civil service is dynamic, digital” the President said.

Head of the Civil Service of the Federation, Didi Walson-Jack in her welcome address told the President that his presence and strong words of commendation at the conference has renewed the morale and mandate of public servants across the country.

Walson-Jack described Tinubu as the backbone of driving transformation in the Nigerian civil service, and noted that the takeaways from past study tours undertaken to understudy the civil service in Singapore, the UK and US under her leadership, is already yielding multiplier effects.

Walson-Jack assured Tinubu that her office, in collaboration with reform-minded stakeholders, will not relent in accelerating the implementation of the Federal Civil Service Strategy and Implementation Plan, FCSSIP 25.

She affirmed that digitalisation, performance management, and continuous learning remain key pillars in strengthening accountability, transparency, and service delivery across MDAs.

Walson-Jack reaffirmed that the civil service is determined to exceed expectations by embedding a culture of innovation, ethical leadership, and citizen-centred governance in the heart of public administration.

-

Sports5 days ago

Spanish Football Fires Entire Refereeing Committee

-

Features5 days ago

Features5 days agoBetween EFCC And NDDC: Strategic Alliance For Niger Delta

-

News5 days ago

News5 days agoCourt Sentences Gospel Singer To Death For Killing Girlfriend In Nasarawa

-

Politics5 days ago

Politics5 days agoMakinde Renames Polytechnic After Late Ex-Gov

-

Sports5 days ago

Olympic Day Sparks Nationwide Fitness Fever

-

Nation5 days ago

Nation5 days agoOgoni Stakeholders Hail Zabbey’s Performance

-

Sports5 days ago

I Joined Saudi League To Win Titles – Senegal Keeper

-

Niger Delta5 days ago

Niger Delta5 days agoOBALGA Sole Administrator Presents Brand New Fire Extinguishers To Council …Commiserates With Traders Over Rumuomasi Market Fire Incident …Commences Desilting Of Drainages