News

Fresh Crisis In Bayelsa Over N207bn Debt

A staggering sum of N207billion debts left behind by the administration of Chief Timipre Sylva may hurt projects development in Bayelsa, if the reports of the Financial Management Review Committee is anything to go by.

The committee headed by one-time Managing Director of Niger Delta Development Commission (NDDC), Chief Timi Alaibe submitted its report on Monday with the disclosure that the former regime of Timipre Sylva left behind a liability of over N207 billion.

The committee requested the government to recover funds from alleged questionable payments of contracts of N123.18 by the previous government.

Among the alleged questionable payments to the said contractors included, Moreno Construction Company, N10.2billion, Vehicles purchase N2billion, FAK Engineering, N9billion, SENECO N14.28billion and Ratana N2billion.

Chief Alaibe, who disclosed this in Yenagoa when presenting its report to Governor Seriake Dickson, revealed that only N4,500 cash was in the state treasury when the present government emerged.

The committee recommended that government should tactically reduce the cash flow in the state and review the biometric process of payment of civil servants to expunge “ghosts” on government nominal roll.

He highlighted that N660billion was received during Sylva’s government in the past four and half years, stressing that only N2.89billion was discovered in government bank accounts which cannot be assessed.

The 11-man committee was inaugurated on February 27 by the state governor to investigate the income and expenditure of the last administration.

Alaibe said the N47.18 billion bond collected by Sylva’s government at the capital market was not repaid, as he noted that government would pay back N104.2billion.

The committee recommended that competent hands should be appointed as accountant general of the state and director of treasury to enhance internal control mechanism to provide checks in the treasury department.

Alaibe called for a fresh valuation exercise of all existing contracts in the state before performance certificate is issued to them for payment and also recommended short, medium and long term planning to increase the Internally Generated Revenue(IGR)in the state.

The report also revealed that the former Acting Governor of the state, Nestor Binabo, awarded contract of N1.8billion on February 7, immediately approved payment and the release of the contract funds without the jobs being executed.

To this end, the committee recommended that the contracts should be revoked.

Earlier, Bayelsa State Governor, Seriake Dickson, said the committee report would serve as living document and assured that government will look at its recommendations and take action where necessary.

Meanwhile, former Governor of Bayelsa State, Chief Timi Sylva, has said that the outcome of the report of the committee set up by the Bayelsa State Government constituted another means of witch-hunting him.

Sylva said the probe committee, headed by a former Managing Director of the Niger Delta Development Commission, Chief Timi Alaibe, was another obsession with his ghost.

According to a statement by his aide, Doifie Ola, Sylva said the outcome of the probe committee was premeditated.

He said the report never indicted him of any wrongdoing.

The statement by Ola reads in full: “Our attention has been drawn to a committee report administered by Mr. Ndutimi Alaibe in which phoney allegations of grand financial crimes were made against the government of Chief Timipre Sylva.

“Sylva dismisses these allegations as unfounded, and a failed attempt to divert attention from the calamitous political parodies committed in Bayelsa State by these accusers.

“The report of the kangaroo committee is as ridiculous as it is unsurprising to any Nigerian. The composition did not belie its intent as another mock team impulsively set up to deliver a pre-determined judgement. In their continued battle with the ghost of Sylva, those who have installed a puppet administration in Bayelsa State have once again demonstrated their loss of touch with the essence of government and their choice of shadowboxing as state policy.

“To be sure, government is an administrative structure set up to govern human beings with needs. Any normal investigation of government expenditure would try to demonstrate how the financial laws were flouted. The Alaibe committee did not attempt to do this. It simply compiled the incomes that accrued to Bayelsa State within a carefully selected period targeted to smear Sylva, and assumed that there were no needs met in the period.

“The Alaibe report did not demonstrate any flouting of the state’s financial laws and regulations. If anyone had proof of such contravention, they knew where to go. And where to go is not an illegal committee unknown to the laws of Bayelsa State and Nigeria.

“Besides, the allegations thrown up by the power usurpers in Bayelsa State are too weighty to be handled by people with vested political interests in the state and whose track record and history smell of corruption.

The report by the Alaibe committee is at best biased, petty, and heavily tainted. This is yet another manifestation of the constant distress in the camp of those who recently usurped power in Bayelsa State as they live in perpetual fear of Sylva, and guilt of the harsh judgement of democratic humanity.

“As we near a judicial resolution of the manifest political travesty in Bayelsa State, those who believe they should do nothing other than fight the ghost of Sylva should learn to mitigate their desperation, at least, for the decency of what remains of our democracy that they have tried so hard to compromise.”

In the report by the Alaibe committee, presented to the state government on Monday, Sylva was accused of mismanaging the N660.45 billion his government received from the Federation Account from 2007 to 2011.

Sylva was also accused of accumulating almost all the N207 billion liabilities on the state government in terms of debts and frittering the N50 billion bond he received in December 2009 from the capital market without utilising the funds for the capital projects it was meant for.

The Alaibe committee, tagged the Financial Management Review Committee, told the state Governor, Seriake Dickson, that the state under Sylva received N99.5 billion in 2007; N164.7 billion in 2008; N106.3 billion in 2009; N110.6 billion in 2010; and N189.1 billion in 2011.

Alaibe said though government expenditure increased from N165 billion in 2007 to N208 billion in 2010, the chunk of the money was used to finance recurrent expenditure such as personnel, overhead and other contingency costs.

He said the recurrent expenditure maintained steady increase from 48 per cent in 2007 to 80 per cent in 2010 and 2011, observing that there was 48 per cent decline in capital expenditure within the period under review.

Alaibe added: “This accounted for the absence of funds for the implementation of capital projects. In the same period, recurrent expenditure had increased to 123 per cent from 2007 to 2010. In contrast, there was 48 per cent drop in capital expenditure during the same period.”

The report said most of the spending was without supporting documents, noting that security and ‘Government House emergency expenses subheads were used as a conduit to move the cash.

It further alleged that apart from the conventional security votes contained in the recurrent expenditure, the immediate past administration claimed to have spent on security N3.3 billion in 2010, N10.3 billion in 2011 and N3.87 billion in January and February 2012.

Sylva allegedly withdrew N1.6 billion in 2010, N7.4 billion in 2011 and N155 million in January and February 2012 from the treasury under the subhead: Government House Emergency Expenses.

Alaibe said in the report: “These payments were in spite of the regular monthly security payment made out of recurrent expenditure amounting to N3.19 billion in 2010; 7 billion in 2011 and N890 million for January and February 2012. Clearly these payments are abnormal payments. They are frivolous and in fact fraudulent.”

Dickson vowed to implement the recommendations of the committee as he lamented the collapse of institutions and processes in the past administration, adding: “It is difficult to believe that this kind of thing happened amidst poverty and so many challenges. “Never again will the state return to the time when all institutions and processes vanished.”

News

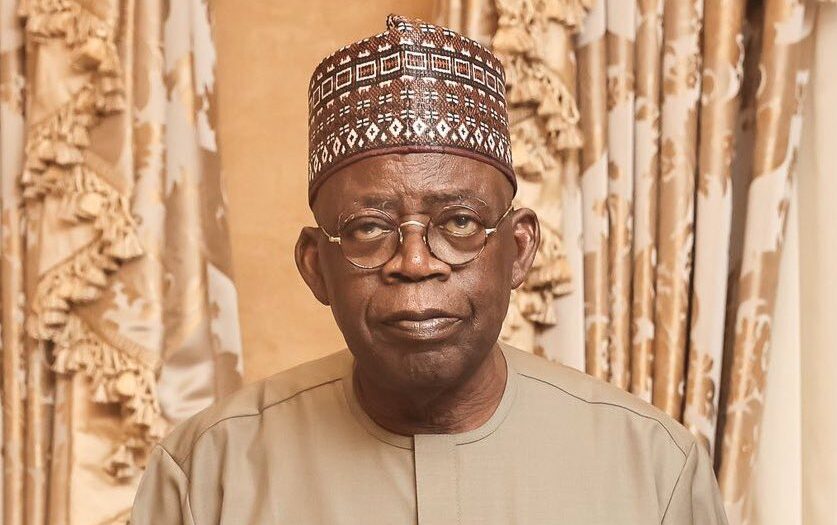

Shettima In Ethiopia For State Visit

Vice President Kashim Shettima has arrived in Addis Ababa, Ethiopia, for an official State visit at the invitation of the Prime Minister, Dr. Abiy Ahmed.

Upon arrival yesterday, Shettima was received at the airport by the Minister of Foreign Affairs of Ethiopia, Dr. Gedion Timothewos, and other members of the Ethiopian and Nigerian diplomatic corps.

Senior Special Assistant to the Vice President on Media and Communication, Stanley Nkwocha, revealed this in a statement he signed yesterday, titled: “VP Shettima arrives in Ethiopia for official state visit.”

During the visit, Vice President Shettima will participate in the official launch of Ethiopia’s Green Legacy Programme, a flagship environmental initiative.

The programme designed to combat deforestation, enhance biodiversity, and mitigate the adverse effects of climate change targets the planting of 20 billion tree seedlings over a four-year period.

In line with strengthening bilateral ties in agriculture and industrial development, the Vice President will also embark on a strategic tour of key industrial zones and integrated agricultural facilities across selected regions of Ethiopia.

News

RSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

The Rivers State Government has called on the people of the state especially farmers to access the ?4billion agricultural loans made available by the State and domiciled in the Bank of Industry.

This is as the State Project Implementation Unit (SPIU) of Rural Access and Agricultural Marketing Project (RAAMP), a World Bank project, took its sensitization campaign to Opobo/Nkoro, Andoni, Port Harcourt City and Obio/Akpor local government areas.

The campaign was aimed at enlightening community dwellers and other stakeholders in the various local government areas on the RAAMP project implementation and programme activities.

The Permanent Secretary, Rivers State Ministry of Agriculture, Mr Maurice Ogolo, said this at Opobo town, Ngo, Port Harcourt City and Rumuodumanya, headquarters of the four local government areas respectively, during the sensitization campaign.

Ogolo said apart from the ?4billion, the government has also made available fertilizers and other farm inputs to farmers in the various local government areas.

The Permanent Secretary who is the Chairman, State Steering Committee for the project, said RAAMP will construct roads that will connect farms to markets to enable farmers and fishermen sell their farms produce and fishes.

He also said rural roads would be constructed to farms and fishing settlements, and warned against any act that will lead to the cancellation of the projects in the four local government areas.

According to him, the World Bank and Federal Government which are the financiers of the programme will not condone such acts like kidnapping, marching ground and other acts inimical to the successful implementation of the projects in their respective areas.

At PHALGA, Ogolo asserted that the city will benefit in the areas of roads and bridge construction.

He noted that RAAMP was thriving in both the Federal Capital Territory, Abuja; Lagos and other states in the country, stressing that the project should also be given the seriousness it deserves in Rivers State.

Speaking at Opobo town, the headquarters of Opobo/Nkoro Local Government Area, the project coordinator, RAAMP, Mr.Joshua Kpakol, said the programme would reduce poverty in the state.

According to him, both fishermen and farmers will maximally benefit from the programme.

At Ngo which is the headquarters of Andoni Local Government Area, Kpakol said roads will be constructed to all remote fishing settlements.

He said Rivers State is lucky to be among the states implementing the project, and stressed the need for the people to embrace it.

Meanwhile, Kpakol said at PHALGA that RAAMP is a project that will transform the lives of farmers, traders and other stakeholders in the area.

He urged the stakeholders to spread the information to their various communities.

However, some of the stakeholders at Opobo town complained about the destruction of their farms by bulls allegedly owed by traditional rulers in the area, as well as incessant stealing of their canoes at waterfronts.

At Ngo, Archbishop Elkanah Hanson, founder of El-Shaddai Church, commended the World Bank and the Federal Government for bringing the projects to Andoni.

He stressed the need for the construction of roads to fishing settlements in the area.

Also, a former Commissioner for Agriculture in the state and Okan Ama of Ekede, HRH King Gad Harry, noted that storage facilities have become necessary for a successful agricultural programme.

Harry also stressed the need for the programme to be made sustainable.

In their separate speeches, the administrators of Andoni and Opobo/Nkoro Local Government Areas, pledged their readiness to support the programme.

At Port Harcourt City, the Administrator, Dr Arthur Kalagbor, represented by the Head of Local Government Administration, Port Harcourt City, Mr Clifford Paul, said the city would support the implementation of the programme in the area.

Also, the administrator of Obio/Akpor Local Government Area, Dr Clifford Ndu Walter, represented by Mr Michael Elenwo, pledged to support the programme in his local government area.

Among dignitaries at the Obio/Akpor stakeholders engagement is the chairman, Rivers State Traditional Rulers Council and paramount ruler of Apara Kingdom, HRM Eze Chike Wodo, amongst others.

John Bibor

News

Tinubu Orders Civil Service Personnel Audit, Skill Gap Analysis

President Bola Tinubu has ordered the commencement of personnel audit and skill gap analysis across all cadres of federal civil servants.

The president gave this directive in Abuja, yesterday, while speaking at the International Civil Service Conference, reaffirming his resolve to achieve efficiency and professional service delivery in the civil service.

“I have authorized the comprehensive personnel audit and skill gap analysis across the federal civil service to deepen capacity. I urge all responsible stakeholders to prioritize timely completion of this critical exercise, to begin implementing targeted reforms, to realize the full benefit of a more agile, competent and responsive civil service,” the president announced.

Tinubu further directed all Ministries, Departments and Agencies (MDAs), to prioritise data integrity and sovereignty in national interest.

He called for the capture, protection and strategic publication of public sector data in line with the Nigeria Data Protection Act of 2023.

“We must let our data speak for us. We must publish verified data assets within Nigeria and share them internationally recognized as fruitful. This will allow global benchmarking organisation to track our progress in real time and help us strengthen our position on the world stage. This will preserve privacy and uphold data sovereignty,” Tinubu added.

President Tinubu hailed the federal civil service as the “engine” driving his Renewed Hope Agenda, and the vehicle for delivering sustainable national development.

He submitted that the roles of civil servants remain indispensable in modern governance, declaring that in the face of a fast-evolving digital and economic landscape, the civil service must remain agile, future-ready, and results-driven.

“This maiden conference is a bold step toward redefining governance in an era of rapid transformation. An innovative Civil Service ensures we meet today’s needs and overcome tomorrow’s challenges.

“It captures our collective ambition to reimagine and reposition the civil service. In today’s rapid, evolving world of technology, innovation remains critical in ensuring that the civil service is dynamic, digital” the President said.

Head of the Civil Service of the Federation, Didi Walson-Jack in her welcome address told the President that his presence and strong words of commendation at the conference has renewed the morale and mandate of public servants across the country.

Walson-Jack described Tinubu as the backbone of driving transformation in the Nigerian civil service, and noted that the takeaways from past study tours undertaken to understudy the civil service in Singapore, the UK and US under her leadership, is already yielding multiplier effects.

Walson-Jack assured Tinubu that her office, in collaboration with reform-minded stakeholders, will not relent in accelerating the implementation of the Federal Civil Service Strategy and Implementation Plan, FCSSIP 25.

She affirmed that digitalisation, performance management, and continuous learning remain key pillars in strengthening accountability, transparency, and service delivery across MDAs.

Walson-Jack reaffirmed that the civil service is determined to exceed expectations by embedding a culture of innovation, ethical leadership, and citizen-centred governance in the heart of public administration.

-

Women5 days ago

How Women Can Manage Issues In Marriage

-

Politics5 days ago

Church Bans Political Speeches On Pulpits

-

Politics5 days ago

Presidency Slams El-Rufai Over Tinubu Criticism …Says He Suffers From Small Man Syndrome

-

Politics5 days ago

10 NWC Members Oppose Damagum Over National Secretary’s Reinstatement

-

News5 days ago

News5 days agoRSG Tasks Farmers On N4bn Agric Loan ….As RAAMP Takes Sensitization Campaign To Four LGs In Rivers

-

Politics5 days ago

Politics5 days agoMakinde Renames Polytechnic After Late Ex-Gov

-

Featured5 days ago

Featured5 days agoTinubu Signs Four Tax Reform Bills Into Law …Says Nigeria Open For Business

-

Featured5 days ago

Featured5 days agoSenate Issues 10-Day Ultimatum As NNPCL Dodges ?210trn Audit Hearing