Business

Indigenous Refineries To Buy Crude Oil In Naira, Dollar -FG

The Federal Government on Monday complied with the demands of domestic crude oil refiners and other operators in the sector with a declaration that indigenous refineries can now buy crude oil in naira or dollars.

At a briefing in Abuja, where it unveiled the new template for domestic crude oil supply obligation, the Government, through the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), also disclosed that the total crude oil and condensate reserves in Nigeria increased to 37.5 billion barrels as of January 1, 2024, with a life index of 68.01 years.

It stated that in compliance with the provisions of Section 109(2) of the Petroleum Industry Act 2021, the NUPRC in a landmark move, had developed a template guiding the activities for Domestic Crude Oil Supply Obligation.

The Chief Executive, NUPRC, Gbenga Komolafe, told journalists in Abuja that “The commission in conjunction with relevant stakeholders from NNPC Upstream Investment Management Services, representatives of Crude Oil/Condensate Producers, Crude Oil Refinery-Owners Association of Nigeria, and Dangote Petroleum Refinery came up with the template for the buy-in of all.

“This is in a bid to foster a seamless implementation of the DCSO and ensure consistent supply of crude oil to domestic refineries”.

On the currency of transaction for crude oil purchase, as approved in the new template, Komolafe stated that it would be either in naira or dollar, adding that naira transactions would free the pressure on the country’s foreign exchange rate.

The NUPRC boss also noted that the template had become effective because all necessary parties had signed up for it.

“The PIA intends to make the implementation (of crude oil obligation) very easy for the parties, both for the producers and refineries. So the answer simply is that the currency for the transaction would either be in naira or dollar. That is the simple answer.

“But we all know that if the transaction is carried out in naira, that itself will free the pressure on the exchange rate. That will help the exchange rate. So that is the intent and besides, the overall intent of the Petroleum Industry Act is to develop our midstream, which is a very laudable provision of the PIA”, he said.

In the currency of payment section of the new template, it was stated that “the payment shall be in either United States dollar or naira or both. Where the payment is in both currencies, the payment split shall be as agreed in the SPA between the producer and the refiner”.

On February 26, 2024, The Tide’s source exclusively reported that modular refineries in Nigeria were facing the threat of shutting down operations following their inability to access foreign exchange for the purchase of crude oil, a commodity priced in United States dollars.

Nigeria has 25 licenced modular refineries with a combined capacity of producing 200,000 barrels of crude oil daily.

Although not all of the plants are currently operational, the report stated that the functional ones were increasingly finding it difficult to purchase crude due to the foreign exchange crisis in the country.

The facilities, which produce Automotive Gas Oil, popularly called diesel, Dual Purpose Kerosene or kerosene, naphtha and black oil, were finding it hard to make the refined products available to oil marketers for distribution to consumers.

Operators of the plants explained that the scarcity of dollars had made it almost impossible for dealers to purchase crude oil, as the modular refinery players and oil marketers demanded the sale of crude oil in naira from the Federal Government.

The modular refinery operators, who spoke under the aegis of the Crude Oil Refinery Owners Association of Nigeria, lamented at the time that the Federal Government had not been able to keep its part of the bargain concerning the provision of feedstock to local crude oil refiners.

The Publicity Secretary, Crude Oil Refinery Owners Association of Nigeria (CORAN), Eche Idoko, had stated that modular refineries might close shop if nothing was done to ameliorate the situation.

CORAN is a registered association of modular and conventional refinery companies in Nigeria, while modular refineries are simplified refineries that require significantly less capital investment than traditional full-scale refineries.

Business

NCDMB Tasks Media Practitioners On Effective Reportage

Business

FCTA, Others Chart Path To Organic Agriculture Practices

The Federal Capital Territory Administration (FCTA) and other stakeholders have charted path to improved organic agriculture practices nationwide.

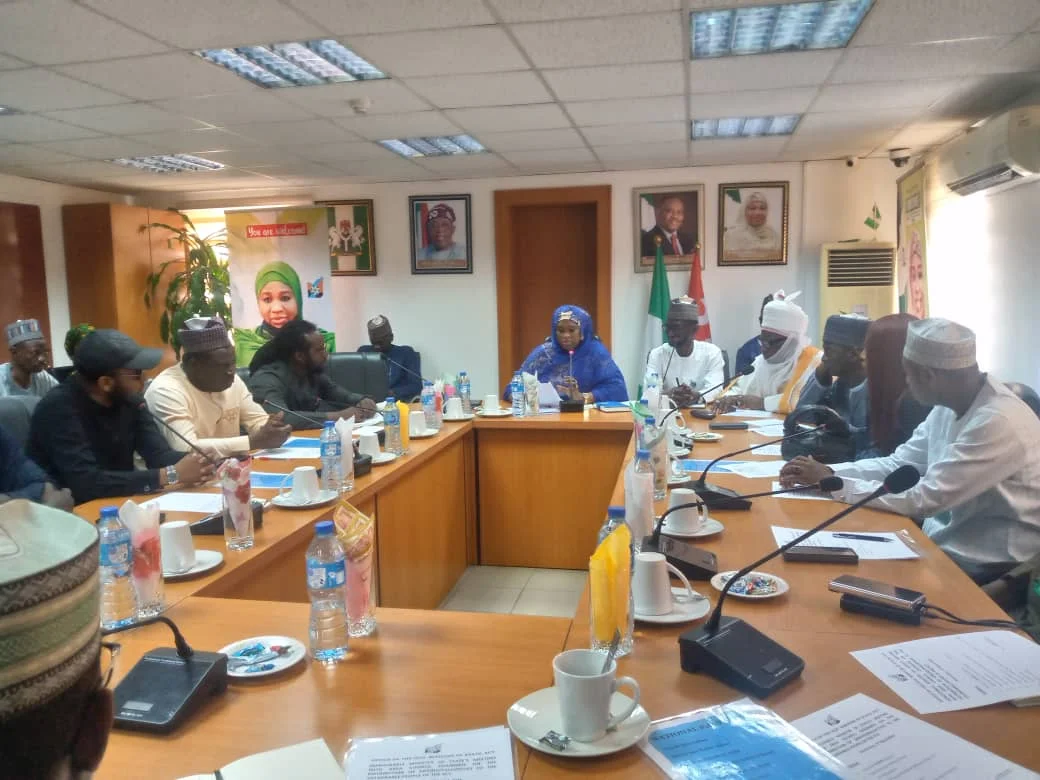

At a 2024 national organic and agroecology business summit held recently in Abuja, stakeholders took turn to speak on the additional areas of promoting the practices.

The Mandate Secretary, FCT Agriculture and Rural Development Secretariat (ARDS), Lawan Geidam, advocated for sustainable practice to develop resilient food systems that will benefit people.

The event, with the theme,”Towards Policies for Upscaling Organic Agroecological Businesses in Nigeria”, is aimed at fostering growth in the organic agriculture sector.

Geidam, who was represented by the Acting Director, Agric Services, in the Secretariat, Mr. Ofili Bennett, emphasised the success of organic and agroecological farming, reling on the active involvement of farmers, businesses and consumers.

He reassured attendees that the FCT Administration, led by the Minister, Nyesom Wike, and Minister of State, Dr. Mariya Mahmoud, remains dedicated to supporting initiatives that enhance the livelihood of residents.

Geidam described the partnership between the Secretariat and the organic and Agroecology initiative for a monthly exhibition and sale of organic products in the FCTA premises as a testament to this commitment.

“The ARDS remains committed to driving policies and initiatives that align with national goals and global standards”, Geidam said.

On her part, the Chairperson of Organic and Agroecology Initiative, Mrs. Janet Igho, urged residents to embrace healthy eating habits to sustain a good lifestyle. She stressed the importance of adopting organic practices, highlighting the benefits of going organic, growing organic and consuming organic products.

Igho expressed her optimism regarding the Agricultural Revival Programmes as articulated in President Bola Ahmed Tinubu’s “Renewed Hope Agenda”, which aims at fostering food and nutrition security.

She also extended her gratitude to ARDS for graciously allocating a space in the FCTA premises for the exhibition and sale of organic products, noting that the platform has been effectively used to advance the promotion of organic agriculture in FCT.

Igho outlined several benefits of organic agriculture which includes improved soil health, increased biodiversity, availability nutritious and healthy food and a reduced carbon footprint.

Stakeholders at the summit, underscored the critical need for enhanced private sector involvement and robust capacity building initiatives for farmers.

They highlighted the importance of implementing supportive policies to foster the growth of the organic agriculture sector.

In the light of the significant challenges facing Nigeria’s agricultural landscape, stakeholders decided that organic agricultural practices present sustainable solutions and a pathway for a more resilient and productive farming systems.

The three-day summit featured exhibitions showcasing organic foods, fruits, vegetables and fertilizers, providing an opportunity for residents to better appreciate the benefits of production and consumption of organic agricultural products.

Business

Dangote Refinery Exports PMS to Cameroon

-

Politics4 days ago

Politics4 days agoWhy My Seat Should Not Be Declared Vacant By PDP – Ibori-Suenu

-

Maritime4 days ago

Maritime4 days agoPrivate Sector Should Drive Blue Economy -Bello

-

Sports9 hours ago

NBF Announces Olympics Preparation Date

-

Nation7 hours ago

Community Organises Civic Reception For LG Boss

-

News4 days ago

News4 days agoNavy Deploys 15 Warships, Three Helicopters To Boost Oil Production In N’Delta

-

Rivers13 hours ago

Expert Advocates IT Driven Security In Rivers

-

News9 hours ago

Tinubu To Present 2025 Budget To NASS Dec 17

-

Oil & Energy4 days ago

Oil & Energy4 days agoNNPC Begins Export From PH Refinery