Featured

CBN Pegs Cash Withdrawals At N.1m, N.5m Weekly For Individuals, Companies

The Central Bank of Nigeria (CBN) has announced a new policy that mandates deposit money banks and other financial institutions to ensure that over-the-counter cash withdrawals by individuals and corporate entities do not exceed N100, 000 and N500, 000, respectively, per week.

According to a new memo to banks issued, yesterday, and signed by the Director of Banking Supervision, Haruna Mustafa, individuals will only be able to withdraw N100,000 per week (from over the counter, Point of Sale Machines or the Automated Teller Machines), while organisation can access N500,000 per week.

Banks have also been directed to load only N200 and lower denominations into their ATM.

The memo read, “Further to the launch of the redesigned naira notes by President Muhammadu Buhari, on Wednesday, November 23, 2022, and in line with the cashless policy of the CBN, all deposit money banks and other financial institutions are hereby directed to note and comply with the following:”The maximum cash withdrawal over the counter by individuals and corporate organisations per week shall henceforth be N100,000 and N500,000, respectively. Withdrawals above these limits shall attract processing fees of 5percent and 10percent, respectively.

“Third-party cheques above N50,000 shall not be eligible for payment over the counter, while extant limits of N10,000,000 on clearing cheques still subsist.

“The maximum cash withdrawal per week via Automated Teller Machine shall be N100,000 subject to a maximum of N20,000 cash withdrawal per day.

“Only denominations of N200 and below shall be loaded into the ATMs.

“The maximum cash withdrawal via the point of sale terminal shall be N20,000 daily.

“In compelling circumstances, not exceeding once a month, where cash withdrawals above the prescribed limits are required for legitimate purposes, such cash withdrawals shall not exceed N5,000,000.00 and N10,000,000.00 for individuals and corporate organisations, respectively, and shall be subject to the referenced processing fees in (1) above, in addition to enhanced due diligence and further information requirements.

“Further to (6) above, you are required to obtain the following information at the minimum and upload same on the CBN portal created for the purpose: ‘a. Valid means of identification of the payee (National Identity Card, International Passport, Driver’s License.). b. Bank Verification Number of the payee. c. Notarised customer declaration of the purpose of the cash withdrawal. d. Senior management approval for the withdrawal by the Managing Director of the drawee, where applicable. e. Approval in writing by the MD/CEO of the bank authorising the withdrawal.

“Please, further note the following: i. Monthly returns on cash withdrawal transactions above the specified limits should be rendered to the Banking Supervision Department. ii. Compliance with extant AMUCFT regulations relating to the KYC, ongoing customer due diligence and suspicious transaction reporting etc., is required in all circumstances. iii. Customers should be encouraged to use alternative channels (internet banking, mobile banking apps, USSD, cards/POS. eNaira, etc.) to conduct their banking transactions.”

Featured

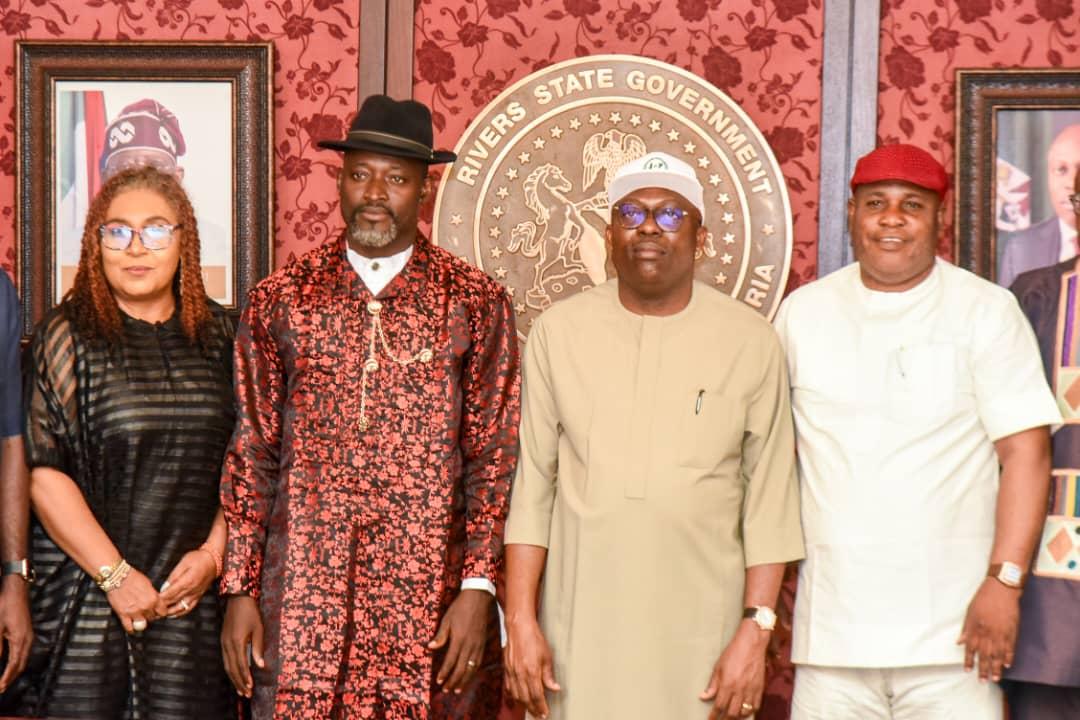

Rivers’ll Be Known For Peace, Not Crisis -Fubara

Rivers State Governor, Sir Siminalayi Fubara, has said that peace has prevailed because he draws strength from God to resist insults and tantrums thrown at him while frustrating attempts by some disgruntled persons who wanted to plunge the State into unending crisis.

The Governor also said that because he has anchored his Government on promoting peace, the enabling atmosphere has been provided for investments and sustainable development to flourish.

Governor Fubara made the assertion when he received a delegation of members of the Bishops and Gospel Ministers’ Association International Incorporated, Rivers State Chapter, at Government House in Port Harcourt, yesterday.

Represented by the Head of Rivers State Civil Service, Dr George Nwaeke, Governor Fubara said while most people took his meekness for weakness, his stance on peace has unarguably enhanced harmonious atmosphere of concord as residents sleep with their two eyes closed, and investors and shareholders are happy with the returns on investment.

He said, “Before, what they hear of Rivers State is that they are fighting, and some genuine investors will not come. Some people even ask you: How are you coping in Rivers State?

“But now”, he asserted: “The Governor has brought about a lot of changes in the State. One of the most important things is that he has changed the negative narrative. It is no longer Rivers of blood. It is now Rivers of peace.

“We are enjoying our lives here. Why? Because there is a change in the narrative. We have peace. The Governor is, as much as possible, absorbing any level of insult at him only for one purpose: that Rivers State may have peace; that we may grow; that this state will experience genuine development.”

Governor Fubara urged them, as members of the Christian family in the State, to continue to pray for the State and the Government so that the enemies of the State will be put to greater shame.

“This peace is what I want you to embrace. Go and continue to pray, because when the sower of the seed went and sowed, the enemy went in the night and sowed tares inside there. But the Governor is sowing peace.

“When I listened to the leader of the team, His Grace Eddy Ogbonda, he said you came all the way from Eleme Junction, and stopped at major junctions, and you uttered prayers for the peace of Rivers State.”

He also said: “I, hereby want to thank you for identifying with the Governor at a time like this. At a time when it looks as if someone wants the Governor’s peace posture misunderstood as weakness.

“When someone has the strength to fight back, but refuses to fight back. That is a bigger strength; that power of restrain does not just come, it can only come from God.

“You cannot give peace, if you do not have peace within you. The Governor is not interested in any form of trouble or violence. What he is interested in is known, and it is: let there be peace in Rivers State,” he said.

In his address, leader of the group, Archbishop Eddy Ogbonda, said they had observed a week-long intensive prayers that culminated into a peace rally, which brought them to Government House, and assured the Governor that God will continue to give him victory over his adversaries while preserving Rivers State.

“It is Rivers State Prophetic Prayer Convocation and Rally 2024 with the theme: ‘Peace be still’. Of a truth, everyone of us understands that we live in a time when we need peace much more than any other thing.

“Rivers State needs peace. Everyone as individuals need peace. The country needs peace, and the world at large needs peace. So, we are here to do a peace march. We pray that God will command His peace to reign in Rivers State,” he said.

Featured

Hoteliers, School Owners Charging In Dollars Risk Arrest -EFCC

The Economic and Financial Crimes Commission (EFCC) has stated that hotels, schools, and other establishments that accept payments in dollars from their customers are at risk of facing arrest.

The Chairman of EFCC, Ola Olukoyede, said this in the agency’s publication called EFCC Alert on Monday, adding that action would be taken against individuals involved in the dollarisation of the economy.

According to him, the exception is if foreigners come in to transact business and the only means of transacting is their credit card and dollar but to charge local customers in dollars or other foreign currencies would no longer be allowed.

He said charging local activities and customers in dollars is against Nigeria’s constitution.

The EFCC chairman said, “Schools that charge Nigerians in dollar, supermarkets that trade in dollar, estate developers that sell their property in dollar, hotels that are invoicing in dollar, we are coming after you and we have made arrests in that area.

“Yes, if foreigners are coming in and the only means of transacting is their credit card, and dollar, why not? You will get that.

“But document it properly as against selling things within the system, local economy and you will be using dollar as the medium of exchange, it is illegal.

“Our law does not allow for that. And we have also affected some arrests.”

Featured

Eid-El-Fitr: Fubara Felicitates Muslims, Calls For Unity, Tolerance

Rivers State Governor, Sir Siminalayi Fubara, has enjoined Muslim faithful to remain steadfast to the lessons learnt during the holy month of Ramadan.

Governor Fubara stated this in his message of felicitations to Muslims as they celebrate the 2024 Eid-el-Fitr Sallah, which marks the end of the one-month Ramadan fasting.

The Governor emphasised the importance for Muslims to also uphold the tenets of Islam by exhibiting the fear of God and showing piety in their daily work.

Governor Fubara said, “We must all continue in the good attributes imbibed during the holy month of Ramadan as directed by God through His Prophet, so as to ensure peace, unity and harmony in the society for a better future.”

While praying that the essence of the festival offers them happiness, peace and prosperity in all aspects of life, Governor Fubara said he recognises and appreciates the critical role that the Muslim community continues to play in the development of Rivers State, and indeed, Nigeria at large.

Governor Fubara charged them to remain unwavering and steadfast in their commitment and positive contributions to advance the development of the State and the country.

“I enjoin you all in the State to remain calm, be patient and continue to do what is right,” the Governor added.

He wished the Muslim faithful in the State and across the country a happy Eid-el-Fitr celebration.

-

Business3 days ago

Business3 days agoPaper Industry’s Economic Contribution Hits N398bn

-

News3 days ago

News3 days agoPolice Attribute Societal Decay To Parents’ Too Much Love For Children

-

Sports3 days ago

Sports3 days agoTennis: Abuja Set To Host Davis Cup

-

Niger Delta3 days ago

Niger Delta3 days agoHYPREP’s Livelihood Training: Dana Air Employs Three Ogoni Youths

-

Maritime3 days ago

Maritime3 days agoNavy Nabs 75 Stowaway Suspects In Eight Months

-

News3 days ago

News3 days agoNLC Demands Creation Of State, LG Police

-

Editorial3 days ago

For Peace In The M’East

-

News3 days ago

News3 days agoWomen Play Important Roles In Development Of The Society -Odu