Featured

$418m Paris Club Loan: Don’t Tamper With Our Money, States Warn FG

The 36 states of the federation have warned the Federal Government not to tamper with funds accruing to them and the 774 local government councils in the guise of satisfying alleged $418million London/Paris Club Loan refund-related judgement debts.

Speaking through the Body of Attorneys-General of the Federation, the states said should the Federal Government proceed to make any deduction, it would be acting illegally and in contempt of their appeal challenging the judgement.

The states said they were not party to any suit on the London/Paris Club refund, and thus were not liable to any person or entity in any judgement debt being relied on by the Federal Government.

They gave the warning in an April 4 letter as part of their response to a November 11, 2021 letter from the Minister of Finance, Budget and National Planning, advertising the commencement of the deduction for the liquidation of the alleged judgement debts.

The 36 states’ reply was signed by the Body of Attorneys-General of the Federation Interim Chairman, Mr Moyosore Onigbanjo of Lagos State; and Interim Secretary, Dr.Abdulkarim Abubakar Kana of Nasarawa State; as well as the Attorneys-Generals of Rivers, Abia, Taraba, Benue and Zamfara states, for and on behalf of all the state Attorneys-General.

It read in part: “Their Excellencies have drawn our attention to your letter referenced above, which the various states of the federation received at about the end of March, 2022. The letter notifies the states of your intention to commence deduction from allocations due to the states from the federation account for the liquidation of London/Paris Club Loan refund-related judgement debts on behalf of the 36 states of the federation and the 774 local government councils.

“Please note that the states of the federation were not parties to any contract or suits concerning the London/Paris Club refund, from which the said judgement debts arose.

“Consequently, the 36 states of the federation are not liable to any person or entity in any judgement debt.”

The letter noted that the deduction of the allocations due to the 36 states from the federation account to liquidate the London/Paris Club Loan refund-related judgement debts is the subject of an appeal filed by the 36 states at the Court of Appeal, Abuja.

It explained that: “The appeal challenges the Federal High Court’s (per Honourable Justice I.E. Ekwo) judgement delivered on March 25, 2022 in Suit No: FHC/ABJ/CS/1313/2021 between A.G Abia State v. President, Federal Republic of Nigeria & 42 Ors. Therefore, the issue is subjudice.”

In addition, it noted that the states have also filed a Motion on Notice for an Order of Injunction pending appeal.

The letter added that the Body’s legal representatives had published a public caveat in national dailies notifying the public of the pending appeal, which also advised concerned parties “to desist from dealing with the subject matter thereof pending the hearing and determination of the appeal and the application for injunction pending appeal.”

It said that given the above, “the law requires you to restrain from taking any step whatsoever that is capable of interfering with the rest of the suit, which is now a subject of an appeal.

“Accordingly, Nigerian case law enjoins you to refrain from effecting any deduction whatsoever from the allocations due to the 36 states from the federation account for the liquidation of the London/Paris Club Loan refund-related judgement debts purportedly on behalf of the 36 states of the federation and the 774 local government councils, pending the hearing and determination of the appeal by the states of the federation. Doing otherwise in the face of the pending appeal and Motion on Notice for Injunction pending appeal shall be at your peril.”

Featured

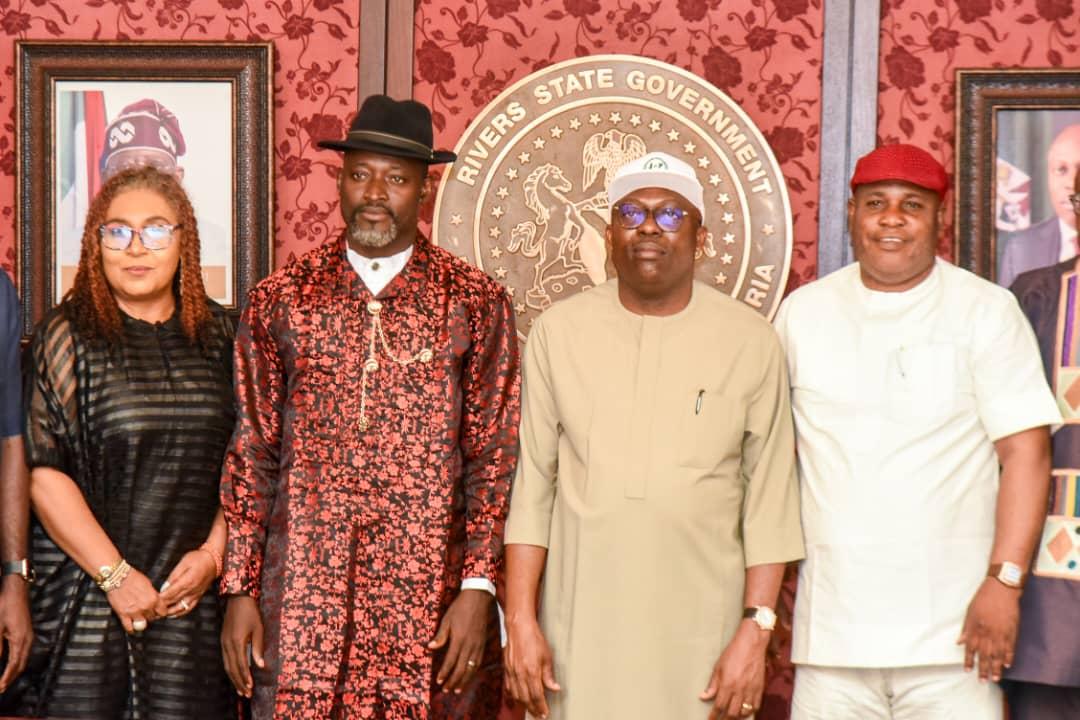

Rivers’ll Be Known For Peace, Not Crisis -Fubara

Rivers State Governor, Sir Siminalayi Fubara, has said that peace has prevailed because he draws strength from God to resist insults and tantrums thrown at him while frustrating attempts by some disgruntled persons who wanted to plunge the State into unending crisis.

The Governor also said that because he has anchored his Government on promoting peace, the enabling atmosphere has been provided for investments and sustainable development to flourish.

Governor Fubara made the assertion when he received a delegation of members of the Bishops and Gospel Ministers’ Association International Incorporated, Rivers State Chapter, at Government House in Port Harcourt, yesterday.

Represented by the Head of Rivers State Civil Service, Dr George Nwaeke, Governor Fubara said while most people took his meekness for weakness, his stance on peace has unarguably enhanced harmonious atmosphere of concord as residents sleep with their two eyes closed, and investors and shareholders are happy with the returns on investment.

He said, “Before, what they hear of Rivers State is that they are fighting, and some genuine investors will not come. Some people even ask you: How are you coping in Rivers State?

“But now”, he asserted: “The Governor has brought about a lot of changes in the State. One of the most important things is that he has changed the negative narrative. It is no longer Rivers of blood. It is now Rivers of peace.

“We are enjoying our lives here. Why? Because there is a change in the narrative. We have peace. The Governor is, as much as possible, absorbing any level of insult at him only for one purpose: that Rivers State may have peace; that we may grow; that this state will experience genuine development.”

Governor Fubara urged them, as members of the Christian family in the State, to continue to pray for the State and the Government so that the enemies of the State will be put to greater shame.

“This peace is what I want you to embrace. Go and continue to pray, because when the sower of the seed went and sowed, the enemy went in the night and sowed tares inside there. But the Governor is sowing peace.

“When I listened to the leader of the team, His Grace Eddy Ogbonda, he said you came all the way from Eleme Junction, and stopped at major junctions, and you uttered prayers for the peace of Rivers State.”

He also said: “I, hereby want to thank you for identifying with the Governor at a time like this. At a time when it looks as if someone wants the Governor’s peace posture misunderstood as weakness.

“When someone has the strength to fight back, but refuses to fight back. That is a bigger strength; that power of restrain does not just come, it can only come from God.

“You cannot give peace, if you do not have peace within you. The Governor is not interested in any form of trouble or violence. What he is interested in is known, and it is: let there be peace in Rivers State,” he said.

In his address, leader of the group, Archbishop Eddy Ogbonda, said they had observed a week-long intensive prayers that culminated into a peace rally, which brought them to Government House, and assured the Governor that God will continue to give him victory over his adversaries while preserving Rivers State.

“It is Rivers State Prophetic Prayer Convocation and Rally 2024 with the theme: ‘Peace be still’. Of a truth, everyone of us understands that we live in a time when we need peace much more than any other thing.

“Rivers State needs peace. Everyone as individuals need peace. The country needs peace, and the world at large needs peace. So, we are here to do a peace march. We pray that God will command His peace to reign in Rivers State,” he said.

Featured

Hoteliers, School Owners Charging In Dollars Risk Arrest -EFCC

The Economic and Financial Crimes Commission (EFCC) has stated that hotels, schools, and other establishments that accept payments in dollars from their customers are at risk of facing arrest.

The Chairman of EFCC, Ola Olukoyede, said this in the agency’s publication called EFCC Alert on Monday, adding that action would be taken against individuals involved in the dollarisation of the economy.

According to him, the exception is if foreigners come in to transact business and the only means of transacting is their credit card and dollar but to charge local customers in dollars or other foreign currencies would no longer be allowed.

He said charging local activities and customers in dollars is against Nigeria’s constitution.

The EFCC chairman said, “Schools that charge Nigerians in dollar, supermarkets that trade in dollar, estate developers that sell their property in dollar, hotels that are invoicing in dollar, we are coming after you and we have made arrests in that area.

“Yes, if foreigners are coming in and the only means of transacting is their credit card, and dollar, why not? You will get that.

“But document it properly as against selling things within the system, local economy and you will be using dollar as the medium of exchange, it is illegal.

“Our law does not allow for that. And we have also affected some arrests.”

Featured

Eid-El-Fitr: Fubara Felicitates Muslims, Calls For Unity, Tolerance

Rivers State Governor, Sir Siminalayi Fubara, has enjoined Muslim faithful to remain steadfast to the lessons learnt during the holy month of Ramadan.

Governor Fubara stated this in his message of felicitations to Muslims as they celebrate the 2024 Eid-el-Fitr Sallah, which marks the end of the one-month Ramadan fasting.

The Governor emphasised the importance for Muslims to also uphold the tenets of Islam by exhibiting the fear of God and showing piety in their daily work.

Governor Fubara said, “We must all continue in the good attributes imbibed during the holy month of Ramadan as directed by God through His Prophet, so as to ensure peace, unity and harmony in the society for a better future.”

While praying that the essence of the festival offers them happiness, peace and prosperity in all aspects of life, Governor Fubara said he recognises and appreciates the critical role that the Muslim community continues to play in the development of Rivers State, and indeed, Nigeria at large.

Governor Fubara charged them to remain unwavering and steadfast in their commitment and positive contributions to advance the development of the State and the country.

“I enjoin you all in the State to remain calm, be patient and continue to do what is right,” the Governor added.

He wished the Muslim faithful in the State and across the country a happy Eid-el-Fitr celebration.

-

Sports3 days ago

Nigeria’s Onakoya Sets New Chess Record

-

Niger Delta3 days ago

Niger Delta3 days agoA’Ibom Plans 486 Rural Road Repairs To Boost Agric

-

Maritime3 days ago

Maritime3 days agoNigeria Records 3,310 Boat Mishaps In 10 Years

-

News3 days ago

News3 days agoEFCC, Experts Warn Nigerians To Guard Against Cyber Crimes

-

Opinion3 days ago

Agriculture: Solution To Hunger, Inflation, Food Insecurity

-

News3 days ago

Pan-Igbo Group Hails Dangote Group For Reducing Diesel Price

-

Sports3 days ago

Minister Renews Hope For Sports Dev, Signs MoU

-

Rivers3 days ago

Rivers3 days agoBayelsa LG Polls: BYSIEC Issues Return Certificates To Chairmen, Others