News

CCT Resumes Onnoghen’s Trial, Monday

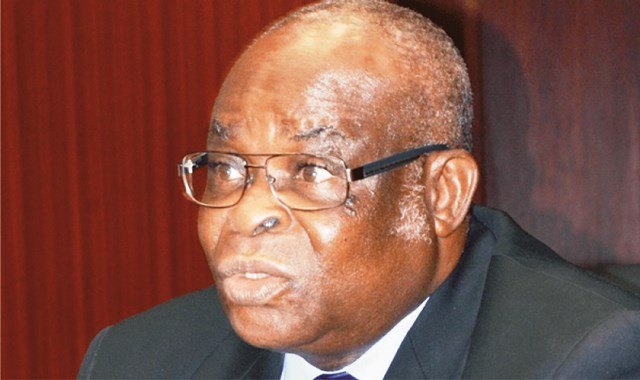

Following a request from the Federal Government, the Code of Conduct Tribunal (CCT) in Abuja, yesterday, fixed February 4 to resume proceedings on the non assets declaration charge pending against the suspended Chief Justice of Nigeria (CJN), Justice Walter Samuel Nkanu Onnoghen.

The Mr. Danladi Umar-led tribunal, in a statement made available to newsmen, disclosed that the Federal Government had in a letter that was signed by two legal officers at the Code of Conduct Bureau (CCB), Musa Ibrahim Usman and Fatima Danjuma Ali, applied for continuation of hearing on the charges against Onnoghen.

Onnoghen, who was last Friday, suspended from office by President Muhammadu Buhari, is facing a six-count charge bothering on his alleged failure to declare his assets as prescribed by the law.

He was in the charge marked CCT/ABJ/01/19, equally accused of maintaining five separate foreign bank accounts, in breach of the code of conduct for public office holders.

In the statement signed by the Head, Press and Public Relations, at the CCT, Mr. Ibraheem Al-Hassan, the Federal Government, via the letter it sent through the CCB, last Wednesday, drew attention of the Umar’s three-member panel to a ruling of the Abuja Division of the Court of Appeal, which cleared the coast for Onnoghen’s trial to proceed.

According to Al-Hassan, the Federal Government’s request read in part: “The above subject refers.

“This case came up for hearing of preliminary objection to the jurisdiction of the Tribunal on the 28th of January, 2019 but the Tribunal could not proceed due to the pendency of the case at the Court of Appeal.

“However, in the wake of this afternoon, 30th January, 2019, the Court of Appeal has thrown out the appeal.

“Consequently on the above, we urge the Honourable Tribunal to give us a date for resumption of the trial subject to the convenience of the Tribunal, most obliged my Lord”.

The appellate court had in a unanimous decision by a three-man panel led by Justice Abdul Aboki, declined Onnoghen’s request for his trial to be temporarily suspended, pending the determination of an appeal he lodged to challenge the competence of the charge and the procedure adopted by the CCT.

In the appeal he lodged on January 15, the suspended CJN, who had on two occasions, declined to appear before the CCT to enter his plea to the charge, contended that the Umar-led tribunal erred in law when it decided to hear the preliminary objection he filed to quash the charge, alongside a motion the Federal Government filed to secure an order to remove him as both the CJN and chairman of the National Judicial Council (NJC).

Onnoghen insisted that it was wrong for the tribunal to hear and determine the Federal Government’s motion when its jurisdiction to entertain the substantive charge was being challenged.

He, therefore, prayed the appellate court to set-aside the decision of the CCT as contained in a ruling its chairman delivered on January 14.

Meanwhile, before the appeal could be heard, Onnoghen, on January 18, filed a motion wherein he prayed the appellate court to stay further proceedings in the case against him.

Based on the motion, the Appeal Court, on January 24, ordered the Umar-led CCT panel to suspend further proceedings in the matter to enable it to consider Onnoghen’s request.

The order of the court came barely 24 hours after the Federal Government secured an ex-parte order from the tribunal, which gave President Muhammadu Buhari the nod to suspend Onnoghen and swear-in the most senior jurist of the Supreme Court, Justice Tanko Muhammad, as the acting CJN.

At its resumed sitting, last Wednesday, the appellate court vacated its initial order that stopped the CCT from taking further steps in Onnoghen’s trial.

The appellate court held that granting the suspended CJN’s motion would amount to a “fundamental interruption” of a criminal proceeding before the CCT.

It noted that Onnoghen himself had in a judgment he delivered in a case involving a firm owned by former National Publicity Secretary of the Peoples Democratic (PDP), Chief Olisa Metuh, Destra Investment Limited, banned the grant of stay of proceeding in criminal matters.

Aboki further recalled that the suspended CJN had in another case that involved the Senate President, Dr. Bukola Saraki, identified the CCT as a special court with quasi-criminal jurisdiction.

He maintained that section 306 of the Administration of Criminal Justice Act, 2015, expressly forbade courts from granting orders to stay proceedings in criminal cases.

“We cannot run away from the fact that the CCT which has quasi-criminal jurisdiction does not have an option than to abide and apolitical the criminal laws in all proceedings before it”, Aboki added.

Consequently, the appellate court dismissed Onnoghen’s appeal, stressing that the order from stay of proceedings he requested for could not be granted as a matter of cause.

“An applicant must convince the court that grant of such order will be in the interest of justice”, the court held, saying there was no “special or exceptional circumstance”, to warrant the suspension of the case pending against Onnoghen before the CCT.

“The applicants’ motion for an order for stay of proceeding is hereby refused”, Aboki ruled.

Nevertheless, the appellate court fixed February 4 to hear the substantive appeal the suspended CJN filed to challenge decision of the CCT to hear his preliminary objection alongside the Federal Government’s motion to remove him from office.

It will be recalled that the CCT had last Monday, adjourned Onnoghen’s trial sine-die (indefinitely) to await the outcome of the appellate court’s ruling.

Onnoghen had through his team of lawyers led by Chief Wole Olanipekun, SAN, contended that his objection and the Federal Government’s motion were mutually exclusive, and as such, could not be heard together.

He argued that the tribunal ought to firstly determine whether or not it has the requisite jurisdiction to handle the charge against him, before it could proceed to hear any other application.

Specifically, Justice Onnoghen faulted the competence of his trial before the CCT on the premise that the Federal Government failed to allow the NJC to investigate the allegations against him, before it proceeded to prefer a criminal charge against him.

Aside the instant appeal, Onnoghen had also lodged another appeal to challenge the ex-parte order the CCT issued for his suspension.

In the four grounds of appeal he filed, last Tuesday, Onnoghen, argued that the CCT erred in law by granting an ex-parte order for his removal, even it had yet to determine whether or not it has the jurisdiction to try him.

He, therefore, applied for, “An order setting aside the order of the tribunal made on the 23rd of January, directing the appellant to step aside as the Chief Justice of Nigeria and a further order that the President of the Federal Republic of Nigeria takes all necessary measures to swear-in the most senior Justice of the Supreme Court of Nigeria as Acting Chief Justice of Nigeria and Chairman of the National Judicial Council”.

More so, the appellant maintained that “the exercise of powers over the motion ex-parte without first determining the jurisdiction of the tribunal amounted to unlawful exercise of jurisdiction and therefore void”.

The NJC, which is the organ of the judiciary with the statutory mandate to discipline judicial officers, had last Tuesday, handed the suspended CJN seven days to respond to the allegations against him.

The legal body equally gave the same number of days to the Acting CJN, to adduce reasons why disciplinary actions should not be taken against him for presenting himself to President Buhari to be sworn-in to replace Onnoghen.

Likewise, the council forwarded a petition accusing the CCT chairman of engaging in reckless abuse of his judicial powers by granting the ex-parte order that led to Onnoghen’s suspension, to the Federal Judicial Service Commission (FJSC).

News

Tinubu Lauds Dangote’s Diesel Price Cut, Foresees Economic Relief

President Bola Tinubu, yesterday, applauded Dangote Oil and Gas Limited for reducing the price of Automotive Gas Oil, also known as diesel, from N1,650 to N1,000 per litre.

The Dangote Group recently reviewed downwards the gantry price of AGO from N1,650 to N1,000 per litre for a minimum of one million litres of the product, as well as providing a discount of N30 per litre for an offtake of five million litres and above

Tinubu described the move as an “enterprising feat” and said, “The price review represents a 60 per cent drop, which will, in no small measure, impact the prices of sundry goods and services.”

In a statement signed by his Special Adviser on Media and Publicity, Ajuri Ngelale, Tinubu affirmed that Nigerians and domestic businesses are the nation’s surest transport and security to economic prosperity.

The statement is titled ‘President Tinubu commends Dangote Group over new gantry price of diesel.’

Tinubu also noted the Federal Government’s 20 per cent stake in Dangote Refinery, saying such partnerships between public and private entities are essential to advancing the country’s overall well-being.

Therefore, he called on Nigerians and businesses to, at this time, put the nation in priority gear while assuring them of a conducive, safe, and secure environment to thrive.

This statement comes precisely a week after Dangote met President Tinubu in Lagos, where he said Nigerians should expect a drop in inflation given the cut in diesel pump prices.

“In our refinery, we have started selling diesel at about ¦ 1,200 for ¦ 1,650 and I’m sure as we go along…this can help to bring inflation down immediately,” Dangote told journalists after he paid homage to President Bola Tinubu at the latter’s residence to mark Eid-el-Fitr.

The businessman said his petroleum refinery had been selling diesel at N1,200 per litre, compared to the previous price of N1,650–N1,700.

He expressed hopes that Nigeria’s economy will improve, as the naira has made some gains in the foreign exchange market, dropping from N1,900/$ to the current level of N1,250 – N1,300.

Dangote said this rise in value has sparked a gradual drop in the price of locally-produced goods, such as flour, as businesses are paying less for diesel. Therefore, he asserted that the reduced fuel costs would drive down inflation in the coming months.

“I believe that we are on the right track. I believe Nigerians have been patient and I also believe that a lot of goodies will now come through.

“There’s quite a lot of improvement because, if you look at it, one of the major issues that we’ve had was the naira devaluation that has gone very aggressively up to about ¦ 1,900.

“But right now, we’re back to almost ¦ 1,250, ¦ 1,300, which is a good reprieve. Quite a lot of commodities went up.

“When you go to the market, for example, something that we produce locally, like flour, people will charge you more. Why? Because they’re paying very high prices on diesel,” he explained.

He argued that the reduced diesel price would have “a lot of impact” on local businesses.

“Going forward, even though the crude prices are going up, I believe people will not get it much higher than what it is today, N1,200.

“It might be even a little bit lower, but that can help quite a lot because if you are transporting locally-produced goods and you were paying N1,650, now you are spending two-thirds of that amount, N1,200. It’s a lot of difference. People don’t know.

“This can help bring inflation down immediately. And I’m sure when the inflation figures are out for the next month, you’ll see that there’s quite a lot of improvement in the inflation rate, one step at a time. And I’m sure the government is working around the clock to ensure things get much better,” Dangote added.

He also urged captains of industry to partner with the government to improve the lives of citizens.

“You can’t clap with one hand,” said the businessman, adding, “So, both the entrepreneurs and the government need to clap together and make sure that it is in the best interest of everybody.”

News

Court Halts Amaewhule-Led Assembly From Extending LG Officials’ Tenure

The Rivers State High Court sitting in Port Harcourt has issued an interim injunction directing the maintenance of status quo ante belum following the move by the Martin Amaewhule-led Assembly in Rivers State to extend the tenure of the elected local government councils’ officials.

The Amaewhule-led Assembly, which is loyal to the Minister of Federal Capital Territory, Nyesom Wike, had amended the Local Government Law Number 5 of 2018 and other related matters.

Amaewhule, explained that the amendments of Section 9(2), (3) and (4)of the Principal Law was to empower the House of Assembly via a resolution to extend the tenure of elected chairmen and councilors, where it is considered impracticable to hold local government elections before the expiration of their three years in office.

But the court asked all the parties to maintain the status quo ante belum pending the hearing and determination of motion on notice for the interlocutory injunction.

The court presided over by G.N. Okonkwo also ordered that the claimant/applicant would enter into an undertaking to indemnify the defendants in the sum of N5million should the substantive case turned out to be frivolous.

The court fixed April 22, 2024 to hear the motion on notice for interlocutory injunction.

Okonkwo also issued an order of substituted service of the motion on notice for interlocutory injunction, originating summons and other subsequent processes on the defendants.

The orders were made following a suit filed by Executive Chairman, Opobo-Nkoro, Enyiada Cooky-Gam; Bonny, Anengi Claude-Wilcox; and five other elected council officials challenging the decision of the Amaewhule-led House of Assembly to extend the tenure of local government areas.

Also named as defendants in the suit are the Governor of Rivers State, the Government of Rivers State and the Attorney-General of Rivers State.

The claimants/applicants are praying the court for a declaration that under section 9(1) of the Rivers State Local Government Amendment Law number 5 of 2018 the tenure of office of the chairmen and members of the 23 local government councils of Rivers State is three years

A declaration that the tenure of office of the elected chairmen and members of the local government areas would expire on the 17th of June 2024 having commenced on the 18th of June 2021 when they were sworn in.

A declaration that the defendants cannot in any manner or form extend the tenure of office of the chairmen and members of the local government areas after the expiration of their tenure.

An order of perpetual injunction restraining the defendants from extending the tenure of office of the chairmen and members of the local government areas.

An order of perpetual injunction restraining the 28th, 29th and 30th defendants (the Governor, the Government House and the Attorney-General) from giving effects to any purported extension of the tenure of the chairmen and members of the local government areas.

They also prayed for an order of interlocutory injunction directing all the defendants to maintain the status quo by not elongating the three-year tenure of the chairmen and councilors.

The claimants further sought an order of interlocutory injunction restraining the defendants from extending the tenures of the chairmen and the councilors.

News

Nigeria’s Inflation Rate’ll Drop To 23% By 2025 -IMF

In a recent release of its Global Economic Outlook at the International Monetary Fund/World Bank Spring Meetings in Washington D.C., on Tuesday, the IMF provided projections for Nigeria’s economy, indicating a significant shift in inflation rates.

Division Chief of the IMF Research Department, Daniel Leigh, highlighted the impact of Nigeria’s economic reforms, including exchange rate adjustments, which have led to a surge in inflation rate to 33.2 percent in March.

Nigeria’s inflation rate rose to 33.2 percent according to recent data released by the National Bureau of Statistics.

Also, the food inflation rate increased to over 40 per cent in the first quarter of 2024.

Leigh stated, “We see inflation declining to 23 per cent next year and then 18 percent in 2026.”

This is however different from the fund’s prediction of a new single-digit (15.5 per cent ) inflation rate for 2025 which it predicted last year.

He further elaborated on Nigeria’s economic growth, which is expected to rise from 2.9 percent last year to 3.3 percent this year, attributing this expansion to the recovery in the oil sector, improved security, and advancements in agriculture due to better weather conditions and the introduction of dry season farming.

The IMF official also noted a broad-based increase in Nigeria’s financial and IT sectors.

“Inflation has increased, reflecting the reforms, the exchange rate, and its pass-through into other goods from imports to other goods,” Leigh explained.

He added that the IMF revised its inflation projection for the current year to 26 percent but emphasised that tight monetary policies and significant interest rate increases during February and March are expected to curb inflation.

An official of the IMF Research Department, Pierre Olivier Gourinchas commented on the global economic landscape, mentioning that oil prices have risen partly due to geopolitical tensions, and services inflation remains high in many countries.

Despite Nigeria’s inflation target of six to nine percent being missed for over a decade, Gourinchas stressed that bringing inflation back to target should be the priority.

He warned of the risks posed by geo-economic fragmentation to global growth prospects and the need for careful calibration of monetary policy.

“Trade linkages are changing, and while some economies could benefit from the reconfiguration of global supply chains, the overall impact may be a loss of efficiency, reducing global economic resilience,” Gourinchas said.

He also emphasised the importance of preserving the improvements in monetary, fiscal, and financial policy frameworks, particularly for emerging market economies, to maintain a resilient global financial system and prevent a permanent resurgence in inflation.

-

News4 days ago

News4 days agoMonarch Lauds Fubara Over Road Project

-

Politics4 days ago

Politics4 days agoFubara’s Victory Thanksgiving: Semenitari Challenges Okocha Over Funding Allegation

-

Nation4 days ago

Nation4 days agoAnglican Bishop Urges Politicians To Lead With Integrity

-

Business16 hours ago

Manufacturers Blame High Product Cost On Diesel

-

Oil & Energy4 days ago

Oil & Energy4 days agoPETAN Moves To Boost Oil Production

-

World4 days ago

World4 days agoSouth Korea’s President Promises Changes Amid Poor Showing At Polls

-

Politics21 hours ago

Politics21 hours agoNew SIM Support Group Inaugurates State Officials

-

Rivers16 hours ago

Rivers16 hours agoFubara Has Demystified Governance-Elder Statesman